JV Article: Treaty Creek Project – One of the largest gold discoveries in the last 30 years worldwide

Location is key for success in many undertakings. In real estate it is the only consideration.

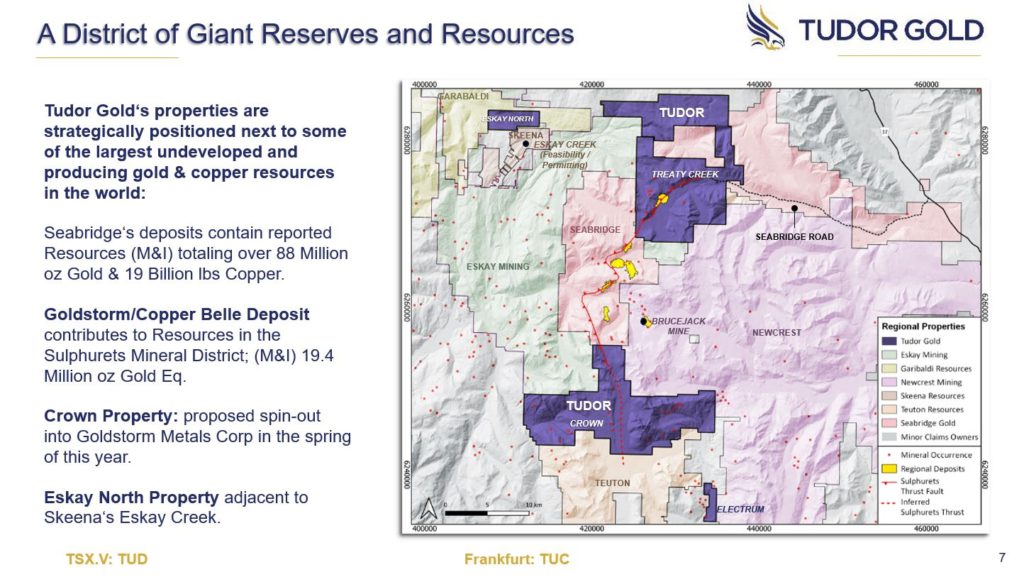

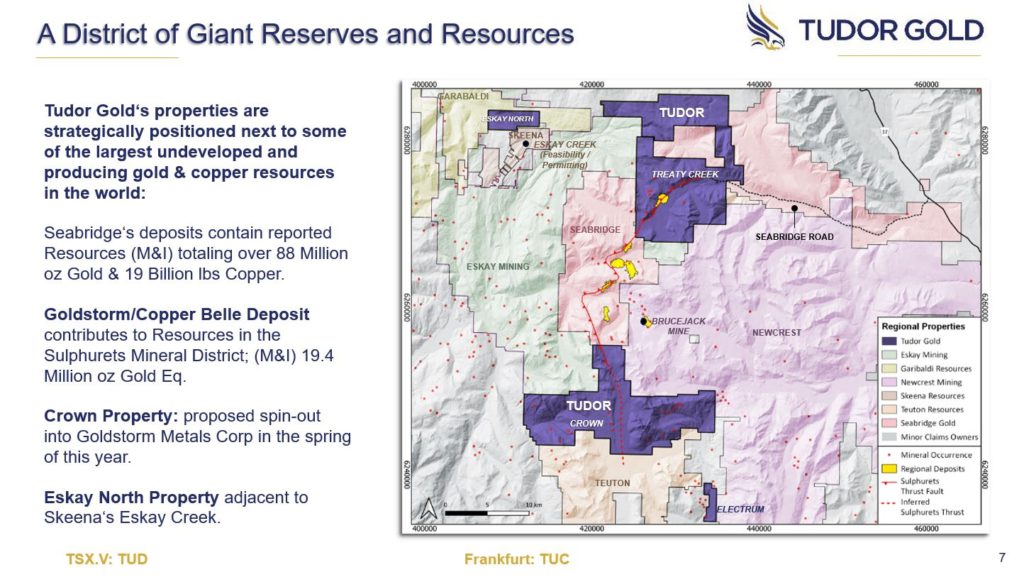

In gold exploration the best location to look for is where there are other gold deposits and mines. There are several hot spots in Canada such as Ontario’s Red Lake Gold District, the Abitibi Greenstone Gold Belt in Quebec or the Golden Triangle region in British Columbia.

