JV Article: Defense Metals closes in on pre-feasibility for its Wicheeda rare-earth project

Defense Metals Corp. (TSX-V: DEFN; OTCQB: DFMTF; FSE:35D) is advancing its British Columbia 100% owned Wicheeda rare-earth deposit toward development.

In 2022, the company released a robust Preliminary Economic Assessment (PEA), which was followed by an additional 5,500 metres of diamond drilling and additional flotation and leach testing, further confirming that the Wicheeda carbonatite sill complex contains a significant deposit of rare earths.

The Wicheeda deposit PEA outlined an indicated resource of 5.0 million tonnes averaging 2.95% total rare-earth oxides (TREO) and an inferred resource of 29.5 million tonnes at 1.83% TREO.

The value of this resource is enhanced by its location— 80 kilometres northeast of Prince George and positioned along a major forestry service road that connects to a paved highway. A hydroelectric power line, gas pipeline and a Canadian National Railway line are also nearby.

For the project economics, the PEA uses an annual 1.8-million-tonne mill throughput and an open-pit mining operation over a 19-year mine life. This level of production could produce an average of 25,423 tonnes of rare-earth oxides annually.

Permitting, environmental, social, and governmental issues have also been addressed. Permits are in place for present exploration activities. Environmental baseline studies are in-progress to ensure timely and positive environmental assessment, licensing, and regulatory procedures.

Defense Metals has consulted with Indigenous Peoples, on whose traditional lands the Wicheeda Project is located. The principal group is the McLeod Lake Band, with which the company has signed an agreement to ensure mutual benefit from the exploration and development of the project.

These positives provide a potential project after-tax net-present value (NPV@8%) of $517 million and an 18-percent internal rate of return (IRR).

The company is now gathering data for a Preliminary Feasibility Study (PFS), which it plans to subcontract to a major mining consulting firm in the first quarter of 2023.

William Bird, PhD, PGeo, a Defense Metals Director, and geological advisor to the company, began studying rare earths 50 years ago. In 2005, he took over Rare Element Resources and the exploration of its Bear Lodge rare-earth project in Wyoming. Shortly after, Bird said he took note of the remarkable characteristics of the early-exploration stage of the Wicheeda project and was so impressed that he attempted to acquire it.

“Bastnaesite and monazite are the only two rare-earth minerals that have ever been successfully profitably exploited as sources for commercial production of rare earths,” Bird said.

“From about 70 years ago, when the Mountain Pass, California, rare-earth deposit was put into production, bastnaesite, with minor amounts of its fluorocarbonate siblings, parasite and synchysite, has been the world’s major source of rare-earth elements,” he noted.

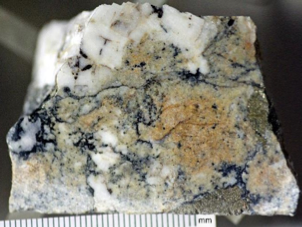

What sets Wicheeda apart from most North American rare-earth exploration projects is its carbonatite-hosted fluorocarbonate rare-earth mineralisation. The geology, mineralisation, and location logistics appear similar to the famous Mountain Pass deposit, Bird said. Outside China, very few rare-earth occurrences have these advantages. This translates directly into positive economics for the Wicheeda project, Bird noted.

With history and academic mineralogy as a foundation, Bird pointed out the practical side of rare-earth exploration and production.

“If you’re exploring for an economically viable rare-earth deposit, model your search using the very successful Mountain Pass deposit. Find a carbonatite intrusive, look for coarse-grained bastnaesite and monazite. Check out the logistics and environmental and social issues to make sure they will support efficient production,” he said.

“Tonnage and grade are important; but, only if the character of the mineralogy supports efficient metallurgical extraction of the rare earths,” Bird said. “I’m excited about the Wicheeda Rare-Earth project because it appears to meet these criteria.”

Bird said a rare-earth deposit’s efficient metallurgy is the practical result of the right mineralogy.

“Successful extraction of rare-earths from ore begins with flotation separation and concentration of the rare-earth minerals. Wicheeda’s rare-earth fluorocarbonate minerals, bastnaesite, parisite, and synchysite, along with lesser monazite, are well-crystalized and relatively coarse grained.

“This allows for a reasonable grind-size to separate the individual grains of the valuable rare-earth minerals from the waste minerals. Once separated, the rare-earth grains can be floated to form a concentrate of the rare-earth minerals.”

Tests indicate that a Wicheeda flotation concentrate of 40 to 50% total rare-earth oxides (TREO) can be attained with a recovery of 70 to 80% of the TREO. A series of tests on a 25-tonne bulk sample, which graded 4.66% TREO, resulted in a 51.6% concentrate TREO grade with a recovery of 77.3% of the TREO.

The next metallurgical step in the production process is the extraction of the rare-earth elements from the flotation mineral concentrate. Again, mineralogy is key. Bastnaesite and monazite, which are the minerals at Wicheeda, have been successfully leached of their rare earths for a hundred years. No other rare-earth minerals are as well understood by metallurgists.

The PEA reports that a Wicheeda flotation concentrate grading 51% total rare-earth oxides (TREO) was subjected to caustic-leach-extraction tests, which resulted in a recovery of 87% of the rare earths. This is a similar procedure to that which Mountain Pass has used for 70 years.

As good as these Wicheeda results may be, Defense Metals’ metallurgists decided that there could be improvements, if a more up-to-date acid-bake extraction method was employed. Since the completion of the PEA, acid-bake tests have begun, which indicate that better leach results are possible.

Rare earths are difficult to find and extract and costly to produce. That’s why North America has only one rare-earth mine in full production, the famous Mountain Pass mine in California. It’s the only mine that can compete with China’s mines because it has the right combination of carbonatite-hosted bastnaesite and monazite.

But all the Mountain Pass concentrates are shipped to China, which only adds to China’s rare-earth monopoly. At a time when North America’s dependency on China for critical minerals has become increasingly untenable, a secure North American rare-earth supply chain in needed.

Bird said he believes that, in the Western Hemisphere, the Wicheeda rare-earth deposit is the only potential new secure source. When everything is considered, from logistics to mineralogy and metallurgy, to size of deposit, Wicheeda’s characteristics are close to the characteristics of Mountain Pass, California.

“This is why I am so excited about Wicheeda,” he said.

“For an exploration project, Wicheeda is as close in character to the Mountain Pass deposit as one can hope. This is fantastic. There are very few deposits in the world that can make this claim and Wicheeda is one of them. In my opinion, Wicheeda has the best chance to be the next significant rare-earth producer.”

The preceding Joint-Venture Article is PROMOTED CONTENT sponsored by Defense Metals Corp. and produced in cooperation with The Northern Miner. Visit www.defensemetals.co

Comments