JV Article: QuestEx Gold & Copper is exploring for world-class projects in BC

Canadian explorer QuestEx Gold & Copper (TSXV: QEX; US-OTC: CLASF) holds approximately 110,000 hectares of mineral tenures that host precious and base metals projects in the Golden Triangle and Toodoggone areas of British Columbia.

The Vancouver-headquartered junior is focused on advancing its 100%-owned KSP copper-gold project in northwestern B.C., about 85 km northwest of Stewart.

The 312-sq.-km property “is one of the most advanced exploration projects in the Golden Triangle that does not already have a mineral resource estimate,” says Tony Barresi, QuestEx’s president.

“Once considered remote, KSP can now be accessed via a road that extends right onto the property, providing some of the best access in the region.”

The project lies in the heart of the Golden Triangle, which hosts some of the world’s largest copper and gold deposits and highest grade current and past producing mines.

KSP has high-grade gold veins similar to those found at Pretium Resources’ (TSX: PVG; NYSE: PVG) Valley of the Kings deposit and the past-producing Snip mine, jointly owned by Skeena Resources (TSX: SKE) and Hochschild Mining (LSE: HOC; US-OTC: HCHDF), which produced approximately one million ounces of gold between 1991 and 1999 at an average grade of 27.5 grams gold per tonne.

It also contains bulk-tonnage copper-gold mineralization similar to Seabridge Gold’s (TSX: SEA; NYSE: SA) KSM project, which has proven and probable reserves of 2.2 billion tonnes grading 0.55 g/t gold, 2.6 g/t silver, 0.21% copper, and 42.6 g/t molybdenum for 38.8 million contained oz. gold, 183 million oz. silver, 10.2 billion lb. copper, and 207 million lb. molybdenum.

Several major mining companies, says Barresi, are also competing for exploration and development projects in the region.

Last month, Australian miner Newcrest Mining (TSX: NCM; ASX: NCM) made a $3.5 billion bid for Pretium. If the acquisition is successful, Newcrest would own the Brucejack gold mine, approximately 20 km east of KSP, in addition to their 70% interest in the Red Chris copper-gold mine.

In May, Newmont (TSX: NEM; NYSE: NGT), the world’s top gold miner, acquired Canadian explorer GT Gold for $393 million. Following the acquisition, Newmont now owns the Tatogga copper-gold project, which Barresi says is “surrounded to the east and west by mineral tenures under the control of QuestEx.”

In addition, Skeena Resources continues to develop the past-producing Eskay Creek mine, about 15 km east of KSP, which it acquired in 2020 from Barrick Gold (TSX: ABX; NYSE: GOLD), the world’s second largest gold miner.

According to Barresi, previous operators of KSP identified 48 mineral occurrences on the property, with the Inel and Khyber Pass gold prospects having seen the most amount of historical exploration. Both targets, he said, are outlined by high-grade soil anomalies greater than one gram gold per tonne and 0.2% zinc. “Although our 2021 exploration program primarily focused on Inel, we also have our sights set on Khyber Pass for future exploration.”

“Inel is primarily a gold target, where historical drilling intersected both narrow intervals of high-grade mineralization and long intervals of lower grade mineralization. Both styles of mineralization start right at surface.”

Historical exploration of Inel included 305 drill holes (38,000 metres) and 1,240 metres of underground development. Highlights from the drilling included holes INDDH17-081, which returned 1.4 metres grading 1,670.51 g/t gold from 35.6 metres downhole, and INDDN16-029, which cut 52 metres of 4.24 g/t gold from 44 metres.

