Site visit: Dolly Varden Silver targets high-grade expansion at Kitsault Valley in BC

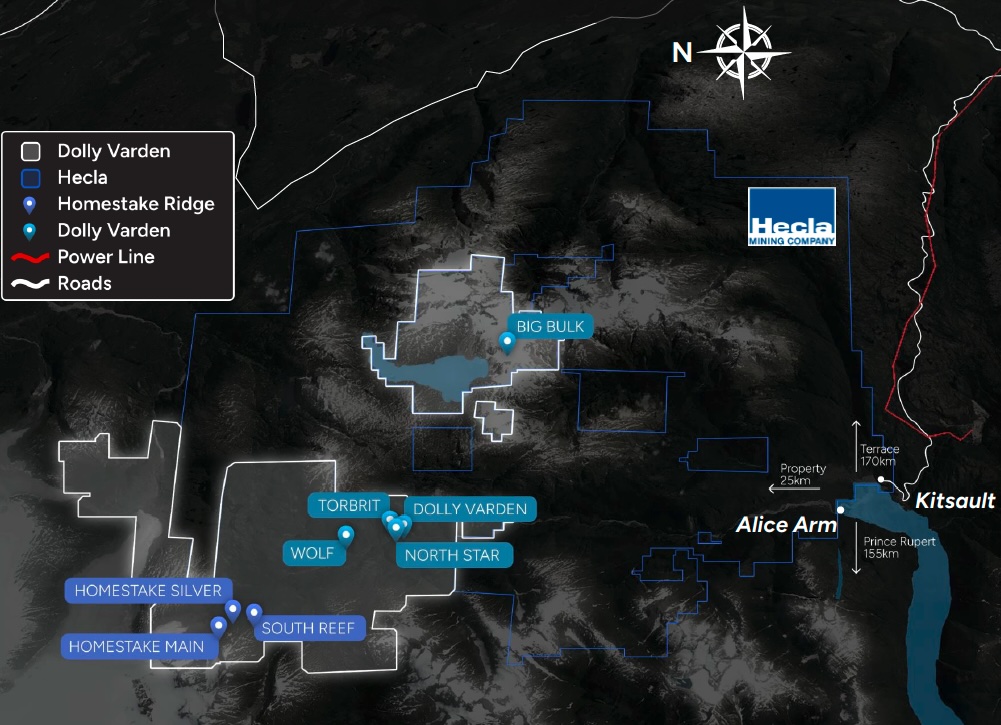

Dolly Varden Silver (TSXV: DV; US-OTC: DOLLF) says its drilling is on pace to triple the Kitsault Valley project’s contained metal in northern British Columbia where the junior is considering a sale or its own development.

A recent site visit showcased several deposits including Homestake Silver, the northernmost along a 15-km-trend that also hosts the Moose, Dolly Varden, Torbrit, and North Star deposits. The project is already pegged to hold 34.7 million oz. silver in a 2023 indicated resource. As part of an initial 25,000-metre drill program this year, Dolly Varden reported in June a hole at Moose intersected 977 grams silver per tonne over 5 metres, including 3,670 grams silver over 0.8 metre from 115.2 metres depth.

“We’ve hit the ground running this season, starting earlier than ever before, with three rigs testing high-priority targets,” exploration manager Amanda Bennett told The Northern Miner during the visit. “The results so far are encouraging, and we’re optimistic about what this season will yield.”

Dolly Varden is backed with a 15% stake held by 130-year-old Hecla Mining (NYSE: HL) as it advances Kitsault Valley towards a resource update this year and a preliminary economic assessment to follow. It’s located in B.C.’s Golden Triangle – an area that has seen about US$5 billion in mergers and acquisitions since 2018. The company is benefiting from investor interest in silver which has gained about 18% to US$27.04 per oz. in the past year.

The project, combining the brownfield Dolly Varden and Homestake Ridge projects, respectively holds an indicated resource of 3.4 million tonnes at 299.8 grams silver per tonne for 32.9 million oz. silver, and 736,000 tonnes grading 74.8 grams silver per tonne and 7.02 grams gold-equivalent for 1.8 million oz. silver and 165,993 oz. gold. The estimate was constrained at 150 grams silver per tonne cut-off for the Dolly Varden deposit and 2 grams gold cut-off per tonne for the Homestake Ridge deposit.

Comments