VANCOUVER — The future of Sabina Gold and Silver’s promising Back River gold property, 400 km southwest of the community of Cambridge Bay in Nunavut, has come into question following a decision by the Nunavut Impact Review Board (NIRB) that recommends that permitting be delayed until “circumstances are more favourable, and uncertainty regarding potential effects and efficacy of mitigation measures has been established.”

In a report that runs roughly 350 pages the regulatory agency cited a number of concerns with the Back River mine plan, but the major issues surround regional caribou populations, and closure uncertainties related to climate change and the remediation of tailing facilities.

Sabina president and CEO Bruce McLeod called the decision “surprising and disappointing” during a conference call, and added the report didn’t seem to represent the positive tone of recent public hearings.

The company had been anticipating receipt of a project certificate from the Minister of Aboriginal and Northern Affairs Canada during the second quarter, which would have led into construction start-up in late 2017 and first gold by 2020.

McLeod did note that the NIRB “clearly opened the door for re-submission and modification,” but said there was “no timeline” on the process. The company estimates that the permit setback will likely delay construction at Back River by at least one year due to “seasonality.”

The decision indeed strikes an odd chord since Back River did appear to enjoy relatively wide-spread support from many stakeholders. The Kitikmeot Inuit Association (KIA) openly championed the project, while the governments of Nunavut and the Northwest Territories (NWT) also suggested that Sabina’s final environmental impact statement (FEIS) was sufficient to warrant development permits.

Nunavut has recently been viewed as a relatively low-risk permit jurisdiction in Canada, with Agnico Eagle Mines operating the Meadowbank gold mine, and TMAC Resources recently receiving NIRB approval for development of its Doris North project in the Kitikmeot region; 125 km southwest of Cambridge Bay and east of Bathurst Inlet.

The NIRB also noted that “many of the preferred means of carrying out [the project] chosen by [the company,] such as tailings disposal and impoundment measures, are based on methods and technologies widely used in other northern mines.”

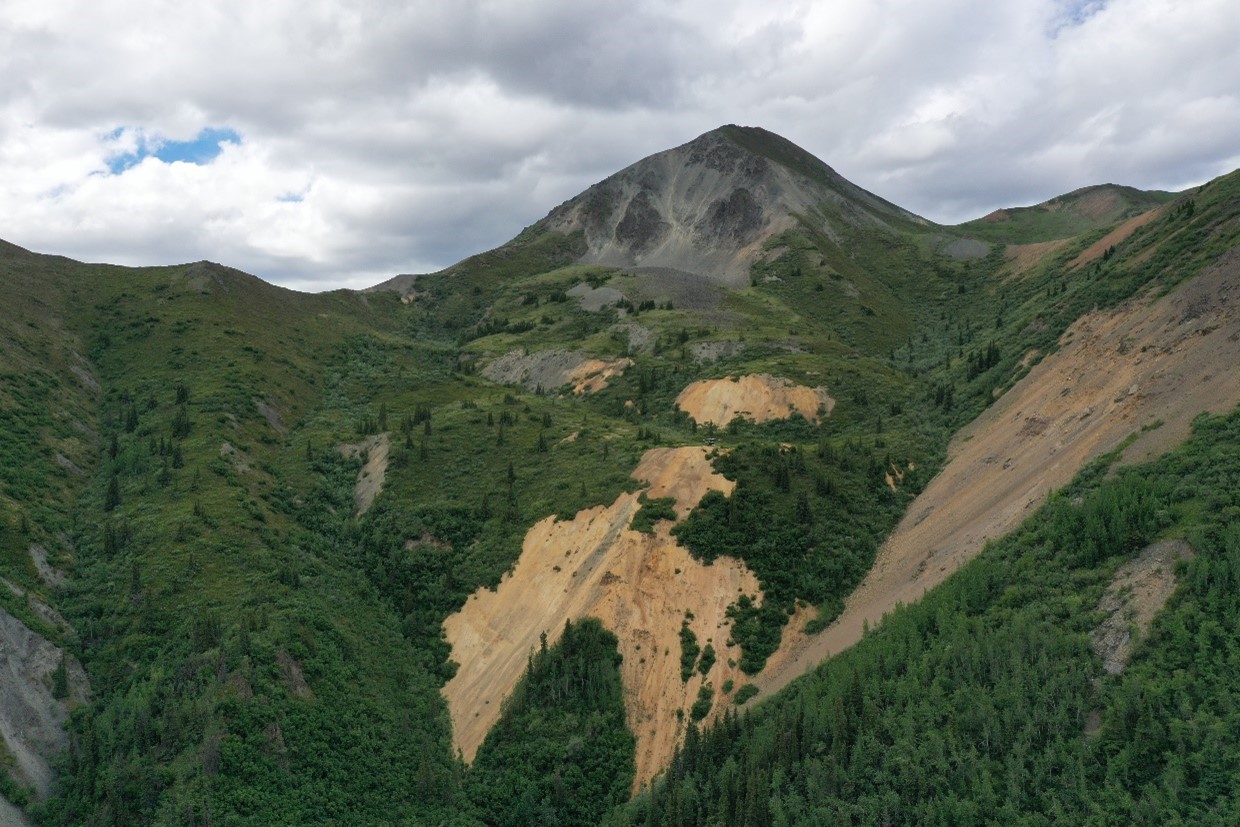

In the end, it appears Sabina suffered from Back River’s location, however, and specifically its proximity to the migration route of the Bathurst caribou herd, which the NWT government estimates has decreased by 50% since 2012 to roughly 16,000 animals.

Sabina noted in its research that the Bathurst caribou range hadn’t overlapped the project area in “over 20 years,” but the NIRB regulators cited speculation that it could hypothetically swing back to the area at some point.

Interestingly, the issue has an important transboundary component due to the opposition of communities in the NWT, specifically the Lutsel K’e Dene and Yellowknives Dene First Nations.

Under the provisions of the Nunavut Land Claim Agreement, the next step in the review process is for the federal Minister of Indigenous and Northern Affairs to review the NIRB’s report. Sabina is reportedly “reviewing its options,” including a request to the Minister to refer the report back to NIRB for further consideration.

On June 16, McLeod sent a letter to Minister Carolyn Bennett requesting she “defer any decision in response to the report until [the company] has time to review [it] in detail.”

In September 2015 Sabina released a revised feasibility study (FS) at Back River that models a more compact, 3,000-tonnes-per-day operation that would generate 198,100 oz. gold annually over an 11.8 year mine life at all-in sustaining cash costs of US$763 per oz.

Initial capital for the project is estimated at $415 million, with sustaining capital of $185 million. Based on a US$1,150 per oz. gold price, the mine would generate a US$480 million after-tax net present value at a 5% discount rate, and a 24.2% internal rate of return.

Canaccord Genuity analyst Eric Zaunscherb noted that transcripts of the final public hearing for the environmental assessment “suggested a positive and supportive tone from stakeholders,” while documents indicated “that the current Bathurst herd caribou calving and post-calving ranges do not overlap the project development area.”

Zaunscherb concluded that Back River will “eventually become a mine,” but Canaccord dropped Sabina’s target price by 75¢ to $1 per share, pushed project start-up back by two years, and added $50 million to capital expenditures to “cover additional remediation efforts and the expected increase in equipment and services costs through the cycle.” Zaunscherb also labelled the setback “surprising” and noted that NIRB based the decision on “several hypothetical issues.”

Comments