MONTREAL: TomaGold Corporation is pleased to report that is has signed a Letter of Intent ("LOI") to acquire, pursuant to a takeover bid, business combination or similar transaction, all of the issued and outstanding common shares of Red Metal Resources Ltd., namely 34,290,302 common shares, as well as all of the common shares of Red Metal that may be issued upon the exercise of any options, warrants or other convertible securities after the formal filing of the transaction but before its closing. The proposal would be that such Red Metal shareholders will receive in exchange an aggregate consideration of CAD$3,250,000 payable through: (i) the payment in cash of the Red Metal's debts for a maximum amount of CAD$500,000; and (ii) for the remainder of the aggregate consideration, the issuance of class "A" common shares of the capital stock of TomaGold at a price that is the higher between the average market price over the 20 days before the execution date of the Definitive Agreement and of CAD$0.15, subject to a maximum price of CAD$0.20. The parties to the transaction are at arm's length.

The LOI includes customary provisions, including non-solicitation of alternative transactions, the right to match superior proposals and the closing by TomaGold of a financing of CAD$700,000 before the closing of the Transaction. The parties have agreed to a break-up fee of CAD$175,000 (i) payable to TomaGold if Red Metal is in default of this LOI and if a superior proposal is accepted by Red Metal's shareholders, and (ii) payable to Red Metal if TomaGold does not complete the Transaction for reasons other than discovering an issue with their confirmatory due diligence.

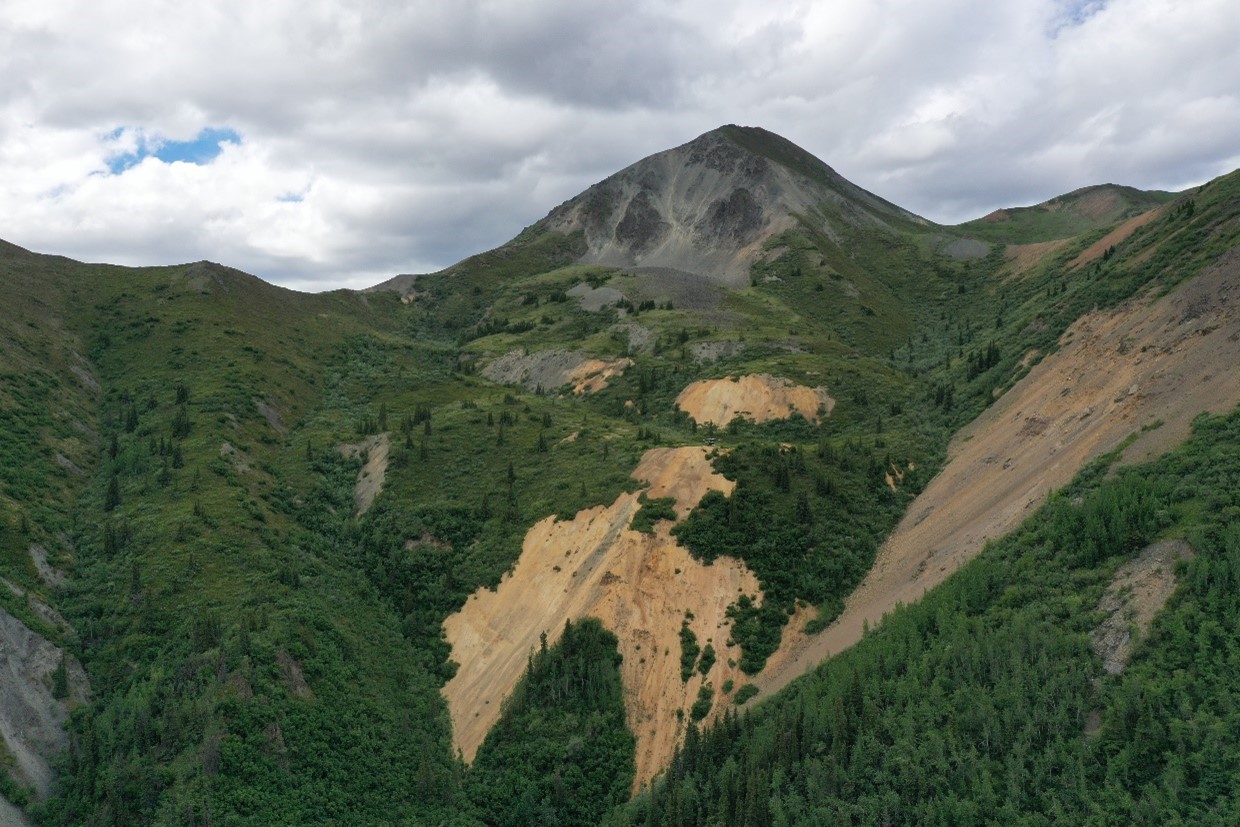

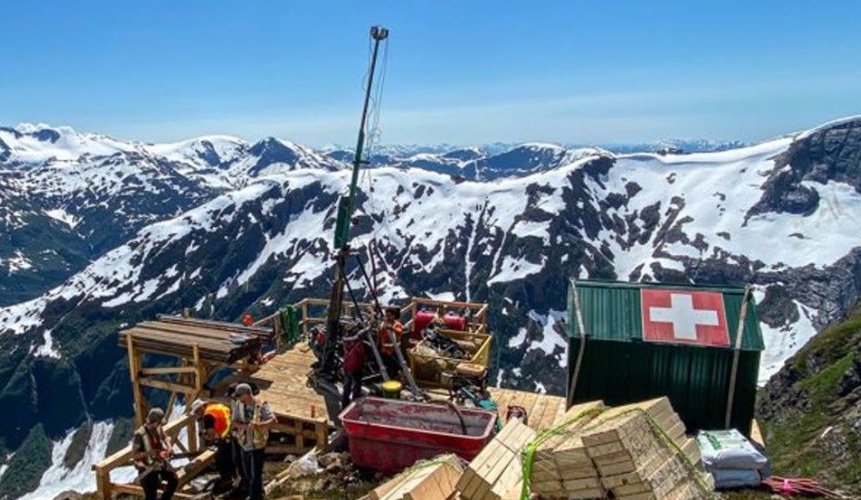

Red Metal owns, or has the option to own, 100% of three projects (Farellon, Perth and Mateo) located in the prolific Candelaria iron oxide copper-gold (IOCG) belt of Chile's coastal Cordillera, host to Freeport McMoRan's Candelaria Mine and Anglo American's Mantoverde Mine.

David Grondin, President and CEO of TomaGold, stated: "This is a great transaction for TomaGold, as we are adding high-quality assets with strong exploration potential to our portfolio of properties. We are also diversifying our asset base into copper-gold properties in the world's leading copper producing country. Moreover, this transaction will enable us to become a producer and generate cash flow on a short-term horizon."

For more information visit www.tomagoldcorp.com.

Comments