Merger and acquisition activities in the Golden Triangle have increased massively in recent years. Total transaction value of $4.35 billion since 2018 show the high confidence of majors such as Newmont Mining or Newcrest for the highly prospective region.

The Golden Triangle is home to the producing Red Chris copper-gold mine of Newmont Mining (70%) and Imperial Metals (30%) as well as the Brucejack gold mine 100% owned by Newcrest Mining.

One of the most outstanding exploration and development companies is Tudor Gold (TSXV: TUD; Frankfurt: TUC), which holds sizable properties directly in the heart of the Golden Triangle in British Columbia. The company was founded by renowned Walter Storm, who was also co-founder of one of the top three producing Canadian mining companies, Osisko Mining.

Storm is the chairman of the board of directors. Ken Konkin, P. Geo, a multi award winning geologist is the president and CEO of Tudor Gold and has led the exploration program since 2019. He was instrumental in the discovery of the nearby The Valley of the Kings deposit.

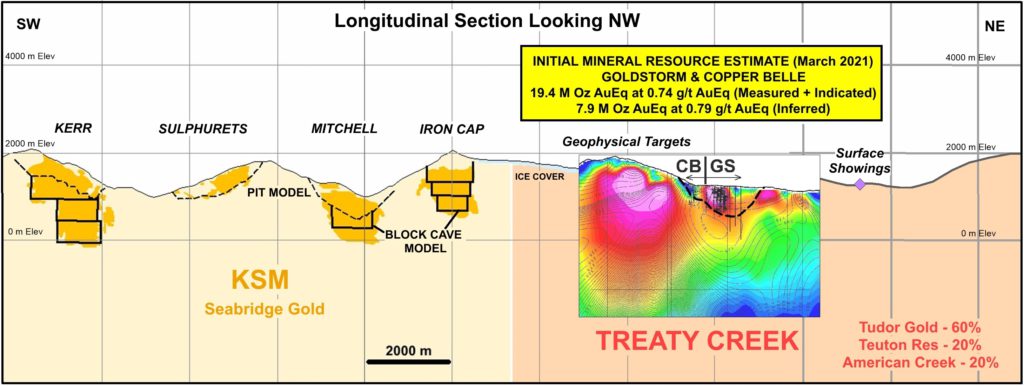

The prime company’s flagship project Treaty Creek (in which Tudor Gold has a 60% interest), comprises 17,913-hectares and borders Seabridge Gold’s KSM property to the southwest and borders Newcrest Mining’s Brucejack property to the southeast.

There are many reasons why the region holds such promise. The Golden Triangle is pretty much underexplored. There are economic mines and many potential high-grade deposits in various stages of exploration. British Columbia is a politically stable, mining friendly jurisdiction. There is an all-weather paved highway only 20 km northeast of Treaty Creek, the Bob Quinn gravel airstrip only 40 km to the north, the high voltage Northwest transmission line nearby, and deep-water ocean port facilities in Stewart. Tudor Gold also has signed engagement, communication and opportunity sharing agreements with the Tahltan First Nation.

