[caption id="attachment_1003717867" align="aligncenter" width="568"]

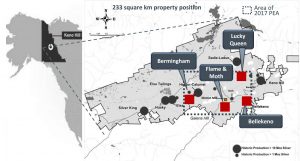

Alexco’s landholdings in the Keno Hill Silver District.

Alexco’s landholdings in the Keno Hill Silver District.[/caption]

YUKON – The preliminary economic assessment of the Keno Hill properties belonging to Vancouver-based

Alexco Resource Corp. has president and CEO Clynton Nauman saying, “… the district is clearly on a path toward redevelopment and ultimately a production decision.”

According to the PEA, the pre-tax and after-tax net present value is C$104.3 million and C$79.4 M (5% discount rate), respectively. The pre-tax and after-tax internal rate of return is 89% and 75%, respectively, at assumed silver prices of US$18.60/oz in 2018 and US$19.35/oz in 2019 through 2025.

Initial capital costs of C$27 million would be needed to achieve production and a positive cash flow with payback occurring in less than 12 months. The mine plan is centered on the Flame and Moth deposit to begin, followed by Bermingham and Lucky Queen. The Keno Hill concentrator has a capacity of 400 t/d and uses conventional crushing, grinding, differential flotation, and dewatering. Silver and lead will report to a bulk concentrate, and zinc with be recovered in a separate concentrate.

Resource estimates for the Bermingham, Flame and Moth, Bellekeno, Lucky Queen and Onek deposits are included in the PEA. The indicated resource totals 3.6 million tonnes averaging 500 g/t silver, 2.00% lead and 5.60% zinc, and the inferred portion totals 1.4 million tonnes at 408 g/t silver, 1.63% lead and 4.26% zinc.

Alexco said it has also amended the silver streaming agreement with

Silver Wheaton Corp. Rather than a fixed price, silver will be delivered based on a percentage of the spot silver price and fluctuations in the head grade.

The full PEA is available at

www.AlexcoResource.com.

Alexco’s landholdings in the Keno Hill Silver District.[/caption]

YUKON – The preliminary economic assessment of the Keno Hill properties belonging to Vancouver-based Alexco Resource Corp. has president and CEO Clynton Nauman saying, “… the district is clearly on a path toward redevelopment and ultimately a production decision.”

According to the PEA, the pre-tax and after-tax net present value is C$104.3 million and C$79.4 M (5% discount rate), respectively. The pre-tax and after-tax internal rate of return is 89% and 75%, respectively, at assumed silver prices of US$18.60/oz in 2018 and US$19.35/oz in 2019 through 2025.

Initial capital costs of C$27 million would be needed to achieve production and a positive cash flow with payback occurring in less than 12 months. The mine plan is centered on the Flame and Moth deposit to begin, followed by Bermingham and Lucky Queen. The Keno Hill concentrator has a capacity of 400 t/d and uses conventional crushing, grinding, differential flotation, and dewatering. Silver and lead will report to a bulk concentrate, and zinc with be recovered in a separate concentrate.

Resource estimates for the Bermingham, Flame and Moth, Bellekeno, Lucky Queen and Onek deposits are included in the PEA. The indicated resource totals 3.6 million tonnes averaging 500 g/t silver, 2.00% lead and 5.60% zinc, and the inferred portion totals 1.4 million tonnes at 408 g/t silver, 1.63% lead and 4.26% zinc.

Alexco said it has also amended the silver streaming agreement with Silver Wheaton Corp. Rather than a fixed price, silver will be delivered based on a percentage of the spot silver price and fluctuations in the head grade.

The full PEA is available at

Alexco’s landholdings in the Keno Hill Silver District.[/caption]

YUKON – The preliminary economic assessment of the Keno Hill properties belonging to Vancouver-based Alexco Resource Corp. has president and CEO Clynton Nauman saying, “… the district is clearly on a path toward redevelopment and ultimately a production decision.”

According to the PEA, the pre-tax and after-tax net present value is C$104.3 million and C$79.4 M (5% discount rate), respectively. The pre-tax and after-tax internal rate of return is 89% and 75%, respectively, at assumed silver prices of US$18.60/oz in 2018 and US$19.35/oz in 2019 through 2025.

Initial capital costs of C$27 million would be needed to achieve production and a positive cash flow with payback occurring in less than 12 months. The mine plan is centered on the Flame and Moth deposit to begin, followed by Bermingham and Lucky Queen. The Keno Hill concentrator has a capacity of 400 t/d and uses conventional crushing, grinding, differential flotation, and dewatering. Silver and lead will report to a bulk concentrate, and zinc with be recovered in a separate concentrate.

Resource estimates for the Bermingham, Flame and Moth, Bellekeno, Lucky Queen and Onek deposits are included in the PEA. The indicated resource totals 3.6 million tonnes averaging 500 g/t silver, 2.00% lead and 5.60% zinc, and the inferred portion totals 1.4 million tonnes at 408 g/t silver, 1.63% lead and 4.26% zinc.

Alexco said it has also amended the silver streaming agreement with Silver Wheaton Corp. Rather than a fixed price, silver will be delivered based on a percentage of the spot silver price and fluctuations in the head grade.

The full PEA is available at

Comments