[caption id="attachment_1003741194" align="aligncenter" width="550"]

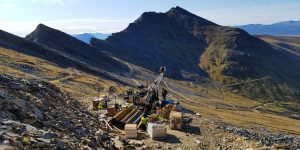

Helicopter at Arctic Credit: Trilogy

Helicopter at Arctic Credit: Trilogy[/caption]

ALASKA –

Trilogy Metals has announced the results of a feasibility study on its 50%-held Arctic copper-zinc-lead-silver-gold project in northwestern Alaska’s Ambler mining district.

The latest study suggests a 10,000-tonne-per-day, 12-year open pit operation, with a conventional mill and flotation process, producing copper, zinc and lead concentrates.

This proposed operation would produce an average of 155 million lb. of copper, 192 million lb. of zinc, 32 million lb. of lead, 32,165 oz. of gold and 3.4 million oz. of silver annually, at all-in cash costs (which include initial and sustaining capital, as well as operating and closure costs, net of by-product credits) of US98¢ per lb. of payable copper.

With an initial capital cost requirement of US$905.6 million and base-case long-term metal prices of US$3 per lb. of copper, US$1.1 per lb. of zinc, US$1 per lb. of lead, US$1,300 per gold oz. and US$18 per silver oz., the after-tax net present value estimate for the project comes in at US$1.1 billion, at an 8% discount rate, with a 27% internal rate of return and 2.6-year payback period.

“Arctic is a special project due to its unique, high-grade, polymetallic nature. The only other time that I’ve seen a project of this quality, where the grades were similar was in an underground mining scenario,” Tony Giardini, the company’s president and CEO, said in a release. “However, Arctic is mineable in an open pit scenario. I also want to highlight that Arctic contains a significant amount of gold and silver.”

Giardini added that, at current spot prices, gold and silver make up approximately 20% of the project’s revenue, and contribute approximately 80,000 payable gold-equivalent oz. annually.

South32, an Australia-based diversified miner, holds the remaining 50% in the Arctic project, which is held within the Ambler Metals joint venture. The feasibility was prepared based on a 100% ownership basis. The miner exercised its right to form the JV in December of 2019.

This latest assessment follows up on a 2018 prefeasibility study for the project, which defined a similar production profile, but at a slightly slower capital cost. As a result, the resource and reserve estimates remain largely unchanged; the prior reserve stands at 43 million tonnes at approximately 5% copper-equivalent.

In the release, Jim Gowans, a director of the company, also highlighted the prospectivity of the Ambler district and Alaska’s “solid environmental regulations and a balanced permitting process…”

Based on an Exploration Agreement and Option to Lease with Nana Regional Corporation, an Alaska Native regional corporation, once a construction decision is made, Nana has the right to purchase a 16% to 25% direct interest in the Arctic project, or to receive a 15% net proceeds royalty. These options were not accounted for in the latest study.

For more information, visit

www.TrilogyMetals.com.

Helicopter at Arctic Credit: Trilogy[/caption]

ALASKA – Trilogy Metals has announced the results of a feasibility study on its 50%-held Arctic copper-zinc-lead-silver-gold project in northwestern Alaska’s Ambler mining district.

The latest study suggests a 10,000-tonne-per-day, 12-year open pit operation, with a conventional mill and flotation process, producing copper, zinc and lead concentrates.

This proposed operation would produce an average of 155 million lb. of copper, 192 million lb. of zinc, 32 million lb. of lead, 32,165 oz. of gold and 3.4 million oz. of silver annually, at all-in cash costs (which include initial and sustaining capital, as well as operating and closure costs, net of by-product credits) of US98¢ per lb. of payable copper.

With an initial capital cost requirement of US$905.6 million and base-case long-term metal prices of US$3 per lb. of copper, US$1.1 per lb. of zinc, US$1 per lb. of lead, US$1,300 per gold oz. and US$18 per silver oz., the after-tax net present value estimate for the project comes in at US$1.1 billion, at an 8% discount rate, with a 27% internal rate of return and 2.6-year payback period.

