In charts: Copper project pantry bare from 2025

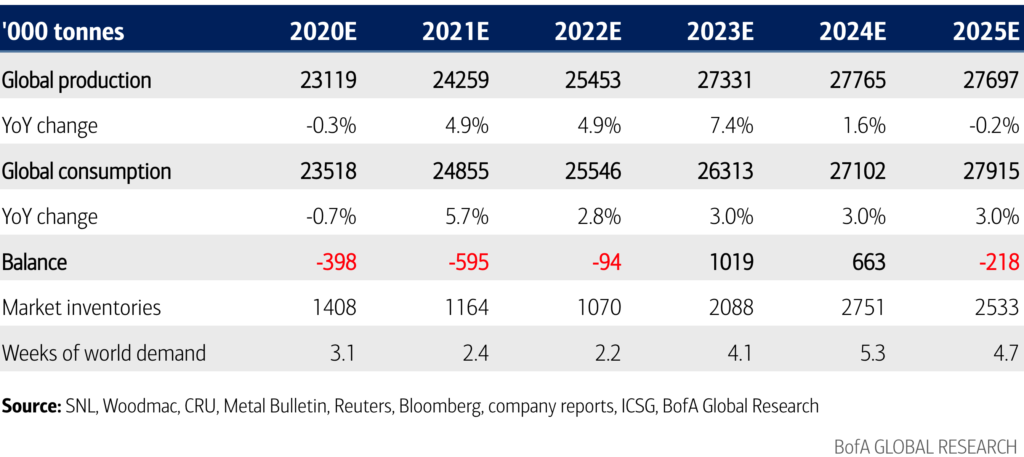

In a new report, Bank of America (BofA) Global Research analysts say they expect the copper market to flip back to a deficit from 2025 onwards following the completion of the current wave of project buildouts.

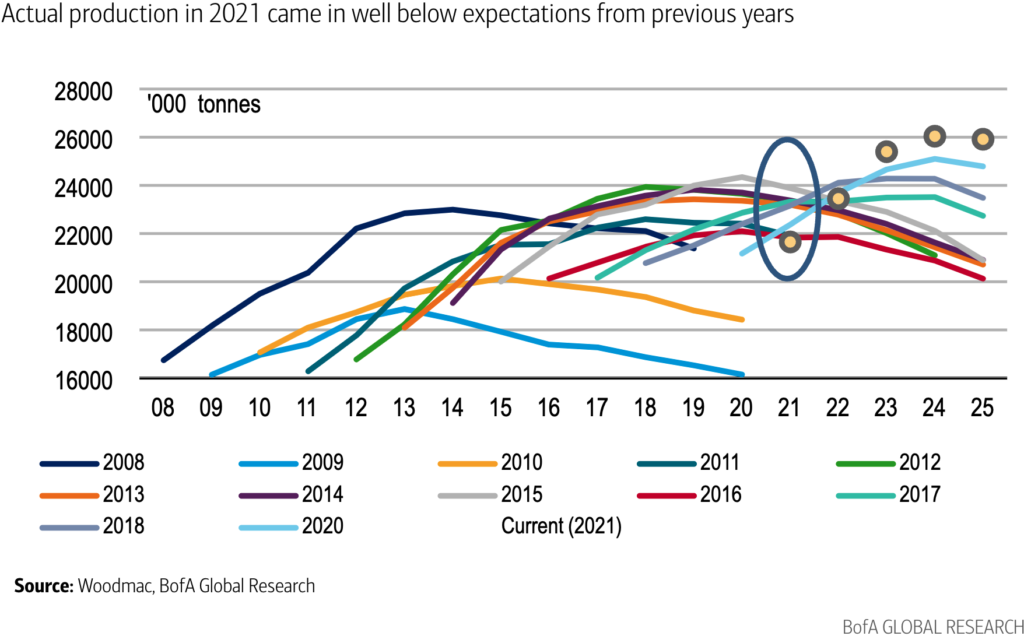

While global copper output is set to grow by 7.7% in 2023, following an expected deficit in 2022, the risks are skewed to the downside, the bank says, given the underperformance of new copper mine builds in recent years.

