JV Article: Tudor Gold moves closer to development at Treaty Creek project in British Columbia’s Golden Triangle

After an expanded resource estimate, the latest drill campaign begins this week on one of the world’s biggest gold projects.

Tudor Gold (TSXV: TUD) is kicking off its 2023 drill program this week at its flagship Treaty Creek gold-copper project in the Golden Triangle of northwest British Columbia after an updated resource in March revealed large increases in gold and copper.

Treaty Creek, one of the largest gold discoveries in the last 30 years, was ranked this year in Mining Intelligence's top ten biggest gold projects in the world.

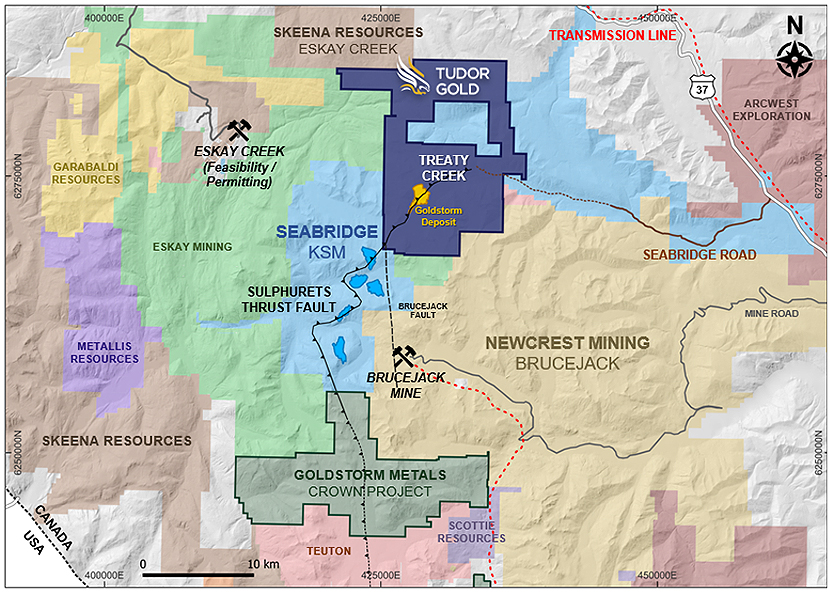

The company’s flagship project Treaty Creek, in which Tudor Gold holds a 60% interest, comprises 179.1 sq. km bordering both Seabridge Gold’s (TSX: SEA; NYSE: SA) KSM property to the southwest and Newcrest Mining’s (TSX: NCM; ASX: NCM) Brucejack mine to the southeast.

The Golden Triangle has been a hotbed of merger and acquisition activity in recent years. The total value of transactions sits at $4.4 billion (US$3.2 billion) since 2018, with majors Newmont (TSX: NGT; NYSE: NEM) and Newcrest acquiring assets and interests in the mineral rich and highly prospective region.

The recently updated resource for Treaty Creek’s Goldstorm deposit resulted in a 53% increase in the gold equivalent grade and a 20% increase in gold-equivalent ounces in the indicated category. In addition to the gold and silver, Tudor delineated a total resource of 3 billion lb. of copper.

The project now holds 23.4 million gold equivalent oz. in a combined open pit and underground indicated resource of 641.9 million tonnes grading 1.13 grams gold equivalent per tonne. Individual grades are 0.91 gram gold per tonne for 18.8 million contained oz.; 5.45 grams silver for 112.4 million oz.; and 0.15% copper for 2.2 billion lb. The estimate used a 0.5-gram gold-equivalent per tonne cut-off grade for open pit resources and a 0.7-gram gold-equivalent cut-off for underground. Even at a higher cut-off grade, open pit and underground indicated resources remain robust. With a cut-off of 1 gram gold equivalent per tonne, the deposit holds 319.2 million tonnes grading 1.48 gram gold equivalent for 15.2 million gold-equivalent ounces. (Individual grades are 1.2 grams gold for 12.3 million oz. of contained metal, 7.02 grams silver for 72.1 million oz., and 0.19% copper for 1.4 billion pounds.

Inferred resources stand at 7.4 million gold-equivalent oz. within 233.9 million tonnes grading 0.98 gram gold equivalent. (Individual grades are 0.74 gram gold per tonne for 5.5 million contained oz., 5.99 grams silver for 45.1 million oz., and 0.16% copper for 848 million pounds.

“We are very pleased by the results of our updated [resource] for the Goldstorm deposit, which resulted in an impressive 53% increase in the gold equivalent grade and a 20% increase in total gold equivalent ounces within the Indicated Mineral Resource category,” says Tudor Gold CEO Ken Konkin.

“These accomplishments are a culmination of two additional years of drilling and refining of our geologic understanding to vector towards higher-grade gold, copper, and silver,” Konkin adds. “These improvements to the Goldstorm Deposit are expected to provide an excellent foundation as the company advances the Treaty Creek Project towards an initial economic assessment.”

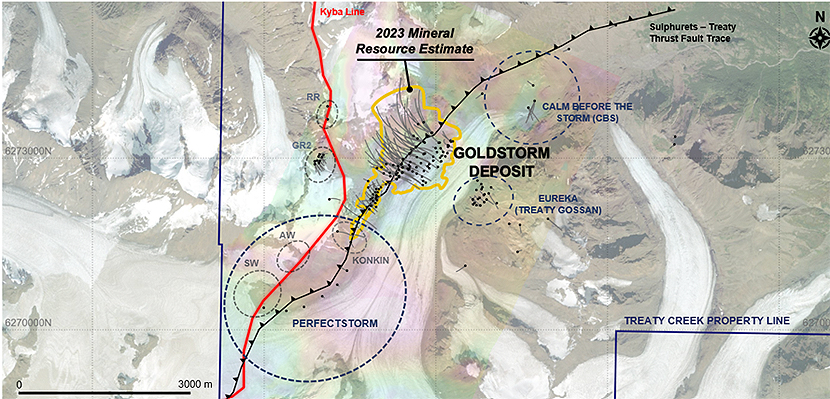

Continued definition and expansion drilling will continue in 2023 to target higher gold, silver and copper grades throughout the northern expansion area of Goldstorm.

This year’s exploration program will come to at least 20,000 metres and will target the deposit’s north and northeast mineral extensions.

In addition, the company plans to carry out exploration drilling at the Perfectstorm zone, which is located about 2.5 km southwest of Goldstorm and approximately 2.5 km northeast from Seabridge Gold’s Iron Cap deposit near the southwestern boundary of the Treaty Claim block.

The company recently completed a $18.5-million capital raise and is fully funded for the 2023 exploration season.

Tudor also points to solid ESG metrics: The company signed an agreement for engagement and opportunity sharing with the Tahltan Central Government, which represents the interests of the Tahltan First Nation, on whose traditional territory the project is hosted.

Gold has had a successful track record for over 5,000 years as a form of exchange and store of value worldwide. Investors are also using gold as a rescue boat in times of high inflation and instability of financial markets.

As of May 5, Tudor Gold has a market cap of $397 million based on a share price of $1.74. The company has 218.6 million shares outstanding. The two largest shareholders are Tudor Holdings (25.3%) and renowned investor Eric Sprott (17.4%).

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Tudor Gold Corp. and produced in co-operation with MINING.com. Visit: www.tudor-gold.com for more information.

Comments

Lloyd Penner

This is bc. They will be in permitting mode forever.