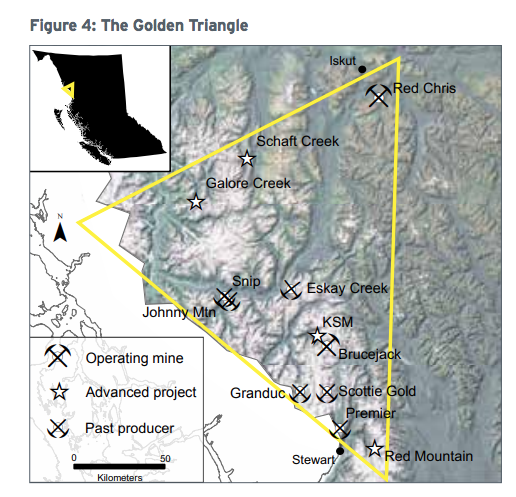

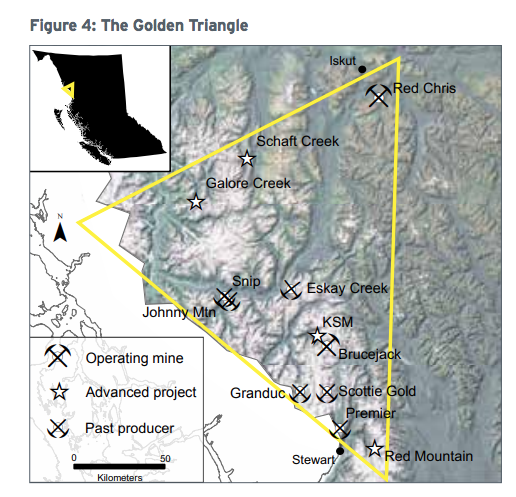

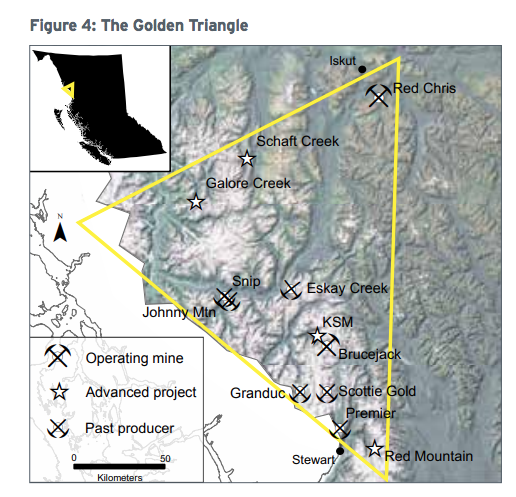

[caption id="attachment_1003734193" align="alignnone" width="516"]

British Columbia's Golden Triangle area. Credit: EY[/caption]

After two years of growth, mineral exploration spending in British Columbia was steady last year, totalling $329 million. But while overall spending didn't change much, the minerals targeted did, with gold exploration declining 11%, and base metal exploration rising 39%.

A report from EY, entitled

British Columbia Mineral and Coal Exploration Survey, details activity across the province and notes the shift away from gold and towards base metals.

"Global demand for base metals has seen a significant increase, likely driven by an uptick in demand for electric vehicles and green energy, pushing investor focus from gold to copper," said Iain Thompson, EY Canada Mining & Metals Advisory Leader in a release.

Base metals accounted for 39% of total exploration spending for a total of $143 million. Copper accounted for 72% of that spending, or $103 million.

The Golden Triangle area of northwest B.C. continued to attract investment, with exploration spending rising 10% from 2018 levels and doubling from 2016 levels to $180 million. While B.C.'s Northwest accounted for 55% of mineral exploration spending last year, gold exploration in the region suffered a 39% decline.

Other notable shifts include prospects for coal. After seeing an uptick in coal exploration in 2018, last year saw a 20% decline in investment.

Read the

full report here.

British Columbia's Golden Triangle area. Credit: EY[/caption]

After two years of growth, mineral exploration spending in British Columbia was steady last year, totalling $329 million. But while overall spending didn't change much, the minerals targeted did, with gold exploration declining 11%, and base metal exploration rising 39%.

A report from EY, entitled

British Columbia's Golden Triangle area. Credit: EY[/caption]

After two years of growth, mineral exploration spending in British Columbia was steady last year, totalling $329 million. But while overall spending didn't change much, the minerals targeted did, with gold exploration declining 11%, and base metal exploration rising 39%.

A report from EY, entitled

Comments