McEwen Copper closes $40M private placement

McEwen Copper, a subsidiary of McEwen Mining (TSX: MUX: NYSE: MUX), has closed the first tranche of the series B private placement announced July 6. McEwen Copper issued 4 million common shares at a price of $10 per share for gross proceeds of $40 million.

Qualified investors can subscribe to the remaining 4 million common shares at the same price, subject to a $1-million minimum investment and certain other conditions. This second tranche is expected to close on or before Sept. 30.

The first tranche of shares was purchased by Evanachan, Rob McEwen’s investment corporation. Rob McEwen will beneficially own 18.6% of McEwen Copper upon closure of the second tranche.

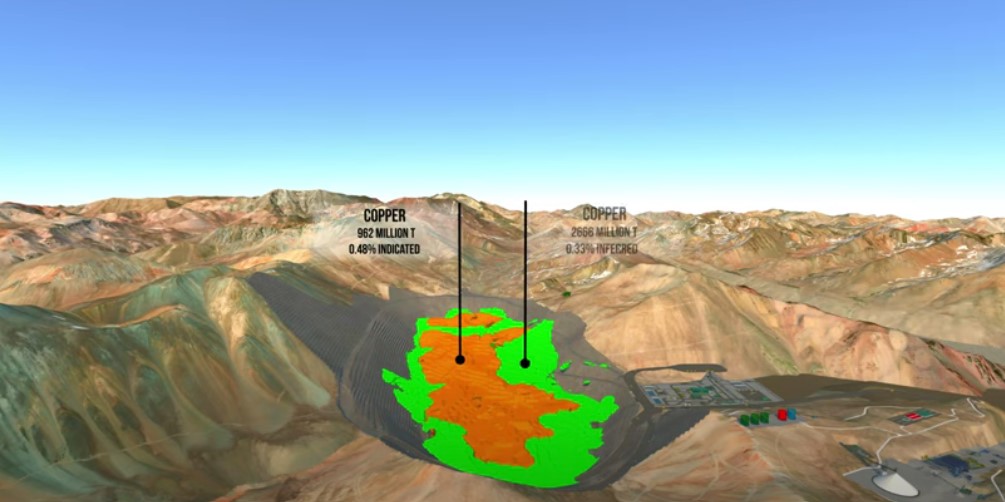

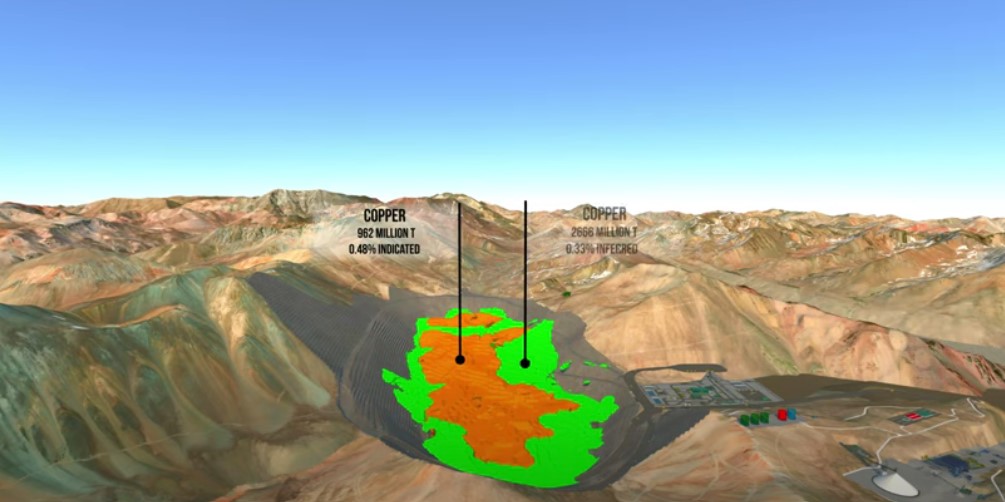

McEwen Copper holds a 100% interest in the Los Azules copper project in San Juan, Argentina, and a 100% interest in the Elder Creek copper-gold exploration property in Nevada, subject to a 1.26% net smelter return (NSR) royalty on both assets payable to McEwen Mining. A portion of the proceeds from the offering will be used to advance Los Azules to a prefeasibility study, building a year-round access road, and infill and continued exploration drilling. At Elder Creek, funds will be budgeted for permitting and community relations.

McEwen Copper intends to make an initial public offering within 12 months of the final closing of the offering.

Access the animated Los Azules project video on YouTube, youtu.be/swTAsZlLxfI.

Comments