“Arctic is a special project due to its unique, high-grade, polymetallic nature. The only other time that I’ve seen a project of this quality, where the grades were similar was in an underground mining scenario,” Tony Giardini, the company’s president and CEO, said in a release. “However, Arctic is mineable in an open pit scenario. I also want to highlight that Arctic contains a significant amount of gold and silver.”

Giardini added that, at current spot prices, gold and silver make up approximately 20% of the project’s revenue, and contribute approximately 80,000 payable gold-equivalent oz. annually.

South32, an Australia-based diversified miner, holds the remaining 50% in the Arctic project, which is held within the Ambler Metals joint venture. The feasibility was prepared based on a 100% ownership basis. The miner exercised its right to form the JV in December of 2019.

This latest assessment follows up on a 2018 prefeasibility study for the project, which defined a similar production profile, but at a slightly slower capital cost. As a result, the resource and reserve estimates remain largely unchanged; the prior reserve stands at 43 million tonnes at approximately 5% copper-equivalent.

In the release, Jim Gowans, a director of the company, also highlighted the prospectivity of the Ambler district and Alaska’s “solid environmental regulations and a balanced permitting process…”

Based on an Exploration Agreement and Option to Lease with Nana Regional Corporation, an Alaska Native regional corporation, once a construction decision is made, Nana has the right to purchase a 16% to 25% direct interest in the Arctic project, or to receive a 15% net proceeds royalty. These options were not accounted for in the latest study.

For more information, visit

Helicopter at Arctic Credit: Trilogy[/caption]

ALASKA – Trilogy Metals has announced the results of a feasibility study on its 50%-held Arctic copper-zinc-lead-silver-gold project in northwestern Alaska’s Ambler mining district.

The latest study suggests a 10,000-tonne-per-day, 12-year open pit operation, with a conventional mill and flotation process, producing copper, zinc and lead concentrates.

This proposed operation would produce an average of 155 million lb. of copper, 192 million lb. of zinc, 32 million lb. of lead, 32,165 oz. of gold and 3.4 million oz. of silver annually, at all-in cash costs (which include initial and sustaining capital, as well as operating and closure costs, net of by-product credits) of US98¢ per lb. of payable copper.

With an initial capital cost requirement of US$905.6 million and base-case long-term metal prices of US$3 per lb. of copper, US$1.1 per lb. of zinc, US$1 per lb. of lead, US$1,300 per gold oz. and US$18 per silver oz., the after-tax net present value estimate for the project comes in at US$1.1 billion, at an 8% discount rate, with a 27% internal rate of return and 2.6-year payback period.

“Arctic is a special project due to its unique, high-grade, polymetallic nature. The only other time that I’ve seen a project of this quality, where the grades were similar was in an underground mining scenario,” Tony Giardini, the company’s president and CEO, said in a release. “However, Arctic is mineable in an open pit scenario. I also want to highlight that Arctic contains a significant amount of gold and silver.”

Giardini added that, at current spot prices, gold and silver make up approximately 20% of the project’s revenue, and contribute approximately 80,000 payable gold-equivalent oz. annually.

South32, an Australia-based diversified miner, holds the remaining 50% in the Arctic project, which is held within the Ambler Metals joint venture. The feasibility was prepared based on a 100% ownership basis. The miner exercised its right to form the JV in December of 2019.

This latest assessment follows up on a 2018 prefeasibility study for the project, which defined a similar production profile, but at a slightly slower capital cost. As a result, the resource and reserve estimates remain largely unchanged; the prior reserve stands at 43 million tonnes at approximately 5% copper-equivalent.

In the release, Jim Gowans, a director of the company, also highlighted the prospectivity of the Ambler district and Alaska’s “solid environmental regulations and a balanced permitting process…”

Based on an Exploration Agreement and Option to Lease with Nana Regional Corporation, an Alaska Native regional corporation, once a construction decision is made, Nana has the right to purchase a 16% to 25% direct interest in the Arctic project, or to receive a 15% net proceeds royalty. These options were not accounted for in the latest study.

For more information, visit

Comments