"While visibility over the near-term project pipeline is good, activity increases come with a wrinkle," says the bank's analysts. "Indeed, many of the projects currently developed have been in the making for almost three decades, and with exploration activity relatively limited in recent years, supply increases may fade from 2025."

BofA sees a range of issues constraining production growth. These were mirrored by a presentation of Edgar Blanco Rand, vice minister of mining in Chile's previous government, during the recent LME Week.

The official showed a portfolio of Chile-based projects set to be realized by 2029 at the cost of US$74 billion to achieve a total production of 7 million tonnes. Focussing on copper, Edgar Blanco highlighted that production has flat-lined since 2000 at around 5.7 million tonnes, after a decade of rapid growth, starting in 1990.

"This implies a capex intensity of around US$50,000 per tonne, well above the US$10,000 to US$20,000 per tonne range seen in recent years. As an aggravating factor, the investment will need to be large enough to offset about 1.5 million tonnes of production losses," says the bank.

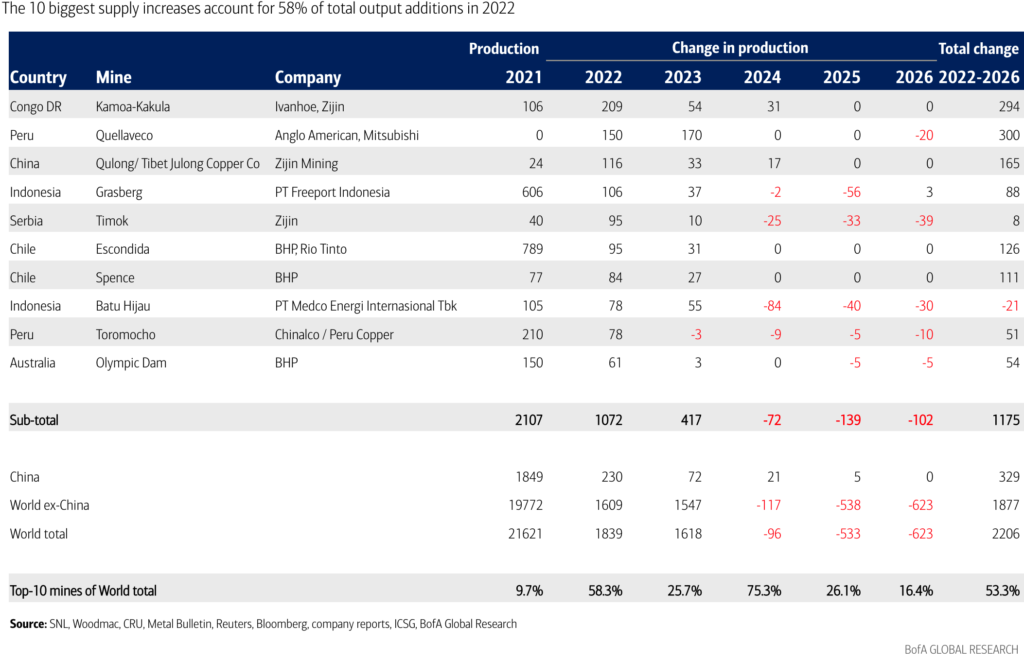

According to BofA, the 10 most significant supply increases will account for 58% of total output additions in 2022.

This supports BofA's view that expansions are very concentrated, with two implications. Firstly, operational issues at just one or two sites could profoundly impact market balances, which means the trajectory of those 10 mines is critical. Secondly, according to BofA, almost all the additions are driven by operators with an excellent operational track record, reducing the risk of disruptions and under-delivery.

This article originally appeared on www.Mining.com.

Comments