RANKED: World’s top 10 nickel projects

While nickel is mostly used for stainless steel, the base metal has begun to take centre stage in the production of batteries in electric vehicles, as it is expected that original equipment manufacturers will increasingly use high-nickel cathode battery chemistries.

The global nickel market is currently running at a surplus, but a supply deficit is expected to form in 2027 – and remain as demand accelerates.

The shift in market dynamics is already being reflected in the price of nickel, which recently surged to its highest since 2014. Prices are now approaching what market participants believe to be a key level for unlocking fresh supply.

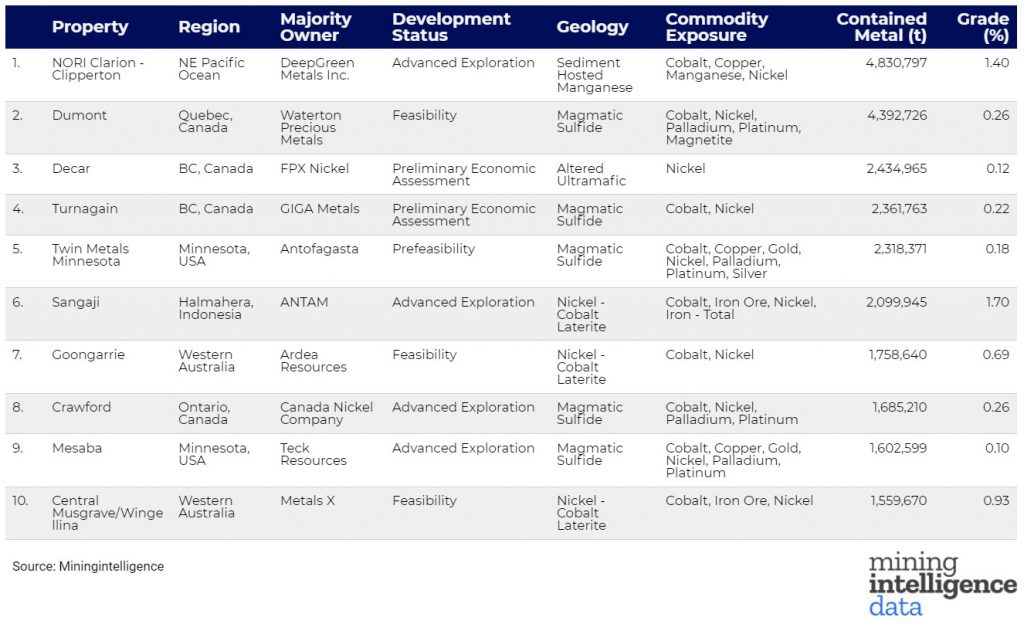

To identify major nickel deposits that could form part of the global supply landscape in the future, MINING.COM and sister company MiningIntelligence compiled the 10 largest projects under development worldwide and ranked them based on contained nickel resources in the measured and indicated categories.

While the world’s top nickel suppliers are Indonesia, the Philippines and Russia, six out of this year’s top ten ranked nickel projects are in North America, and the first is a seafloor deposit in the Clarion Clipperton Zone in the Pacific Ocean, between Hawaii and Mexico.

Grabbing top place is the Nori Clarion-Clipperton polymetallic project, about 4,000-4,500 metres deep into the northeastern part of the Pacific Ocean. The project is named after the seafloor zone between Hawaii and Mexico, and is part of international waters. The exploration contract is held by Nauru Ocean Resources Inc., but DeepGreen Metals has exclusive access to this area.

DeepGreen’s portfolio also includes the TOML exploration zone with estimated wet nodule resources of just under 954,000 tonnes contained nickel and with similar grades to NORI.

Together, the exploration area covers a combined 75,000 km2. TOML Clarion-Clipperton on its own is the 25th largest nickel deposit.

Followed closely in 2nd place is the Dumont nickel-sulphide deposit located in Canada’s Abitibi mining camp. Once in production, it is expected to rank among the biggest nickel operations in the world with an average annual nickel production of 39,000 tonnes for over 30 years.

Taking 3rd place is FPX Nickel’s greenfield discovery at Decar in British Columbia, where the deposit contains little to no sulphides, but has mineralization in the form of a naturally occurring nickel-iron alloy called awaruite. The project — named after the district in central B.C., hosting the awaruite mineralization — is estimated to produce 37,369 tonnes of concentrate per annum over a mine life of 24 years.

Next up is another project found in B.C. of a similar size but of different geology: the Turnagain project operated by Giga Metals. Once developed, this nickel sulphide is able to produce 33,000 tonnes of nickel a year over 37 years, with peak annual production of 45,000 tonnes.

Occupying the 5th spot is Antofagasta’s Twin Metals project located in Minnesota’s Duluth Complex mining camp. The proposed mine has been under close scrutiny for years due to the public outcry over its environmental risks and was halted during Obama’s presidency. However, it was later revived by the Trump administration.

Rounding out the top 10 list are:

Six of the top 10 nickel projects are in North America, including three Canadian deposits that are all ranked in the top 5.

Four projects — NORI Clarion – Clipperton, Sangaji, Crawford and Mesaba — are in the advanced exploration stage. The two British Columbia projects have reached the preliminary economic assessment (PEA) stage. The remaining projects are either at prefeasibility (PFS) or feasibility (FS).

Falling just short of the top 10 rankings is BHP’s Yakabindie deposit, part of the global miner’s Nickel West division in Australia. The project is currently in advanced exploration.

Comments