Teck sees copper supply/demand win

Soaring demand for electric vehicles and power plants should support copper prices over the coming decades as supply constraints continue to plague the industry, Teck Resources (TSX: TECK.A, TECK.B; NYSE: TECK) says.

Copper demand for new energy applications is posed to jump 62% to 42 million tonnes by 2050, according to Teck’s head of market research, Michael Schwartz.

In a “net zero” scenario where countries strive to eliminate greenhouse gas emissions, Teck’s forecast shows annual demand for so-called new energy copper would hit 52 million by 2050 – a 105% surge from 2023.

“We're relatively bullish long term on copper,” Schwartz told the Mining Research Analyst Group’s annual forecast luncheon in Toronto this month. “We’ve spent a few billion dollars to prove our commitment.”

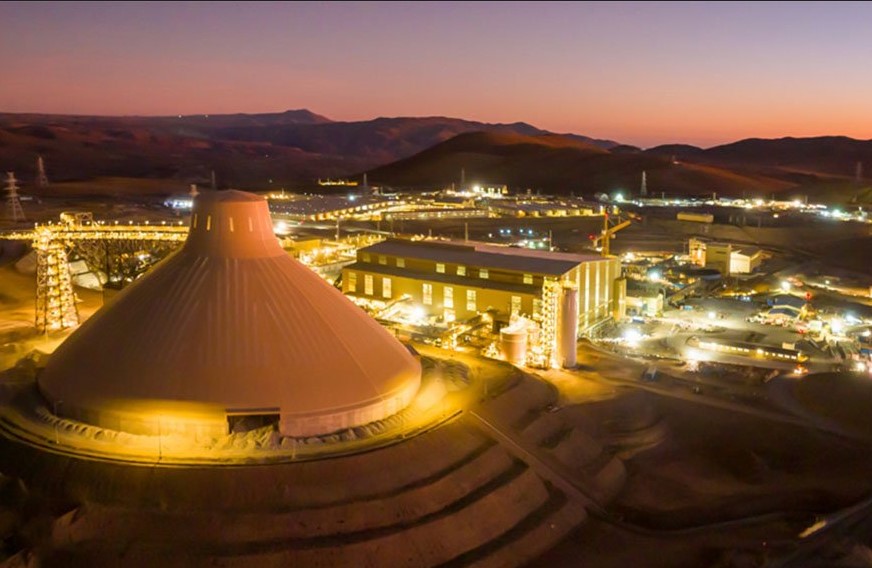

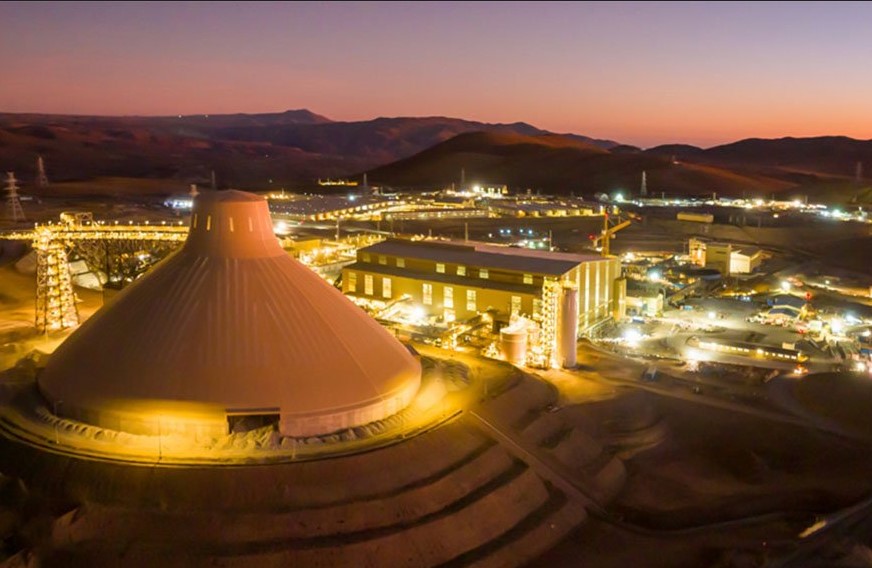

Teck, Canada’s largest diversified miner, is in the midst of a four-year, US$3.9-billion plan to boost copper production to about 800,000 tonnes annually. Central to this growth plan is the ramp-up of Chile’s Quebrada Blanca mine, which is 60% owned by Teck.

Despite a near-term softening in demand, electric vehicles are expected to remain the biggest driver of future copper usage. By 2050, consumption from electric vehicle makers could increase eight-fold from its 2023 level, Teck predicts.

Power grids also figure to be heavy copper users. By 2050, Teck forecasts they will need 10 million additional tonnes of the metal annually.

Urbanization in Asia and elsewhere will be a key accelerator of demand. Sometime in the next decade, southeast Asia is expected to become the world’s fastest growing region, Teck predicts.

“There is infrastructure that needs to be built,” Schwartz said. “People are moving into cities. That is going to require more HVAC (heating, ventilation, and air conditioning) systems. It's going to require more cooling. It's going to require more refrigeration for food to bring into the cities for people that were in rural communities. All of this is electric-driven, and all of it is positive.”

While copper demand climbs, producers are having trouble keeping up.

“The copper concentrate market has certainly gotten tighter, and without some drastic action, relatively shortly, we end up with a fairly large supply gap towards 2040,” Schwartz said. “Even by 2035 we're in a situation where we can't supply the market.”

Global deamnd for cathodes could exceed production by up to 2.5 million tonnes by 2030, Schwartz’s presentation showed. Last year, global ouput slightly outstripped demand.

While copper producers are starting to expand their mines or extend the lives of some properties, new production sites have been hard to find. Teck expects global mine output to peak by 2028, leaving existing sites to provide all future demand growth, Schwartz said.

“If any one of those mines was to be delayed or fail or have problems with a startup, that supply deficit becomes greater,” he said.

The current dearth of copper concentrates has also driven up the price of scrap metal - leading Teck to increase scrap collection efforts, Schwartz said. The company has been approached by several telecom companies that are now looking at digging up old copper wire that was previously too costly to unearth, he said.

“Right now, with the concentrated market being so tight, scrap has become very precious,” he said. “Countries like the U.S. and Europe are now talking about restricting exports of scrap.”

As a result, copper theft is on the rise.

“The stories that we had back during the global financial crisis of people stealing copper, we're starting to see it again,” Schwartz said. “It's happening.”

Comments