JV Article: Southern Silver aims to increase resource estimate by 30% at Cerro Las Minitas in Mexico

Southern Silver Exploration (TSXV: SSV; US-OTC: SSVFF) is a Canadian exploration company focused on developing high-grade precious and base metal properties in North America.

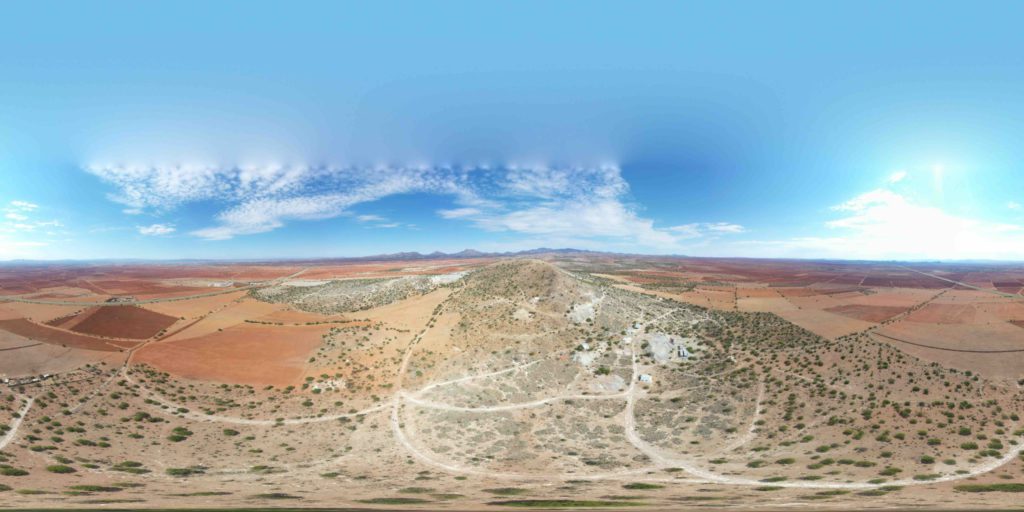

The Vancouver-headquartered junior is advancing its 100%-owned Cerro Las Minitas silver-lead-zinc project in Mexico, about 70 km northeast of the city of Durango.

The 34,450-hectare property lies within the prolific Faja de Plata region of northern Mexico, one of the world's most significant silver-producing regions. The area hosts several mining operations, including Hecla Mining’s (NYSE: HL) San Sebastian silver-gold mine, about 30 km east of Cerro Las Minitas, and the La Preciosa silver-gold project, approximately 30 km to the west, operated by Coeur Mining (NYSE: CDE).

Robert Macdonald, Southern Silver’s vice president of exploration, says Cerro Las Minitas is one of the largest and highest grade undeveloped silver-based projects in the world and is “likely to grow significantly larger.”

“Drilling continues to add considerable value to the project, which we believe could increase the project’s current resource estimate by as much as 30%. The project is a large sulphide deposit, as opposed to a mixed sulphide/oxide deposit, and the silver and base metals grades are high enough for it to be developed as an underground mining operation.”

The project currently contains 11.1 million indicated tonnes grading 105 grams silver per tonne, 0.1 gram gold per tonne, 0.16% copper, 1.2% lead, and 3.7% zinc (375 grams silver-equivalent per tonne) for 37.4 million oz. contained silver, 35,000 oz. gold, 40 million lb copper, 303 million lb lead, and 897 million lb zinc (133.8 million oz. silver-equivalent). Inferred resources stand at 12.8 million tonnes of 111 grams silver, 0.07 gram gold, 0.27% copper, 0.9% lead, and 2.8% zinc (334 grams silver-equivalent) for 45.7 million oz. silver, 31,000 oz. gold, 76 million lb copper, 253 million lb lead, and 796 million lb zinc (138.1 million silver-equivalent ounces). The mineral estimate was based on drilling on the west part of the project, in the Blind, El Sol, Las Victorias, and Skarn Front zones.

