[caption id="attachment_1003718095" align="aligncenter" width="562"]

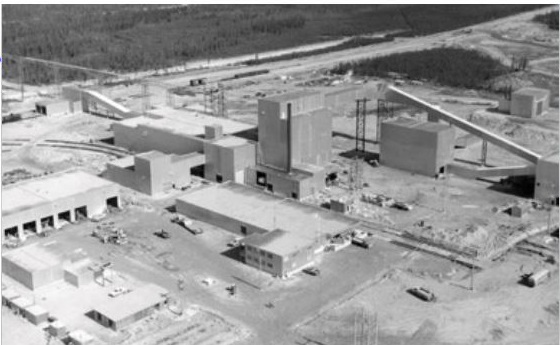

The Pine Point mill and surface facilities as they looked in 1985.

The Pine Point mill and surface facilities as they looked in 1985.[/caption]

NORTHWEST TERRITORIES – Toronto’s

Darnley Bay Resources says the preliminary economic assessment is “robust” for its Pine Point zinc-lead project near Hay River. The PEA was prepared under the direction of

JDS Energy and Mining.

The assessment examined several potential development scenarios and recommended a mining plan where a number of open pit deposits would be developed using dense media separation plants followed by traditional grinding and flotation to upgrade mineralized material into lead and zinc concentrates, similar to the methods used by Cominco when it operated the mine from 1964 to 1987.

The Pine Point project consists of more than 40 separate zinc-lead deposits of varying size and grade. As proposed, they have a pre-tax net present value of $340.8 million (8% discount) and an internal rate of return of 47.8% with a payback period of 1.4 years. After tax NPV is $210.5 million and IRR is 34.5% with payback of 1.8 years.

Preproduction costs are estimated at $153.8 million including a 15% contingency. The sustaining capex would be $117.5 million over a 13-year mine life. Total life of mine production will be 1.35 billion lb. of zinc and 536 million lb. of lead in concentrates. Production might begin by the end of 2019.

Ten open pit deposits would be mined in sequence. The PEA puts resources at 25.8 million measured and indicated tonnes grading 2.94% zinc and 1.12% lead. There is an additional 3.7 million inferred tonnes grading 2.90% zinc and 0.77% lead.

Additional details from the PEA can be read in the news release dated April 18, 2017, and posted at

www.DarnleyBay.com.

The Pine Point mill and surface facilities as they looked in 1985.[/caption]

NORTHWEST TERRITORIES – Toronto’s Darnley Bay Resources says the preliminary economic assessment is “robust” for its Pine Point zinc-lead project near Hay River. The PEA was prepared under the direction of JDS Energy and Mining.

The assessment examined several potential development scenarios and recommended a mining plan where a number of open pit deposits would be developed using dense media separation plants followed by traditional grinding and flotation to upgrade mineralized material into lead and zinc concentrates, similar to the methods used by Cominco when it operated the mine from 1964 to 1987.

The Pine Point project consists of more than 40 separate zinc-lead deposits of varying size and grade. As proposed, they have a pre-tax net present value of $340.8 million (8% discount) and an internal rate of return of 47.8% with a payback period of 1.4 years. After tax NPV is $210.5 million and IRR is 34.5% with payback of 1.8 years.

Preproduction costs are estimated at $153.8 million including a 15% contingency. The sustaining capex would be $117.5 million over a 13-year mine life. Total life of mine production will be 1.35 billion lb. of zinc and 536 million lb. of lead in concentrates. Production might begin by the end of 2019.

Ten open pit deposits would be mined in sequence. The PEA puts resources at 25.8 million measured and indicated tonnes grading 2.94% zinc and 1.12% lead. There is an additional 3.7 million inferred tonnes grading 2.90% zinc and 0.77% lead.

Additional details from the PEA can be read in the news release dated April 18, 2017, and posted at

The Pine Point mill and surface facilities as they looked in 1985.[/caption]

NORTHWEST TERRITORIES – Toronto’s Darnley Bay Resources says the preliminary economic assessment is “robust” for its Pine Point zinc-lead project near Hay River. The PEA was prepared under the direction of JDS Energy and Mining.

The assessment examined several potential development scenarios and recommended a mining plan where a number of open pit deposits would be developed using dense media separation plants followed by traditional grinding and flotation to upgrade mineralized material into lead and zinc concentrates, similar to the methods used by Cominco when it operated the mine from 1964 to 1987.

The Pine Point project consists of more than 40 separate zinc-lead deposits of varying size and grade. As proposed, they have a pre-tax net present value of $340.8 million (8% discount) and an internal rate of return of 47.8% with a payback period of 1.4 years. After tax NPV is $210.5 million and IRR is 34.5% with payback of 1.8 years.

Preproduction costs are estimated at $153.8 million including a 15% contingency. The sustaining capex would be $117.5 million over a 13-year mine life. Total life of mine production will be 1.35 billion lb. of zinc and 536 million lb. of lead in concentrates. Production might begin by the end of 2019.

Ten open pit deposits would be mined in sequence. The PEA puts resources at 25.8 million measured and indicated tonnes grading 2.94% zinc and 1.12% lead. There is an additional 3.7 million inferred tonnes grading 2.90% zinc and 0.77% lead.

Additional details from the PEA can be read in the news release dated April 18, 2017, and posted at

Comments