Rio Tinto to be among top three lithium miners with Arcadium acquisition

Rio Tinto (ASX, LON, NYSE: RIO) has made an approach for Arcadium Lithium (ASX: LTM; NYSE: ALTM), the two sides confirmed on Monday, following market speculation over the weekend, and as the sector begins turning its attention back to growth.

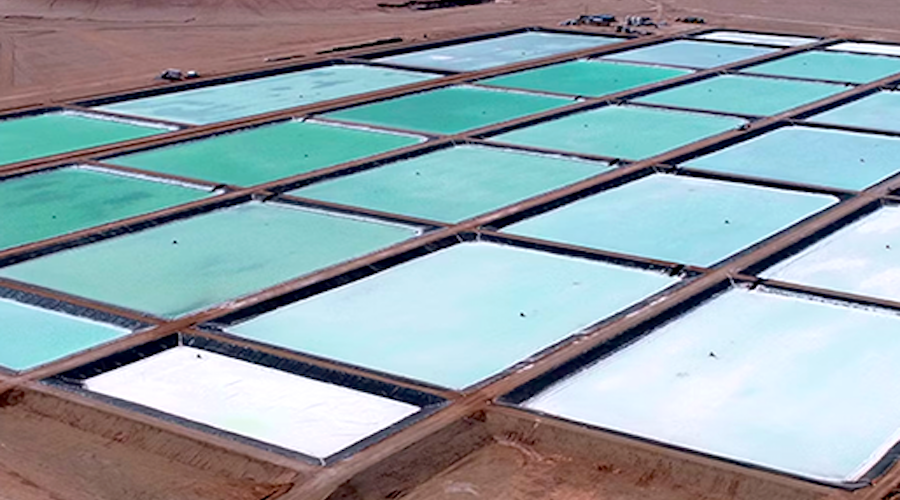

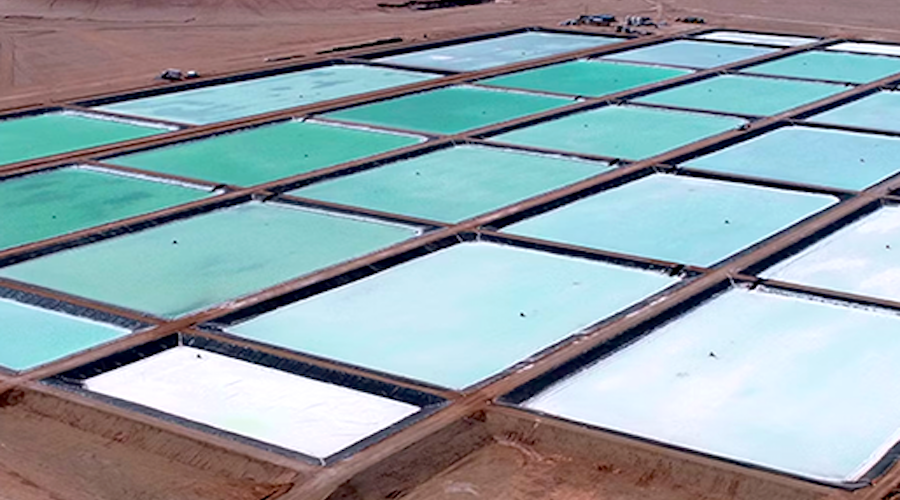

The move would position Rio as one of the world’s largest lithium miners, behind only US-based Albemarle (NYSE: ALB) and Chile’s SQM (NYSE: SQM). This would happen because the acquisition would hand Rio Tinto lithium mines in Argentina and Australia, as well as processing facilities in the US, China, Japan and the UK. Its customer base would include major names, such as Tesla, BMW and General Motors.

Rio Tinto is already a top producer of another coveted battery metal, copper, and has set as goal to produce 1.0 million tonnes of the metal annually within the next five years.

