[caption id="attachment_1003729428" align="aligncenter" width="395"]

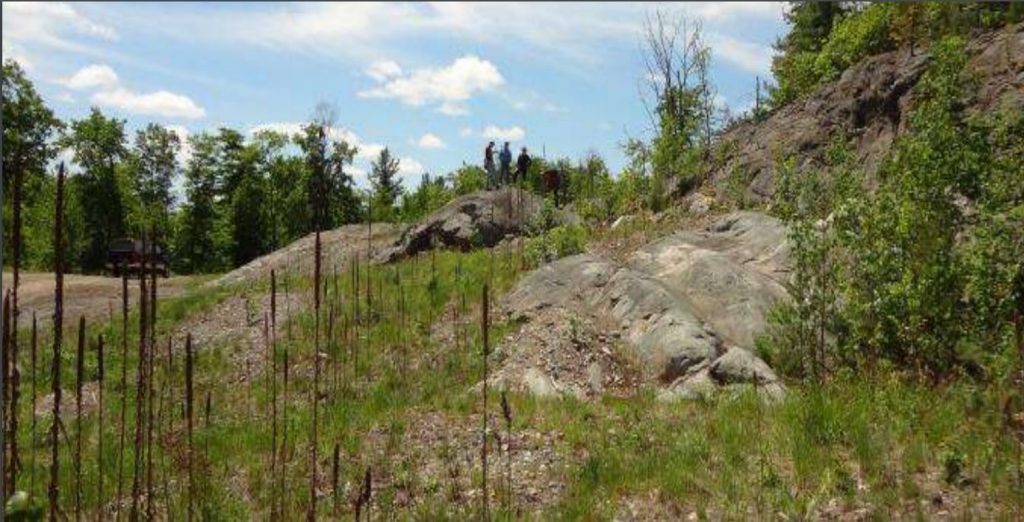

Outcrop of PGM mineralization at the River Valley property 100 km from Sudbury. (Image: New Age Metals)

Outcrop of PGM mineralization at the River Valley property 100 km from Sudbury. (Image: New Age Metals)[/caption]

ONTARIO –

New Age Metals of Vancouver has received the preliminary economic assessment for its 100% owned River Valley platinum group metals project 100 km from Sudbury. The study demonstrates positive economics for a large open pit that would produce palladium and platinum for 14 years, according to the company.

Pre-production capex requirements stand at $495 million. The mill would treat 6.0 million tonnes of ore annually at an average grade of 0.88 g/t palladium equivalent and a process recovery rate of 80%. Annual production would be 119,000 oz. of palladium. A contractor is to be hired to mine the pit.

New Age says the project carries an after tax net present value with a 5% discount of $139 million, and an internal rate of return of 10%. Payback of the capex would occur after 7.0 years. Cumulative undiscounted cash flow is estimated at $384 million.

Resources at River Valley include 99.3 million measured and indicated tonnes at 0.52 g/t palladium and 0.20 g/t platinum; and 52.3 million inferred tonnes at 0.31 g/t palladium and 0.15 g/t platinum. The mineralization also hosts measureable amounts of gold, copper, nickel and cobalt.

More information is available at

www.NewAgeMetals.com.

Outcrop of PGM mineralization at the River Valley property 100 km from Sudbury. (Image: New Age Metals)[/caption]

ONTARIO – New Age Metals of Vancouver has received the preliminary economic assessment for its 100% owned River Valley platinum group metals project 100 km from Sudbury. The study demonstrates positive economics for a large open pit that would produce palladium and platinum for 14 years, according to the company.

Pre-production capex requirements stand at $495 million. The mill would treat 6.0 million tonnes of ore annually at an average grade of 0.88 g/t palladium equivalent and a process recovery rate of 80%. Annual production would be 119,000 oz. of palladium. A contractor is to be hired to mine the pit.

New Age says the project carries an after tax net present value with a 5% discount of $139 million, and an internal rate of return of 10%. Payback of the capex would occur after 7.0 years. Cumulative undiscounted cash flow is estimated at $384 million.

Resources at River Valley include 99.3 million measured and indicated tonnes at 0.52 g/t palladium and 0.20 g/t platinum; and 52.3 million inferred tonnes at 0.31 g/t palladium and 0.15 g/t platinum. The mineralization also hosts measureable amounts of gold, copper, nickel and cobalt.

More information is available at

Outcrop of PGM mineralization at the River Valley property 100 km from Sudbury. (Image: New Age Metals)[/caption]

ONTARIO – New Age Metals of Vancouver has received the preliminary economic assessment for its 100% owned River Valley platinum group metals project 100 km from Sudbury. The study demonstrates positive economics for a large open pit that would produce palladium and platinum for 14 years, according to the company.

Pre-production capex requirements stand at $495 million. The mill would treat 6.0 million tonnes of ore annually at an average grade of 0.88 g/t palladium equivalent and a process recovery rate of 80%. Annual production would be 119,000 oz. of palladium. A contractor is to be hired to mine the pit.

New Age says the project carries an after tax net present value with a 5% discount of $139 million, and an internal rate of return of 10%. Payback of the capex would occur after 7.0 years. Cumulative undiscounted cash flow is estimated at $384 million.

Resources at River Valley include 99.3 million measured and indicated tonnes at 0.52 g/t palladium and 0.20 g/t platinum; and 52.3 million inferred tonnes at 0.31 g/t palladium and 0.15 g/t platinum. The mineralization also hosts measureable amounts of gold, copper, nickel and cobalt.

More information is available at

Comments