International Battery closes $14M private placement to deploy DLE plant

International Battery Metals has raised $14.3 million (US$10.4 million) for the deployment of its of its modular direct lithium extraction (DLE) plant for a customer in the western United States and for general working capital purposes. The company announced sale of the plant in January but did not identify the purchaser.

The recent private placement consisted of approximately 18.6 million units priced at $0.77 per unit. Each unit consists of the right to acquire one common share for a period of two years at an exercise price of $0.96 per share. In connection with the private placement, the company extended the expiry of approximately 6.4 million previously issued share purchase warrant to May 3, 2016, from April 21, 2025.

International Battery intends to make additional private placements of up to about $18.7 million (US$ 13.6 million) on similar terms to this placement.

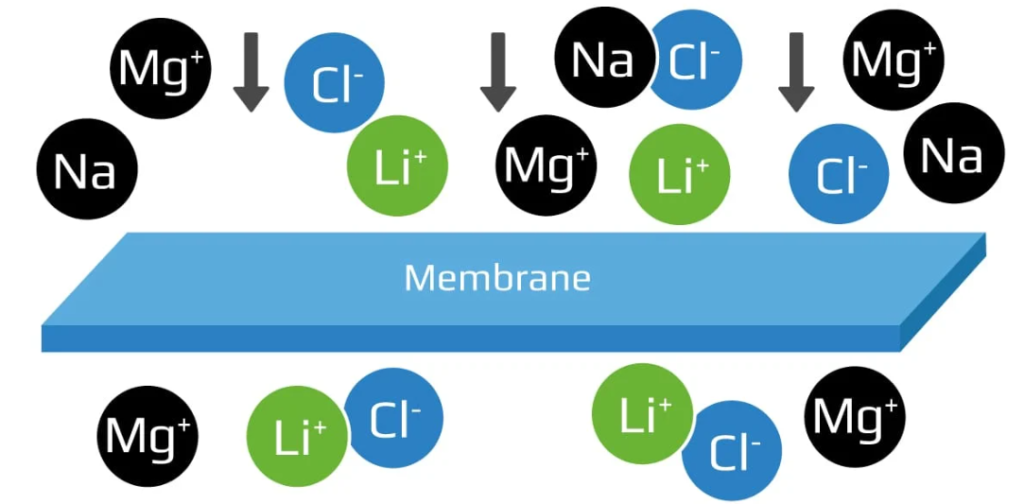

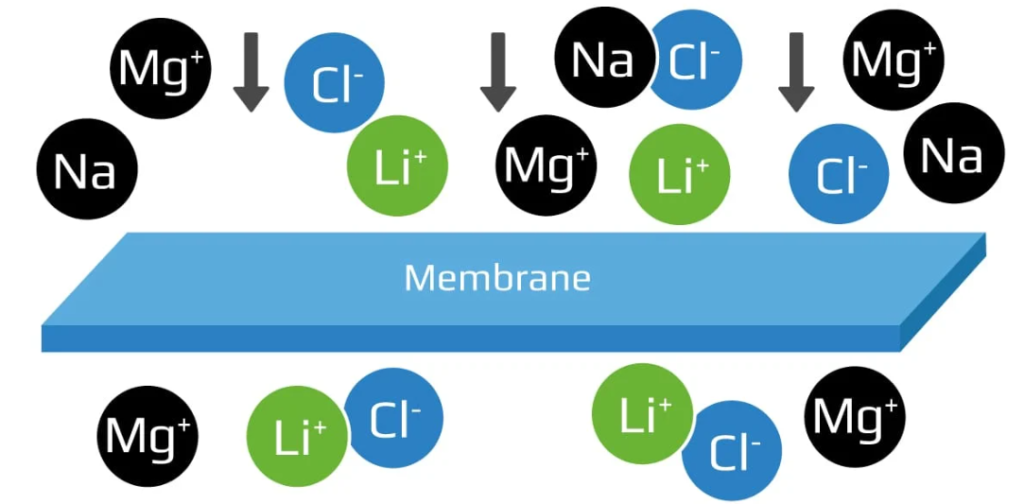

The company’s DLE technology takes direct extraction to the next level compared to ion exchange and solvent extraction methods. The IBAT DLE uses zero acids or bases, so there is no waste salt created, making the process more economical and more environmentally friendly. Nor is throughput capacity effected by unequal distribution of charged ions. IBAT DLE can handle high levels of chloride, magnesium, and other elements present in natural brine without pretreatment and at scale.

Visit www.iBatteryMetals.com to learn more.

Comments