JV Article: Archer’s Grasset nickel deposit is getting its ‘day in the sun’

A multi-million-tonne nickel sulphide deposit discovered more than 10 years ago in the northern Abitibi region of Quebec is receiving fresh scrutiny from Archer Exploration (CSE: RCHR; US-OTC: RCHRF), the latest addition to Canada’s emerging league of battery material-focused junior exploration companies.

Grasset is one of the largest nickel sulphide deposits in Canada’s Abitibi region and the only North American nickel sulphide deposit with more than 50,000 contained tonnes of nickel and an average nickel-equivalent grade of over 1.5% that isn’t controlled by a major mining company.

Archer acquired 100% of Grasset, 77 km northwest of the city of Matagami, in July 2022 in an all-share transaction with gold-focused Wallbridge Mining (TSX: WM; US-OTC: WLBM), in a deal valued at about $53 million. Wallbridge retained a 19.9% stake and is the junior’s largest shareholder.

A resource estimate based on limited drilling in 2014-2015 by Grasset’s former owners, Balmoral Resources, and updated by Wallbridge in November 2021, outlined indicated resources of 5.5 million tonnes grading 1.22% nickel, 0.13% copper, 0.03% cobalt, 0.26 gram platinum per tonne and 0.64 gram palladium (1.53% nickel equivalent). Inferred resources add 217,100 tonnes of 0.83% nickel, 0.09% copper, 0.02% cobalt, 0.15 gram platinum per tonne and 0.34 gram palladium (1.01% nickel equivalent).

The resource has a defined vertical depth of 600 metres with the deepest mineralization intercepted at 775 metres. The deposit remains open along strike and at depth.

In June, the company reported the highest mineralized intercept to date in Grasset’s H1 Zone. Hole GR23-03, drilled in May, cut 4.6 metres of 1.82% nickel, 0.22% copper, 0.04% cobalt, 0.4 gram platinum and 0.95 gram palladium starting 404 metres downhole. The interval included 0.6 metre of 5.75% nickel, 0.24% copper, 0.13% cobalt, 1.68 grams platinum and 3.85 grams palladium.

The hole was designed to test whether nickel mineralization extended to the southeast of the defined resource and was drilled about 200 metres below a historical drill hole, GR-14-38. The historical hole cut 4.5 metres of 0.51% nickel, including 1.1 metre of 0.8% — also in the H1 mineralized horizon.

The H1 lens is one of two high-grade nickel sulphide-bearing horizons within the ultramafic host units striking northwest to southeast at Grasset. H1 has been defined over a strike length of about 900 metres. The second lens, H3, strikes about 500 metres and hosts the bulk of Grasset’s high-grade mineralization. The sub-vertical massive sulphide lenses are contained within a more than 200-metre-thick mineralized footprint.

In mid-August, results from down-hole electromagnetic (DHEM) surveys yielded three new highly conductive plates within the H1 zone. The plates start from 360 metres below surface and are yet to be drill-tested. Archer believes that conductivity measurements suggest semi-massive to massive pyrrhotite (± pentlandite) could be the source of the conductive anomalies — including those nearest to drill hole GR-23-03 reported in June.

"Conductive plates modelled from geophysical surveys indicate the potential for the presence of mineralization such as nickel. The strong and sizable off-hole anomalies below hole GR23-03 support our view of the untested potential at Grasset and it confirms the potential for discovering greater volumes of high-grade nickel mineralization at depth,” says Jack Gauthier, Archer’s VP of Exploration.

“What really excites us about the recently completed DHEM surveys is that when you’re dealing with massive sulphides and nickel tenors in excess of 14%, as observed in the H3 zone, any new discoveries — whether an additional lens or an extension at depth — has the potential to materially increase the size of the resource with relatively few drill holes,” adds Tom Meyer, Archer’s president and CEO. “These newly identified and highly-conductive plates could be that ‘needle in a haystack’ we’re looking for. The space that these plates occupy has never been drilled and our technical team is extremely excited by this prospect — we can’t wait to test this with a drill bit.”

