IsoEnergy closes $36.6M private placement for uranium hunt

IsoEnergy (TSXV:ISO; OTCQX:ISENF) has closed its previously announced private placement raising $36.6 million with which to continue its hunt for economic uranium deposits. The company issued approximately 8.1 million subscription receipts at a price of $4.50 each.

The offering was led by NexGen Energy, Mega Uranium, and Energy Fuels, all players in the uranium sector. The original offering was upsized with the participation of Schem Cover Partners.

Each subscription receipt will entitle the holder to receive, for no additional consideration and without further action on part of the holder thereof, one common share of IsoEnergy, on or about the date that IsoEnergy's previously announced share-for-share merger with Consolidated Uranium by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario) is completed.

IsoEnergy has proposed acquiring all the issued and outstanding shares of Consolidated Uranium (TSXV:CUR; OTCQX:CURUF). Consolidated shareholders will receive half of an IsoEnergy share for each Consolidated share held. The combined company will have an estimated value of about $903.5 million. The companies have a complimentary portfolio of uranium properties and a potential global reach.

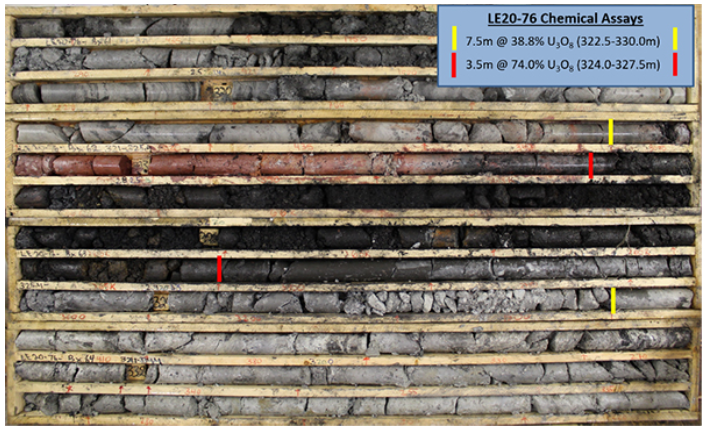

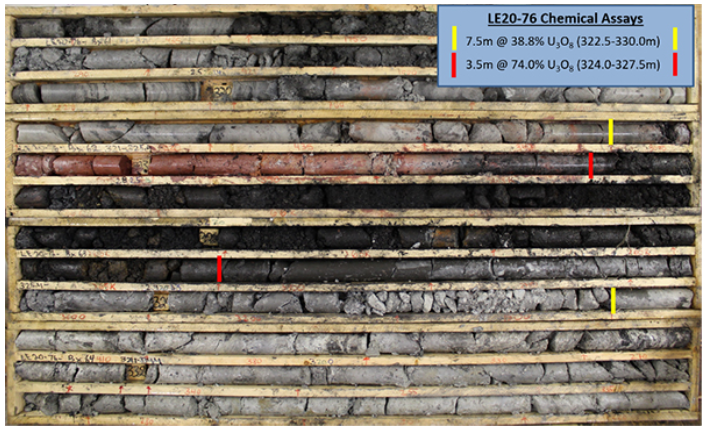

IsoEnergy’s portfolio includes the Hurricane uranium deposit on its 100%-owned Larocque East property in the eastern Athabasca Basin. The deposit has an indicated resource of 63,800 tonnes grading 34.5% uranium oxide (U3O8), containing 48.5 million lb. U3O8. There is also an indicated resource of 54,300 tonnes 2.2% U3O8, 2.7 million lb. U3O8.

IsoEnergy also owns three more uranium projects in the Athabasca Basin.

Consolidated has uranium mines and projects in Canada, United States, Australia, and Argentina.

Visit www.IsoEnergy.ca to see the presentation detailing the IsoEnergy-Consolidated deal.

Comments