Private equity deals in mining sector experience large drop-off in 2024 – S&P

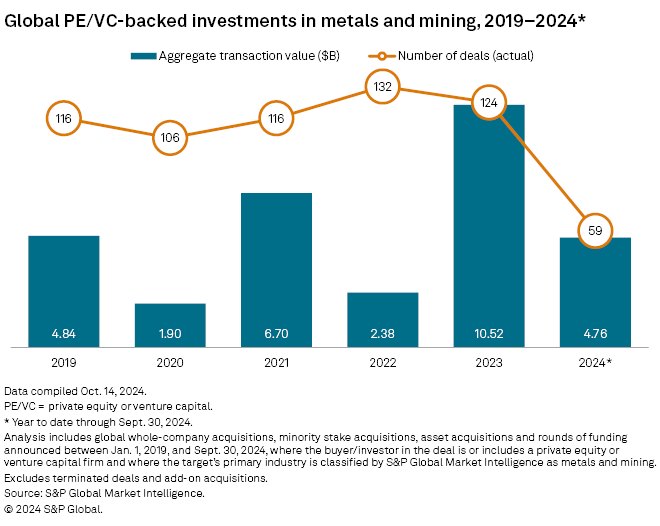

Private equity and venture capital transactions in the global metals and mining industry experienced a sharp drop-off in 2024 after reaching a five-year record last year, says S&P Global Market Intelligence.

Total transaction value as of Sept. 30 was US$4.76 billion, down more than 50% compared to the US$10.52 billion registered in the full year 2023, according to S&P data.

Steel producer H2GS AB's (H2 Green Steel) US$4.14 billion funding round in January led all private equity and venture capital deals in the metals and mining sector during that period.

The number of announced deals in the first three quarters totalled 59, on the year on track for the fewest deals in five years.

In the third quarter alone, total deal value plunged 80% year over year to US$240 million from US$1.22 billion, and the deal count dwindled to 15 from 37.

Antti Gronlund, managing director of UK-based private equity Appian Capital Advisory, said higher acquisition debt financing rates and reduced venture capital deployments have contributed to lower totals.

Transactions in 2023 may have benefited from large deals and non-sector-focused investors attracted by upbeat headlines focused on electric vehicles, which require significant amounts of critical minerals. Those headlines are now more subdued, affecting deal appetite, Gronlund explained.

Private equity investing is challenging because the sector is "working capital intensive," added Kyle Mumford, partner at KPS Capital Partners LP.

"There are no small capital requests in a metals business. There's only really big ones," Mumford continued. "Unlike other businesses, in metals and mining, change in profitability and manufacturing to meet the demand that may be out there takes a long time and is really hard. It can mean a new equipment or a new mill or a new recycling capacity.

"Those are expensive and don't often meet typical private equity return profiles."

Still, opportunity exists for further investment in the coming years. Appian's Gronlund noted that the mining industry is expected to require about US$2.1 trillion by 2050 to support global net-zero goals, citing BloombergNEF estimates.

"A significant portion of that will need to come from private capital sources," he added.

Comments