Wajax to acquire Tundra Process Solutions in $99M deal

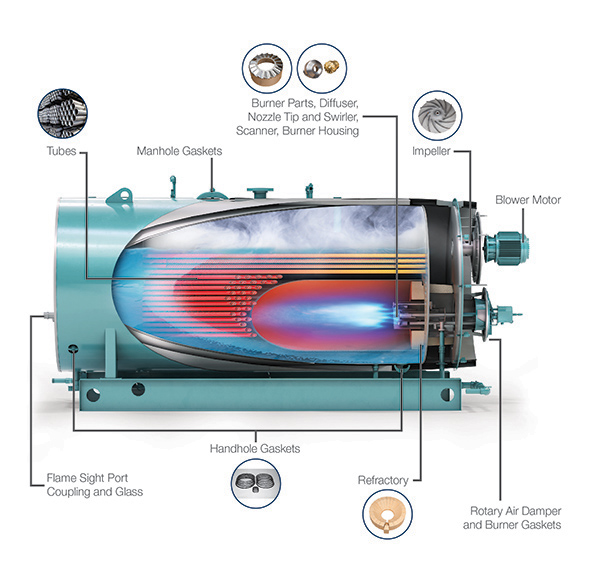

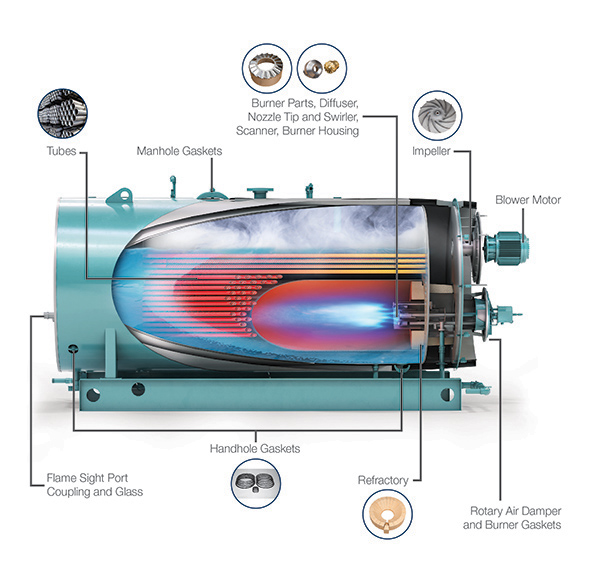

Tundra boiler parts and service Credit: Tundra Process Solutions[/caption]

Tundra boiler parts and service Credit: Tundra Process Solutions[/caption]

Wajax has entered into a definitive agreement to acquire Calgary-based Tundra Process Solutions for total consideration of $99.1 million. The consideration will consist of $74.6 million in cash and the issue of 1.4 million Wajax shares. The transaction is expected to close early in the first quarter of 2021 and is subject to customary closing conditions.

Tundra provides maintenance and technical services to customers in the western Canadian midstream oil and gas, oilsands, petrochemical, mining, forestry and municipal sectors. The company also distributes a range of industrial process equipment, representing industry-leading manufacturers of valves and actuators, instrumentation and controls, motors and drives, control buildings, boilers and water treatment solutions. Tundra operates four facilities in Alberta: Calgary, Edmonton (two locations) and Grande Prairie. Tundra also maintains a local sales presence in Fort McMurray and Red Deer, Alberta; Vancouver and Fort St. John, British Columbia; and southern Saskatchewan.

For Wajax, the Tundra acquisition is expected to provide meaningful growth in its Engineered Repair Services (ERS) and industrial parts categories. For the 12 months ended Nov. 30, 2020, Tundra had revenues of approximately $147.8 million. The acquisition is expected to be immediately accretive to Wajax shareholders in an anticipated range of 10¢ to 15¢ for the 2021 financial year, on an earnings per share basis.

Concurrent with the signing of this agreement, Wajax has entered into an agreement with the lenders under its existing credit facilities for a $50-million acquisition credit facility. The facility is for a 24-month term. Wajax expects to continue to use cash flow from operations to contribute to debt reduction and to maintain its current quarterly dividend of 25¢ per share.

“We welcome Tundra and its team of dedicated professionals to Wajax,” Mark Foote, president and CEO of Wajax, said in a release. “Tundra's market leadership in process control provides Wajax with meaningful scale in ERS and related industrial parts in western Canada. In central and eastern Canada, Tundra's technical capabilities and product and service range will provide new opportunities to further extend Wajax's ERS services to our customers. Our complementary cultures of safety, customer service and product and service innovation translates into growth driven by a consistent vision of constantly increasing what we can do for our customers.”

“Partnering with Wajax allows us to instantly grow our volumes by leveraging our combined customer relationships and branch networks. Existing Wajax customers will benefit from a broader range of valve, instrumentation and electrical products and services, and existing Tundra customers will benefit from Wajax's extensive ERS portfolio and geographic footprint. We are excited to join Wajax and contribute to the goal of becoming Canada's leading ERS provider,” added Iggy Domagalski, CEO of Tundra.

Wajax operates an integrated distribution system providing sales, parts and services to a broad range of customers in diverse sectors of the Canadian economy, including: construction, forestry, mining, industrial and commercial, oilsands, transportation, metal processing, government and utilities, and oil and gas.

For more information, visit www.Wajax.com or www.TundraSolutions.ca.

Comments