JV Article: Platinum Group Metals is at the vanguard of next generation lithium-ion batteries

The rise in the electric vehicle (EV) market share of the car industry is fuelling demand for the metals used in the lithium-ion batteries that power them.

However, current lithium-ion battery technologies suffer from a trade-off between power and weight, with EV manufacturers seeking to maximize the energy density of batteries while minimizing their weight.

Considerable effort is now underway to develop batteries based on lithium-sulphur and lithium-air chemistries that offer the potential for significant increases in energy-to-weight ratios compared with traditional lithium-ion batteries.

Working at the forefront of this effort is Lion Battery Technologies, which is looking to fast-track the development of next-generation lithium-ion battery technologies that use platinum and palladium to enhance battery performance.

The company was founded in 2019 by Platinum Group Metals (TSX: PTM; NYSE: PLG) in partnership with Anglo American Platinum (US-OTC: ANGPY), one of the world’s leading producers of platinum group metals (PGMs). These two PGM miners are now leading the effort to commercialize next generation lithium-ion battery technologies utilizing PGMs.

Presently, about 84% of palladium and 35% of platinum demand comes from their use in catalytic converters in gasoline-powered vehicles. The shift away from internal combustion engine-powered cars to EVs powered by batteries utilizing PGMs “would provide a replacement source of demand for these metals,” says Frank Hallam, Platinum Group’s president and CEO.

“Palladium and platinum are remarkable metals that boost chemical reactions but don’t participate in them and offer the potential to enhance the performance of lithium-ion batteries significantly,” he says.

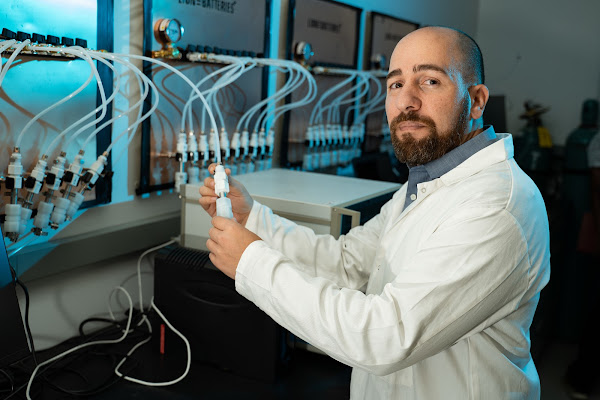

In July 2019, Lion signed an agreement with Florida International University (FIU) to advance research that uses platinum and palladium to unlock the potential of next-generation lithium-air and lithium-sulphur battery technologies. Lion has exclusive rights to the intellectual property developed by FIU under this agreement.

Bilal El-Zahab, who leads the research team developing the technology, says that batteries based on these chemistries have a much higher energy density than traditional lithium-ion batteries. “They can perform up to seven times better than the best performing lithium-ion batteries currently available on the market or in development."

According to El-Zahab, an associate professor in mechanical and materials engineering in the College of Engineering and Computing at FIU, lithium-air and lithium-sulphur batteries “are cheaper to produce and can also significantly increase the range and performance of current lithium-ion batteries.”

He says that using palladium and platinum catalysts in the cathode of these batteries can dramatically improve the charge-rate capability of the batteries. “They also allow the batteries to utilize more of their theoretically available energy while preventing rapid capacity decay of the battery and improving their efficiency, reliability, and safety.”

Such batteries, he adds, also offer the potential for energy-to-weight ratios of up to three to seven times better than current battery chemistries can achieve. Presently, lithium-sulphur batteries can reach energy densities as high as 750 watt-hours per kilogram (Wh/kg) compared to 247 Wh/kg for the batteries used in Tesla vehicles.

Last July, Lion was granted a third U.S. patent for its battery technology. The patent (“Battery Cathodes for Improved Stability) was issued to FIU and covers a preparation method for using PGM catalysts in carbon materials used in the cathodes, primarily of lithium-sulphur batteries.

Another patent application covering the specific application of PGMs in current lithium-ion chemistries was also recently filed. El-Zahab says that the technology covered by the patent could extend the life of the lithium metal anodes and lead to additional weight savings by eliminating the need for graphite in the anode.

“We’re currently in the final stages of the initial research and are transitioning from the lab-scale to producing a commercial prototype. It’s a very exciting time for us.”

In addition to its investment in Lion, Platinum Group is also advancing the Waterberg PGM project located on the North Limb of the Bushveld igneous complex in South Africa, approximately 85 km north of Mokopane and 330 km northeast of Johannesburg. The project has the potential to be one of the largest and lowest-cost underground PGM mines globally.

Waterberg is a joint venture between Platinum Group (37.05%), South Africa-based major Impala Platinum Holdings (15%), Japan Oil, Gas, and Metals National Corp. (12.95%), Japanese trading company Hanwa (9.75%), and Black Economic Empowerment partner Mnombo Wethu Consultants (26%). Factoring in Platinum Group’s 49.9% ownership in Mnombo, it has an effective 50.02% interest in the project.

The 292-sq.-km Waterberg mining right has several highly desirable characteristics, says Hallam. “It offers the potential for fully mechanized production from a low-cost, shallow, and bulk mineable operation with significant growth potential.”

A definitive feasibility study for Waterberg in 2019 envisioned a mining operation producing 420,000 combined oz. of palladium, platinum, gold, and rhodium annually at steady state over 45 years of mine life.

Capital costs were pegged at US$874 million, with US$233.5 million budgeted for operating costs to achieve 70% production capacity. The study estimated the after-tax net present value to be US$982 million, based on an 8% discount rate and a three-year average price of US$1,055 per oz. palladium, US$931 per oz. platinum, US$1,318 per oz. gold, and US$1,930 per oz. rhodium. The after-tax internal rate of return was estimated at 13.3%, with a payback period of 11.4 years from the start of construction.

The mine plan for Waterberg presented in the feasibility study aims to exploit several mineralized zones over an 8-km strike length, says Hallam. “However, unlike many other ore bodies in the region that exhibit narrow widths typically less than a couple of metres, Waterberg presents mining widths ranging from 5 metres to over 100 metres that allow for a bulk mining operation.”

Waterberg contains measured and indicated resources of 242.4 million tonnes grading 2.13 g/t palladium, 0.98 g/t platinum, 0.22 g/t gold, and 0.05 g/t rhodium (3.38 g/t PGMs) for a combined 26.4 million oz. of palladium, platinum, gold, and rhodium. Inferred resources stand at 66.7 million tonnes at 1.92 g/t palladium, 0.96 g/t platinum, 0.34 g/t gold, and 0.04 g/t rhodium (3.27 g/t PGMs) for a combined 7 million oz. of palladium, platinum, gold, and rhodium.

Platinum Group is currently working to complete concentrate offtake and financing for the project. It is also working on a feasibility study for a matte furnace as an alternative to a traditional concentrate offtake arrangement and is considering an update to the feasibility study.

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by PLATINUM GROUP METALS and produced in co-operation with The Northern Miner. Visit www.platinumgroupmetals.net for more information.

Comments