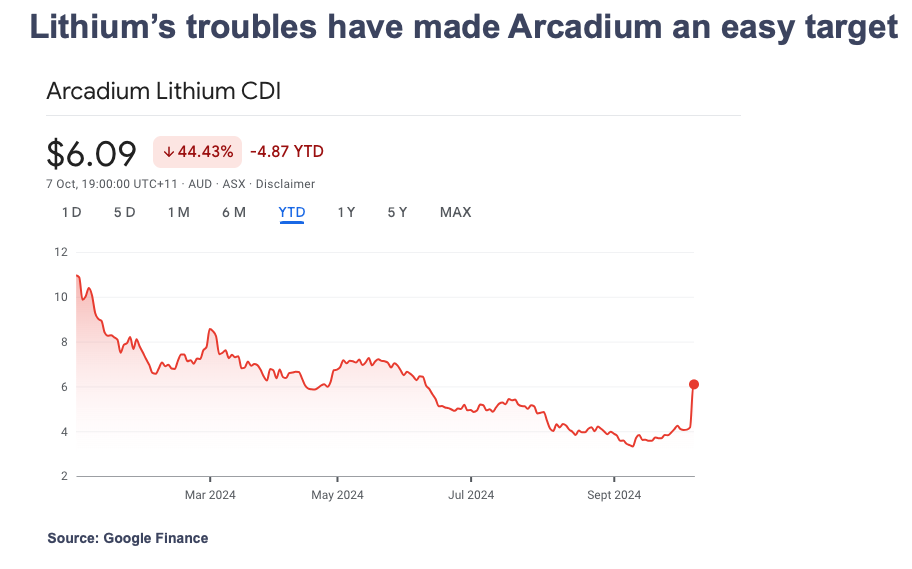

Arcadium was created in January from the merger of Philadellphia-based Livenext and Australia's Alkem. Its shares have fallen since, dragged by declining lithium prices, which in turn is a result of weaker demand from electric vehicle (EV) makers and Chinese oversupply.

On the news of Rio’s approach, Arcadium shares went ballistic, rising almost 46% on Monday in Sydney at A$6.09 each. In New York, the stock shot up 60% in pre-market trading, but pared some of those gains later to trade 30% at $3.08 apiece as of 8:00 am local time. That leaves the American lithium miner with a market capitalization of $3.3 billion.

BMO analyst, Joel Jackson, noted the announced deal has been part of market rumours for years. “Many investors believe that Arcadium (i.e., the Allkem/Livent merger) was completed to shake out interest from suitors like Rio,” he wrote.

While the parties did not disclose financial details, media reports have pegged the transaction value at $4 billion - $6 billion. “In our view, this figure would value Arcadium more like a mining company than a specialty chemicals firm, assuming a mid-cycle price range of $18,000–$19,000 per tonne of lithium carbonate equivalent (LCE), average selling price (ASP),” noted Jackson.

Over the past six years, Rio has been expanding its footprint in the battery market. In 2018, it reportedly attended to buy a $-billion stake in Chile's SQM, the world’s second largest lithium producer.

In April 2021, the world’s second largest miner kicked off lithium production from waste rock at a demonstration plant located at a borates mine it controls in California.

Rio took another key step into the lithium market in 2022, completing the acquisition of the Rincon lithium project in Argentina, which has reserves of almost 2.0 million tonnes of contained lithium carbonate equivalent, sufficient for a 40-year mine life.

The company plans to develop a battery-grade lithium carbonate plant at Rincon with an annual capacity of 3,000 tonnes and has earmarked $350 million to invest in the project.

It is also trying to revive one of its biggest lithium projects, the proposed $2.4 billion Jadar mine in Serbia. Rio had its mining licence revoked in 2022, following widespread protests against the proposed mine on environmental concerns.

The mining giant won a small, but key battle in July, as Serbia reinstated Rio Tinto's licence to develop it, but the company will have to secure approvals to move towards production at the site.

With projected production of 58,000 tonnes of refined battery-grade lithium carbonate per year, Jadar s expected to be Europe's biggest lithium mine.

The operation could supply enough lithium to power 1.0 million electric vehicles and meet 90% of Europe’s current lithium needs.

Comments