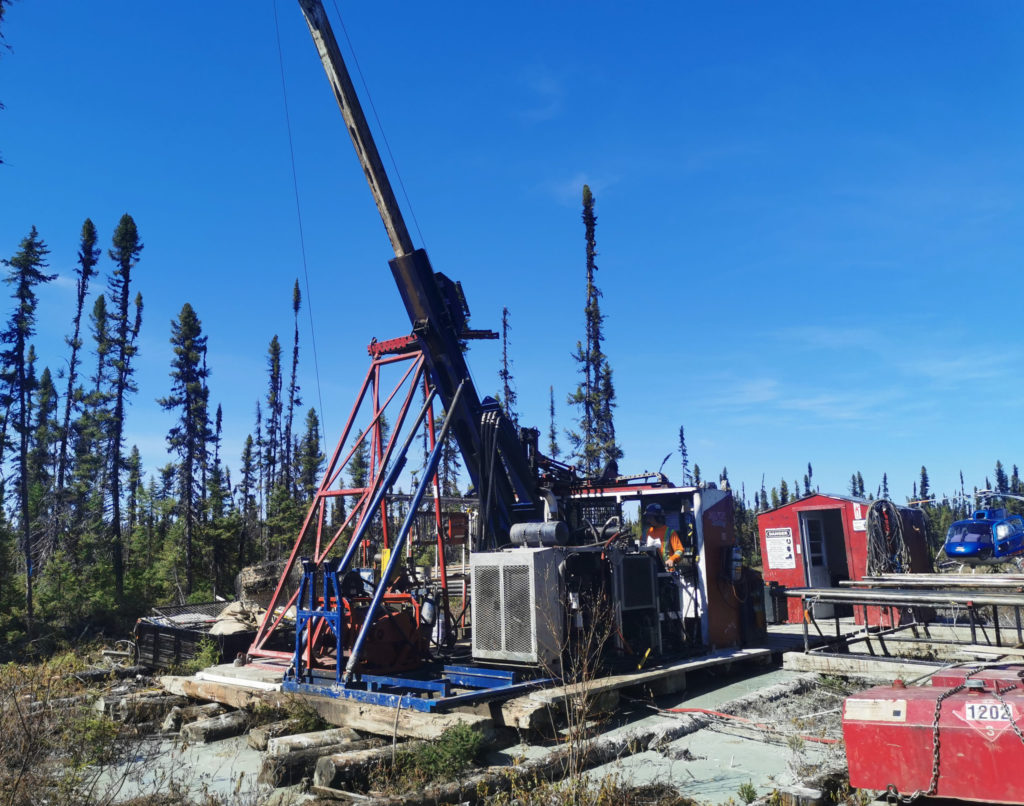

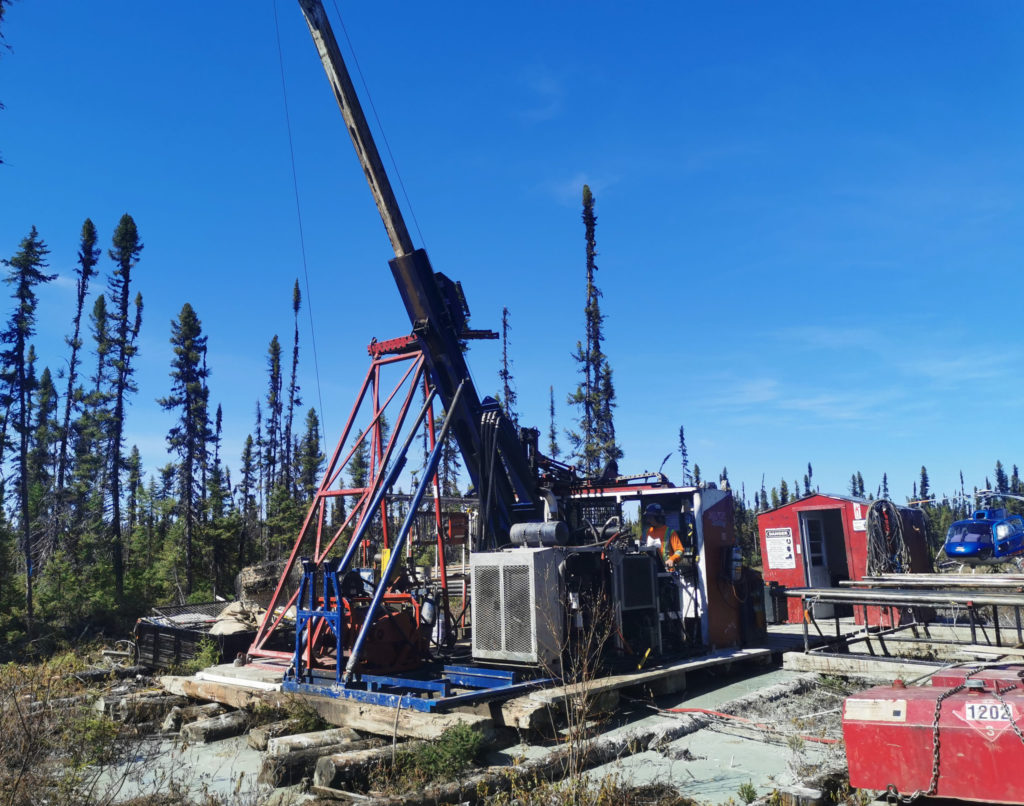

This year’s $6-million exploration program will test the H1 and H3 zones at depth and explore for additional high-grade massive sulphide lenses. The company is also undertaking a 53-line-km grid with two high-power fixed loops and InfiniTEM XL system to look for anomalous conductors (massive sulphides) at a depth of between 800 and 1,000 metres. In addition, assays are pending from a sonic drill program that sampled glacial till anomalies along the GUC.

In 2018-2019, Balmoral (acquired by Wallbridge in May 2020) also discovered another significant zone of nickel mineralization 7 km northwest of Grasset at the GUC Central prospect. Drilling there intersected 7.6 metres grading 1.05% nickel, 0.31% copper, 0.05% cobalt, 0.2 gram platinum and 0.48 gram palladium in hole FAB-18-58. The hole included a 0.65-metre-thick basal massive sulphide zone grading 4.14% nickel, 0.26% copper, 0.18% cobalt, 1.9 grams platinum and 0.89 gram palladium.

Archer believes the GUC Central discovery has significant potential with about 950 metres of favourable southwest-dipping ultramafics and several horizons of nickel sulphides.

“It has the same stratigraphy as the Grasset deposit, and the exact same rock formations in the right places,” Gauthier says. “It has several horizons of nickel sulphides and a best mineralized intercept of 4.14% nickel over 0.65 metre, within 7.58 metres of 1.05% nickel. We just need more drilling.”

“Balmoral put together a maiden resource after what was essentially one or two very successful drill programs,” Meyer says. “But Balmoral was a gold company and ultimately returned its focus to gold and didn’t systematically explore the project for nickel.”

Although exploration at Grasset — which is covered by 60 to 80 metres of glacial till — can be challenging due to the lack of outcropping targets, early results from drilling and advanced imaging support Archer’s enthusiasm for the project, and the region’s potential.

