Rosatom, Nornickel to develop lithium project in Russia

Russia's state-owned nuclear power supplier Rosatom and Nornickel, the world's largest producer of refined nickel, are fine-tuning details of a plan to develop a lithium deposit in the country’s northwest, Sputnik radio reported.

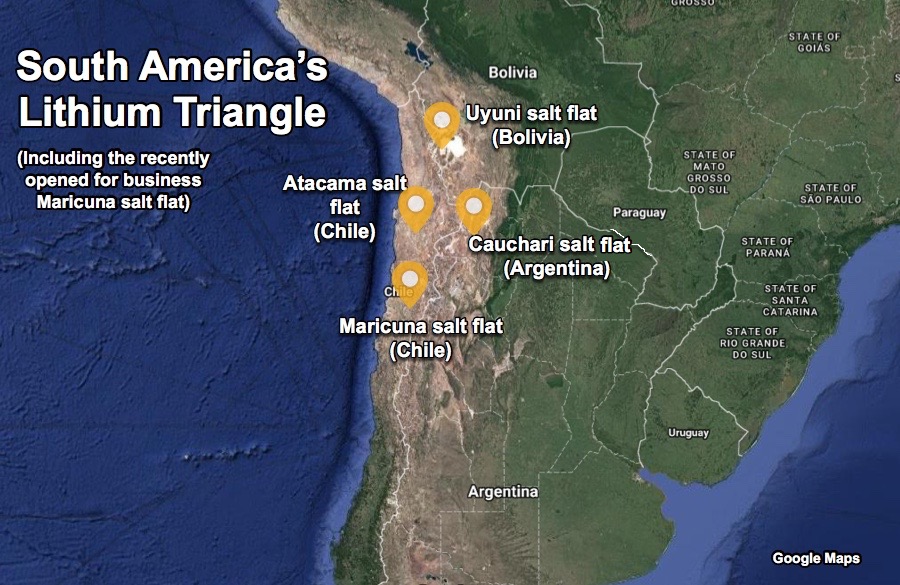

The announcement comes about two weeks after Chile and Argentina suspended raw lithium shipments to Russia amid increasing global sanctions to Moscow linked to the invasion of Ukraine.

The country does not have any lithium mine and it could soon face extreme shortages of the battery metal if Bolivia follows the example of its South American neighbours.

While Russia could receive lithium from China, the country is also experiencing a shortage of the commodity, so the situation seems unlikely, experts say.

"We have processing capacity, but if there is no feedstock there could be a very big problem in supplying our own lithium-ion battery needs," said Vladislav Demidov, deputy head of the Industry and Trade Ministry's metallurgy and materials department earlier this month.

Most of the world’s current lithium output is locked away in long term deals as downstream chemicals producers, battery makers and EV companies are frantically trying to secure future supply.

Experts expect demand for the battery metal coming from the sector to account for almost three quarters of its consumption by 2030, up from 41% in 2020.

This and similar forecasts have increased worries of a global shortage, boosting prices for the metal to record highs.

Amid those concerns, Rosatom's subsidiary Uranium One inked a deal to join a lithium project in Argentina in late 2021 as partner. As part of the agreement, Uranium One has committed to spend US$30 million to buy a 15% stake in Alpha One Lithium, which owns the Tolillar project in the Salta province.

Once a bankable feasibility study is complete, Uranium One will have an option to raise its stake in the project to 50% for US$185 million and secure the right to purchase 100% of the project’s future production.

The world’s second largest miner, Rio Tinto (ASX, LON, NYSE: RIO), recently completed the acquisition of the Rincon lithium project, located in the same area Argentinean province as Tolillar, for US$825 million. Rio Tinto estimates that committed lithium supply and capacity expansions will contribute only about 15% to demand growth over the 2020-2050 period. The remaining 85% would need to come from new projects.

This article was originally posted on www.Mining.com

Comments