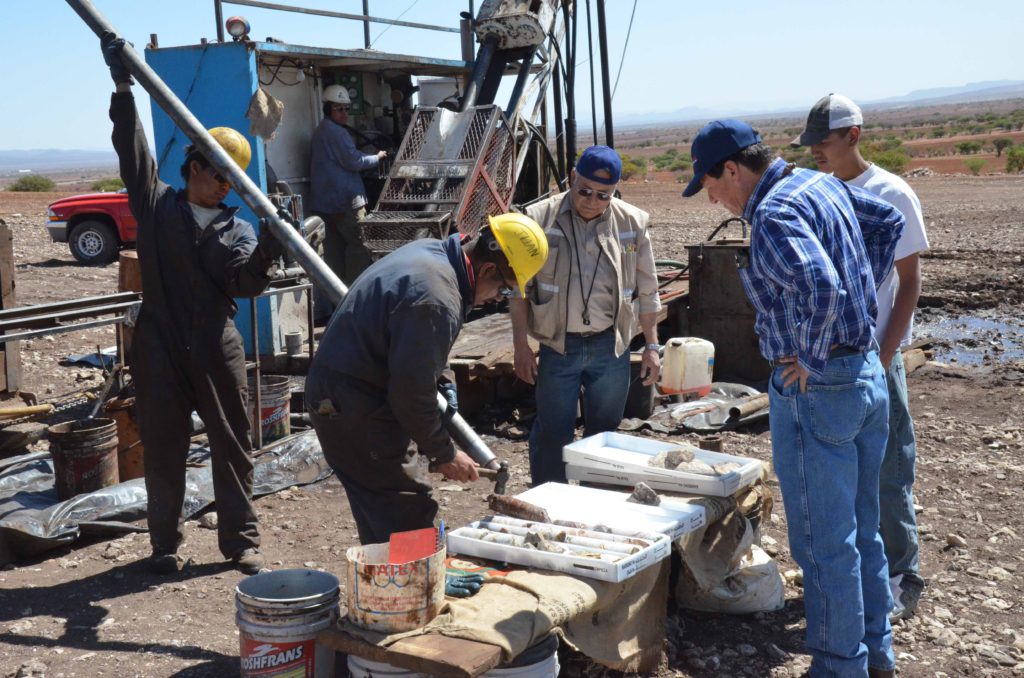

In 2021, Southern Silver expanded its drill program to test the Southern Skarn and Mina La Bocona Extension zones on the east side of the property. At Mina La Bocona, it has been testing three targets: a new near-surface sulphide/oxide zone; the high-grade Muralla chimney; and the La Bocona chimney, which was historically worked by artisanal miners.

“We increased the drilling from an initial 10,000-metre program to more than 20,000 metres,” explained Macdonald. “The drilling focused on the development of these targets, which returned bonanza-grade silver intercepts, as well as the development of mineralisation located to the northwest along the east side of the property.”

Highlights included drillhole 20CLM-131. Drilled in the Mina La Bocona zone to test its down-dip projection, that hole intercepted 15.1 metres of 1,072 grams silver per tonne, 0.61 gram gold per tonne, 0.39% copper, 18.8% lead, and 7.5% zinc (2,040 grams silver-equivalent per tonne) starting from 299.9 metres downhole, including a higher-grade interval of 1.1 metes of 3,180 grams silver, 0.29 gram gold, 0.33% copper, 58.8% lead, and 2.3% zinc (5,148 grams silver-equivalent).

According to Macdonald, Southern Silver currently has one drill turning on Cerro Las Minitas to test a new target on the east side of the property. He said the drilling will then transition back to greenfields testing of the El Sol target, about two km northwest of Mina La Bocona, which covers the northerly projection of previously identified mineralisation in the Blind zone and a second area of artisanal workings.

The company plans to release an updated mineral resource estimate for Cerro Las Minitas in the next few weeks, with a preliminary economic assessment slated for release towards the end of the first quarter of next year.

It currently has about $15 million in the treasury, which “will be more than enough to fund our current work program,” Macdonald said.

Southern Silver’s other asset is its wholly-owned Oro property, an early exploration-stage copper-gold-molybdenum porphyry project in the U.S. state of New Mexico.

The preceding Joint-Venture Article is PROMOTED CONTENT sponsored by SOUTHERN SILVER EXPLORATION and produced in co-operation with Canadian Mining Journal. Visit www.southernsilverexploration.com for more information.

Comments