Mining industry needs US$2.1 trillion in new investments by 2050 – BloombergNEF

The mining industry will require US$2.1 trillion in new investments by 2050 to meet the raw material demands of a net-zero emissions world, according to BloombergNEF’s (BNEF) annual Transition Metals Outlook.

Despite a decade of growth in metals supply, BNEF reports that current raw material availability remains insufficient to meet the rising demand.

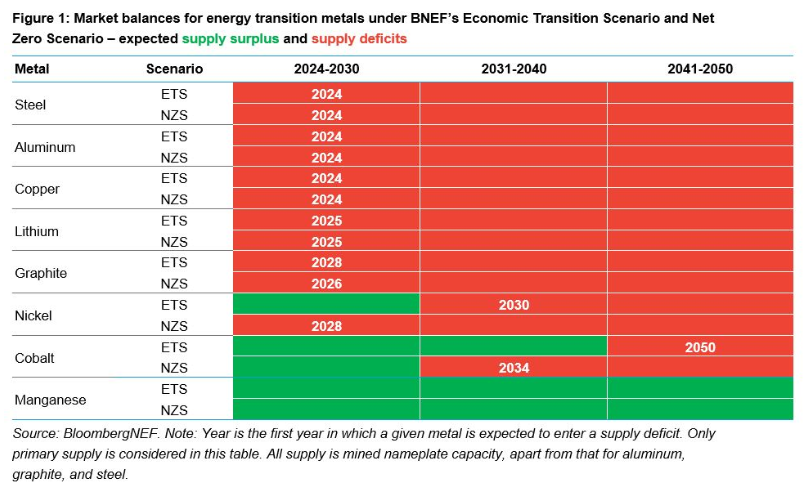

The report highlights that critical energy transition metals, including aluminum, copper, and lithium, could face supply deficits this decade—some as early as this year.

According to BNEF’s Economic Transition Scenario (ETS), which assumes no new policy support and is driven by the cost competitiveness of technologies, the world may need 3 billion tonnes of metals between 2024 and 2050 to support low-carbon solutions such as electric vehicles, wind turbines, and electrolyzers. That figure could rise to 6 billion tonnes to achieve net-zero emissions by 2050.

Recycling could help alleviate some of the pressure, with BNEF predicting that output from secondary sources will become an integral part of the energy transition metals supply chain.

“Good government policies are crucial to the industry’s success. For batteries and stationary storage, governments need to establish collection networks, set recovery rate requirements, develop frameworks to trace individual cells, and provide guidelines for second-life battery management," said Allan Ray Restauro, a metals and mining associate at BNEF.

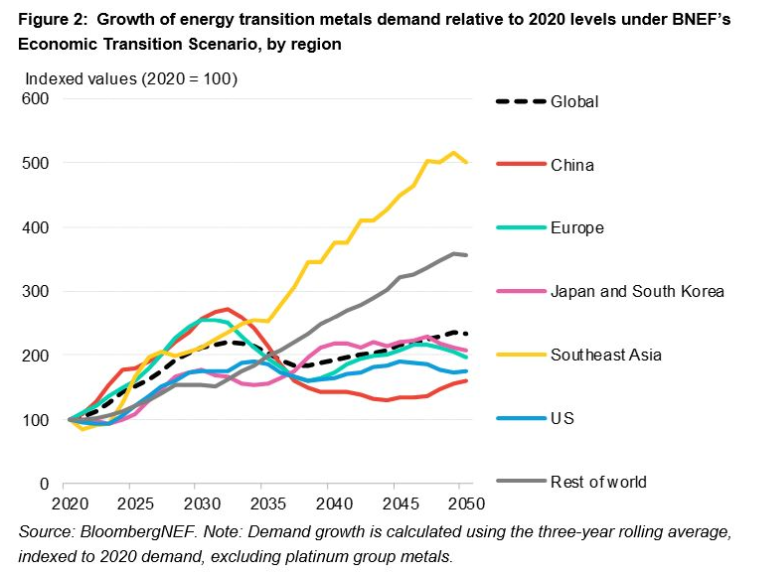

The pace of demand growth will vary across regions.

In China, for instance, consumption outpaced the global average between 2020 and 2023, but the country’s demand for energy transition metals is expected to peak in 2030. Southeast Asia is projected to become the fastest-growing market for these metals during the 2030s, according to BNEF’s ETS.

Read More: Lack of capital rises to top risk in EY mining su

Comments