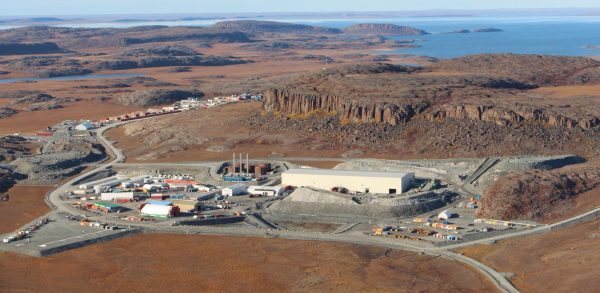

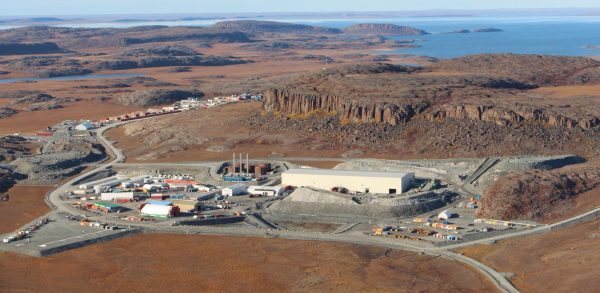

[caption id="attachment_1003742721" align="alignnone" width="600"]

TMAC Resources' Hope Bay gold mine, in Nunavut. Credit: TMAC Resources[/caption]

Months after shareholders of

TMAC Resources approved a takeover of the company by China's

Shandong Gold Mining, the federal government has ordered a national security review of the transaction.

The US$149-million, $1.75-per-share deal was announced in May, with more than 97% of shareholders voting in favour in June. The plan was also approved by the Ontario Superior Court of Justice in June.

TMAC owns the Hope Bay gold mine, 125 km southwest of Cambridge Bay, in Nunavut.

In a release, TMAC noted that the review extends the expected timeline for approval of the transaction to February, as the federal government has lengthened review periods under the

Investment Canada Act due to the pandemic.

“Both TMAC and Shandong believe the transaction has a strong overall net benefit to Canada and does not pose a security risk,” said TMAC in a release. “The extension to timelines as a result of

Bill C-20, An Act respecting further COVID-19 measures, and the related Ministerial Order issued on July 31, 2020, mean that the government of Canada may not complete the regulatory review process and provide

Investment Canada Act approval by February 8, 2021, which is the extended outside date in the arrangement agreement.”

The “outside date” in the agreement is six months after the agreement was signed – Nov. 8, 2020. That date can be extended by up to three months to Feb. 8, 2021, but if approvals take longer, the deal could be jeopardized.

The transaction is drawing scrutiny under the

Investment Canada Act because of the Hope Bay site's location in the Arctic, considered strategically important as climate change makes resources in the region more accessible. The project is also just a few kilometres away from the Arctic Ocean.

COVID-19 cases

Another condition of the deal is that senior officers of Shandong are able to conduct a site visit, something that's been delayed by a current outbreak of COVID-19 at the site that began in September.

As of mid-October, the company has reported 14 confirmed positive cases and two presumptive cases, although most have been asymptomatic. The company is in the process of commissioning rapid-testing equipment that has been deployed to the site.

Since the end of July, the mine has been operating on a reduced operating plan, running the processing plant for three weeks, and then idled for three weeks. With this reduced capacity and staffing, the mine produced 18,420 oz. of gold in the third quarter.

While Hope Bay has been in production since 2017, it has struggled to make a profit. A

prefeasibility study released in March pegged the cost of necessary upgrades to the operation, including a new 4,000 t/d processing facility to replace the current 2,000 t/d mill, at $683 million.

Hope Bay holds reserves of 16.9 million tonnes at 6.5 g/t gold for a total of 3.5 million oz.

For more information, visit

www.tmacresources.com.

Comments