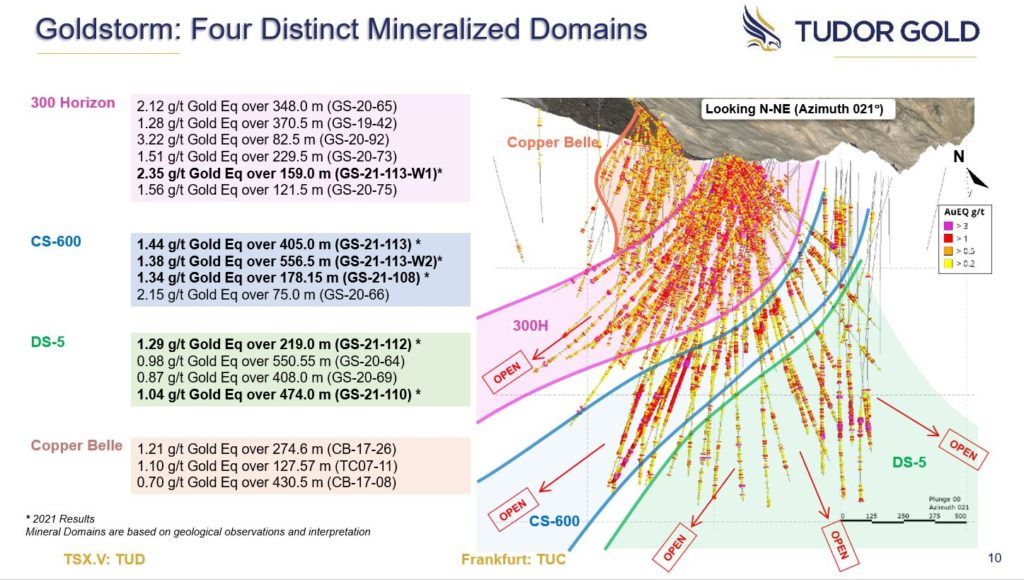

The company released their initial resource estimate for Goldstorm-Copper Belle zone in March 2021 with 19.4 million oz. of gold-equivalent grading 0.74 gram gold-equivalent per tonne (measured and indicated) plus 7.9 million oz. gold-equivalent in material grading 0.79 gram gold-equivalent per tonne (inferred).

President and CEO, Ken Konkin (P. Geo) stated in the news release on March 9, 2021: “We are very pleased with the results obtained from our initial mineral resource estimate. Only 10-12 % of the gold equivalent values are attributed to silver and copper mineralization indicating a strong gold-dominate system. However, due to the immense volume of the system, it contains large quantities of silver and copper. Further studies are required to investigate the potential economic impact of these two metals.”

Tudor has outlined four separate zones (mineral domains) at their Goldstorm deposit. They are the 300 Horizon, CS-600, DS-5 and Copper Belle.

Tudor had a pretty successful drill season last year, with the discoveries of new mineral zones (Calm before the Storm and Eureka) on the Treaty Creek property. Furthermore, step-out drilling particularly in the north and northeast direction from the Goldstorm deposit revealed that ore grades are even higher, confirmed by hole GS-21-113 which returned 1.27 grams gold-equivalent per tonne over 972 metres.

Besides Treaty Creek, the company controls additional properties including the 1,298 hectare Eskay North property which is located adjacent to the former high grade Eskay Creek gold mine. Eskay Creek produced 3.3 million oz. gold from ore grades averaging 45 grams gold per tonne, and there are still an estimated 646,000 oz. gold in the ground according to Skeena Resources, which is re-exploring the site. In addition this area hosts the former Premier and Snip gold mines plus dozens of others going back 100 years or more.

Tudor’s project portfolio compromise also the 15,657-hectare Crown property directly south of the KSM deposits. In July 2021, the company announced the proposed spin-off of the Crown property to a wholly owned subsidiary company, Goldstorm Metals Corp. Once this transaction is complete, Tudor Gold shareholders will receive approximately 0.253 of a common share of Goldstorm for every one common share of Tudor Gold held.

It looks like Treaty Creek is a giant in the making, and so far, indications point toward being in the right place to define what may become one of Canada’s largest open pit gold mines in the upcoming years.

It is expected that Tudor will incorporate the drill results from 2021 and 2022 into an updated resource estimate for Treaty Creek, which will be part of a preliminary economic assessment (PEA) later in 2023.

As of May 2, 2022, Tudor Gold has a market cap of $352 million based on a share price of $1.77. The company has 198.49 million shares outstanding. The two largest shareholders are founder and Chairman Walter Storm (29.28%) and renowned investor Eric Sprott (17.61%).

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by TUDOR GOLD and produced in co-operation with The Northern Miner. Visit www.tudor-gold.com for more information.

Comments