Livent, Allkem create world’s No. 5 lithium miner in $10B merger

Lithium firms Allkem (ASX:AKE) and Livent Corp (NYSE:LTHM) are shaking up the sector by merging to form the world's fifth largest producer of the key metal used in the batteries that power electric vehicles (EVs) and high tech devices.

The all-share merger creates a company with a valuation of $10.6 billion and a forecast production capacity of 248,000 tonnes of lithium carbonate equivalent (LCE) a year.

The deal places the new company among the top five lithium producers, behind Albemarle (NYSE:ALB), Chile’s SQM (NYSE:SQM), Ganfeng Lithium (SHE:002460) and Tianqi Lithium (SHE:002466).

“Allkem and Livent will combine their highly complementary range of assets, growth projects, and operating skills across extraction and processing under a vertically integrated business model,” the companies said Wednesday.

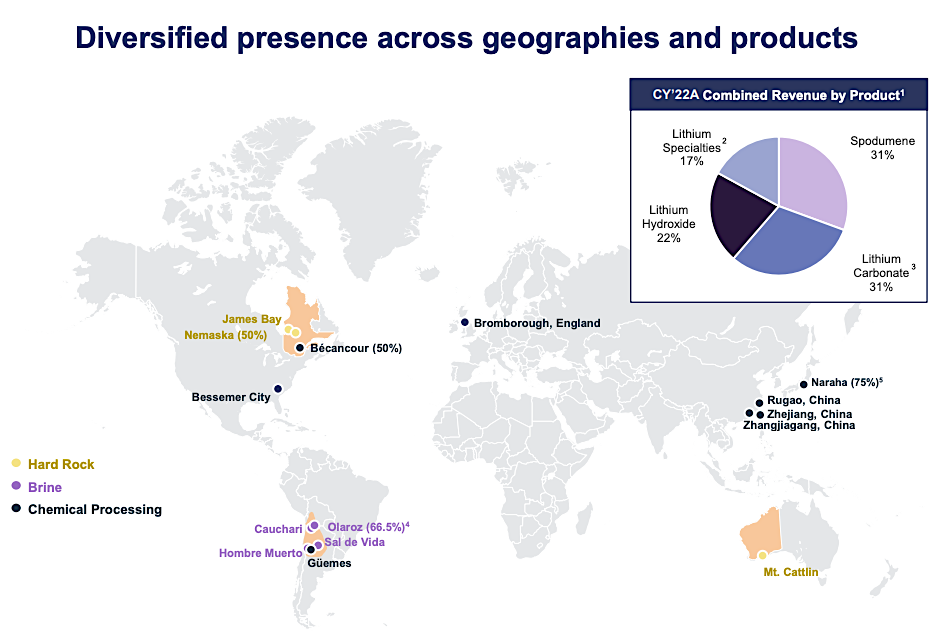

Australia’s Allkem produces lithium carbonate from its Sal de Vida mine in Argentina. The operations is near Livent's Hombre Muerto brines project and the Olaroz lithium facility, which is a joint venture project with Japanese trading giant Toyota Tsusho Corporation (TTC).

Allkem, formed as a result of a scrip merger between Galaxy Resources and Orocobre in 2021, also produces hard rock lithium in Australia and has a chemical conversion facility in Japan.

US-based Livent has brine production in Argentina, a hard-rock based lithium project in Canada, and lithium refineries in the US and China. The company also has a supply agreements with various US-based automakers, including General Motors, Tesla and BMW.

Livent chief executive officer, Paul Graves, will take the top job at the new entity while Allkem's director Peter Coleman will become the chairman. No role was announced for Allkem’s CEO Martín Pérez de Solay.

The company will be primarily listed on the New York Stock Exchange and seek inclusion on Australia's benchmark S&P/ASX 200 index.

As part of the “merger of equals”, set to close by the end of 2023, Allkem shareholders will take 56% of the company and Livent shareholders will own 44%.

“As a combined company, we will have the enhanced scale, product range, geographic coverage, and execution capabilities to meet our customers’ rapidly growing demand for lithium chemicals,” Graves said in the statement.

Livent has previously talked about plans to expand offshore to meet surging demand from EV makers, saying that it was assessing lithium assets in Canada and other countries to boost its capacity.

“We see Canada as a core part of our expansion capacity. We have to get bigger. We can’t just sit still,” Graves said in a November interview.

Allkem gets the lion’s share of its profit from its Mt Cattlin mine in Western Australia, but it has flagged growth plans in Argentina and at the James Bay spodumene project in Canada.

Australian lithium miners have been fending off takeover approaches this year. In March, Liontown Resources (ASX:LTR) rebuffed a $3.7 billion (A$5.5bn) buyout bid from Albemarle, after turning down two previous offers by the US producer since.

The wave of deals in lithium sector comes as prices of the battery metal fell by more than 50% from almost $90,000 per tonne at the end of 2022 to about $24,000 per tonne in April, on weak demand from the Chinese EV sector, according to Benchmark Mineral Intelligence.

Prices have recovered over the past few weeks and are now above $26,000 a tonne. While the drop has been dramatic, Benchmark analysts note lithium prices were only about $10,000 a tonne before the covid-19 pandemic hit worldwide markets.

Comments