In charts: Gold rally defies traditional headwinds

Bank of America expects the gold price rally to persist despite a challenging macro backdrop.

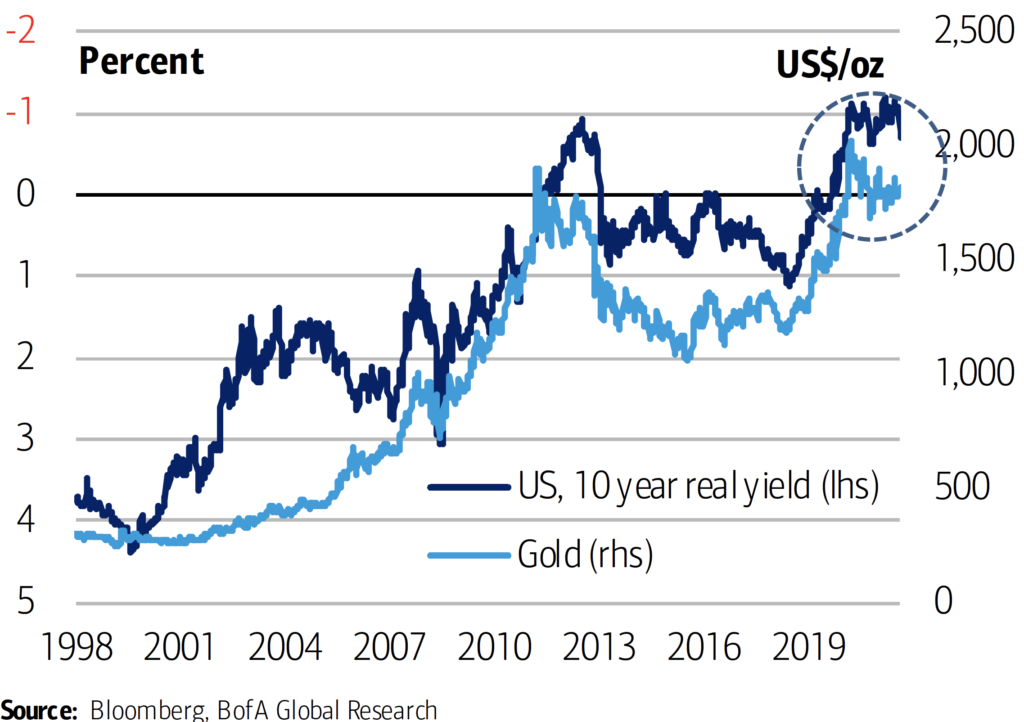

Gold continues trading above $1,800 per ounce despite the respective 10-year interest rates and Dollar Index rising from intra-year lows of -1.25 and 89.5 in 2021 to -0.54 and 95.7. The bank views the sustained price performance as “remarkable” since yields and the dollar tend to be the most critical price drivers of the yellow metal.

Further supporting the gold price are investment flows, which have been “very resilient,” according to BofA analyst and lead author Michael Widmer.

In the bank’s Global Metals Weekly report, he said gold had disconnected from its traditional drivers because of significant dislocations buried beneath headline inflation, interest rates and currency moves. These market forces raised the appeal for investors to hold gold in a portfolio.

BofA expects the gold price to average $1,925 per ounce in 2022.

Comments