In general, the northern Abitibi around Grasset has seen very little nickel exploration, the company notes. “Nearly all historical regional exploration was designed for volcanogenic massive sulphides and gold targets,” Meyer says. “The vast majority of the 23-kilometre-long Grasset Ultramafic Complex is underexplored.”

The company also notes that early metallurgical testing has yielded high-quality nickel concentrate via a conventional flotation flowsheet. “One of the distinctions about the Grasset deposit is the relatively simple metallurgy that comes with it,” Meyer says. “The easiest way to kill a project is when the metallurgy is just too challenging and too expensive to overcome.”

This deposit “has never really had its day in the sun,” Meyer continues. “It was discovered in 2012, drilled in 2014-2015, with some follow up exploration work in 2018-2019 and then put on a shelf. It’s still completely wide open at depth and along strike and the 23-km long corridor has not been systematically tested.”

The fact that Grasset is in a pro-mining jurisdiction is another huge advantage for the company, he says. “In addition to our great community relationships, the province of Quebec is very pro-mining with some of the best exploration tax incentives in the world, the right infrastructure, and a highly skilled workforce.”

On Aug. 17, Ford Motor Co. and its South Korean partners announced they are building a $1.2-billion manufacturing plant for electric vehicle battery material in Quebec with the help of government funding.

Outside of Quebec, Archer has a portfolio of 37 properties spanning more than 300 sq. km in Ontario’s Sudbury mining district.

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Archer Exploration and produced in co-operation with The Northern Miner. Visit: www.archerexploration.com for more information.

Comments

Georges Jr Bernier

Will Archer Exploration will developpe the mine by then sel or with a partner.