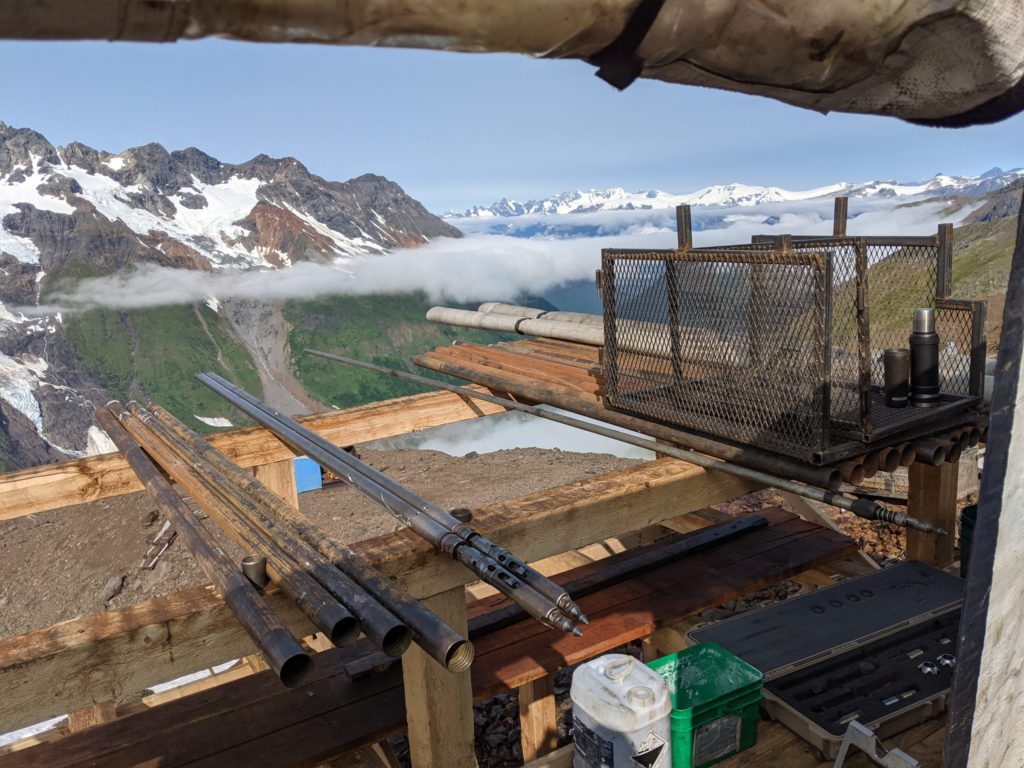

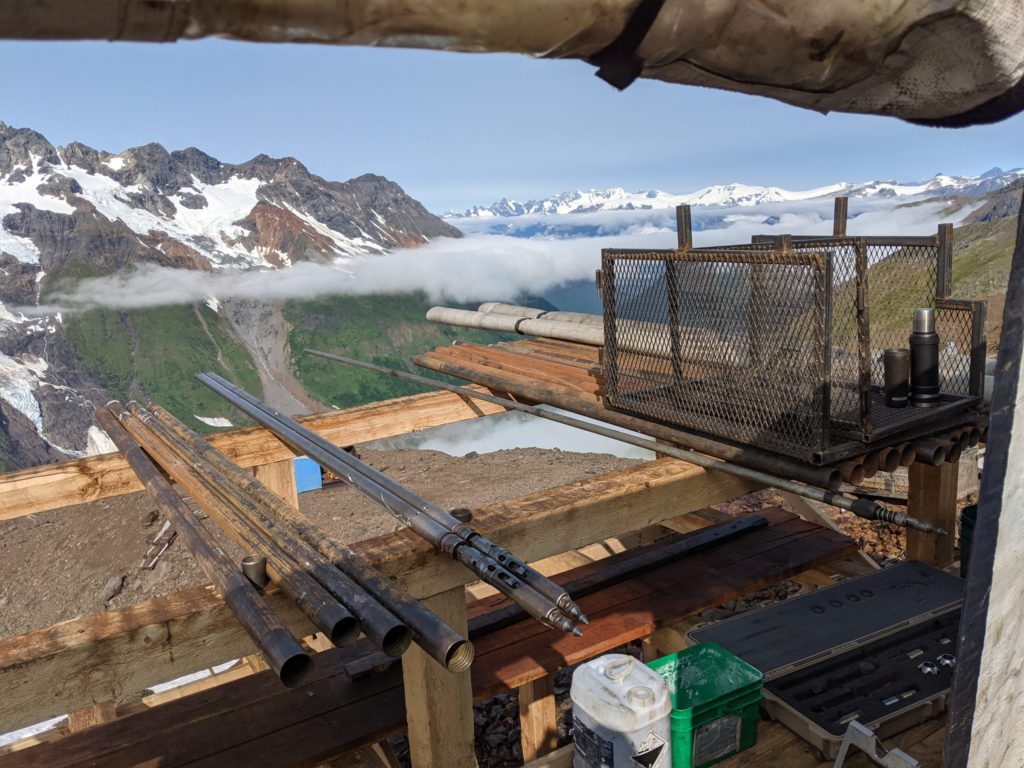

This year, QuestEx completed 13 drill holes (2,418 metres) on Inel, with the first assays expected in the next couple of weeks. The drill program “was designed to support an inaugural mineral resource estimate for the prospect, which we expect to release in the first quarter of next year,” Barresi says.

“Inel was the low-hanging fruit at KSP,” he notes. “It’s where the majority of the historical exploration has been done and we are now ready to bring it into a resource. However, we are also really excited about some of the other underexplored targets on this large and high-potential property.”

The company also explored targets on the Sericite Ridge, Black Bluff, and Khyber Pass prospects.

At Sericite Ridge, about 5 km east of Inel, it conducted a 24-line-km Induced Polarization survey and a hyperspectral survey. “Sericite Ridge hosts one of the largest alteration zones and geochemical anomalies in the Golden Triangle,” says Barresi.

“Although historical exploration had defined a significant gold target (Tami) on the ridge, our 2021 campaign focused on identifying shallowly buried porphyry copper-gold targets like the bulk tonnage copper-gold deposits found on Seabridge’s KSM property, approximately 20 km to the east of KSP.”

Preliminary results from the surveys identified a porphyry target, which will be a focus of drilling in 2022, said Barresi. “KSP is in the land of giant porphyries and now we’ve identified a first order, previously undrilled, porphyry target.”

QuestEx also plans to drill test Black Bluff, about 10 km northeast of Inel, which says Barresi is among the most accessible mineral showings on the property.

The company mapped newly exposed prospects in the area this summer when there was the maximum amount of snowmelt, with assays from new discoveries expected in early 2022.

The company has about $5 million in the treasury and plans to conduct a full season of exploration on KSP next year.

QuestEx’s other 100%-owned properties in the Golden Triangle include Kingpin, Castle, and North ROK. In the Toodoggone area, it has a 100% interest in the Sofia property.

Major shareholders in the company include Newmont, which holds a 16.3% interest; Skeena Resources (14.32%); and management (2.3%).

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by QUESTEX GOLD & COPPER and produced in cooperation with Canadian Mining Journal. Visit www.questex.ca for more information.

Comments