[caption id="attachment_1003731618" align="aligncenter" width="461"]

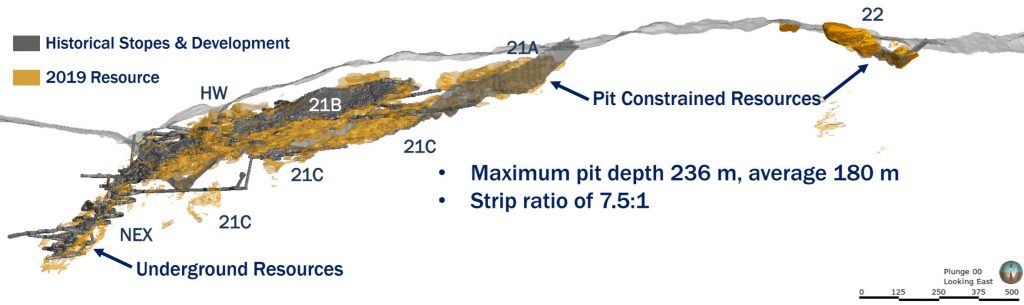

Resources at the Eskay Creek deposit. (Image: Skeena Resources)

Resources at the Eskay Creek deposit. (Image: Skeena Resources)[/caption]

BRITISH COLUMBIA – Vancouver-based

Skeena Resources says the preliminary economic assessment for its Eskay Creek gold mine is robust. The study was produced by

Ausenco Engineering Canada with support from

SRK Consulting (Canada) and

AGP Mining Consultants.

The PEA looks at a high grade (3.23 g/t gold and 78 g/t silver) conventional open pit operation that would cost $303 million to reach production. A 6,850-t/d million and flotation plant that will produce saleable concentrate is planned. The after tax net present value with a 5% discount is $638 million, and the project would pay for itself in 1.2 years.

Average annual production over the life of the mine would be 236,000 oz. of gold and 5.8 million oz. of silver. All-in sustaining costs would be $983 per oz. of gold equivalent recovered.

Pit constrained resources at Eskay Creek are 12.7 million indicated tonnes grading 4.3 g/t gold (1.7 million contained oz.) and 110 g/t silver (44.7 million contained oz.) plus 14.4 million inferred tonnes at 2.3 g/t gold (1.1 million contained oz.) and 47 g/t silver (21.7 million contained oz.).

Underground resources have also been estimated. There are 819,000 indicated tonnes at 6.4 g/t gold and 139 g/t silver plus 295,000 inferred tonnes at 7.1 g/t gold and 82 g/t silver.

Skeena says there is potential to expand the resources with additional drilling. Meanwhile it will consider mine scheduling to allow for various ore blending scenarios, continue metallurgical tests, enhance the current pit slope designs, conduct gap analyses and environmental baseline studies needed for permitting, and continue to optimize water management strategies.

Additional details from the PEA are available at

www.SkeenaResources.com.

Resources at the Eskay Creek deposit. (Image: Skeena Resources)[/caption]

BRITISH COLUMBIA – Vancouver-based Skeena Resources says the preliminary economic assessment for its Eskay Creek gold mine is robust. The study was produced by Ausenco Engineering Canada with support from SRK Consulting (Canada) and AGP Mining Consultants.

The PEA looks at a high grade (3.23 g/t gold and 78 g/t silver) conventional open pit operation that would cost $303 million to reach production. A 6,850-t/d million and flotation plant that will produce saleable concentrate is planned. The after tax net present value with a 5% discount is $638 million, and the project would pay for itself in 1.2 years.

Average annual production over the life of the mine would be 236,000 oz. of gold and 5.8 million oz. of silver. All-in sustaining costs would be $983 per oz. of gold equivalent recovered.

Pit constrained resources at Eskay Creek are 12.7 million indicated tonnes grading 4.3 g/t gold (1.7 million contained oz.) and 110 g/t silver (44.7 million contained oz.) plus 14.4 million inferred tonnes at 2.3 g/t gold (1.1 million contained oz.) and 47 g/t silver (21.7 million contained oz.).

Underground resources have also been estimated. There are 819,000 indicated tonnes at 6.4 g/t gold and 139 g/t silver plus 295,000 inferred tonnes at 7.1 g/t gold and 82 g/t silver.

Skeena says there is potential to expand the resources with additional drilling. Meanwhile it will consider mine scheduling to allow for various ore blending scenarios, continue metallurgical tests, enhance the current pit slope designs, conduct gap analyses and environmental baseline studies needed for permitting, and continue to optimize water management strategies.

Additional details from the PEA are available at

Resources at the Eskay Creek deposit. (Image: Skeena Resources)[/caption]

BRITISH COLUMBIA – Vancouver-based Skeena Resources says the preliminary economic assessment for its Eskay Creek gold mine is robust. The study was produced by Ausenco Engineering Canada with support from SRK Consulting (Canada) and AGP Mining Consultants.

The PEA looks at a high grade (3.23 g/t gold and 78 g/t silver) conventional open pit operation that would cost $303 million to reach production. A 6,850-t/d million and flotation plant that will produce saleable concentrate is planned. The after tax net present value with a 5% discount is $638 million, and the project would pay for itself in 1.2 years.

Average annual production over the life of the mine would be 236,000 oz. of gold and 5.8 million oz. of silver. All-in sustaining costs would be $983 per oz. of gold equivalent recovered.

Pit constrained resources at Eskay Creek are 12.7 million indicated tonnes grading 4.3 g/t gold (1.7 million contained oz.) and 110 g/t silver (44.7 million contained oz.) plus 14.4 million inferred tonnes at 2.3 g/t gold (1.1 million contained oz.) and 47 g/t silver (21.7 million contained oz.).

Underground resources have also been estimated. There are 819,000 indicated tonnes at 6.4 g/t gold and 139 g/t silver plus 295,000 inferred tonnes at 7.1 g/t gold and 82 g/t silver.

Skeena says there is potential to expand the resources with additional drilling. Meanwhile it will consider mine scheduling to allow for various ore blending scenarios, continue metallurgical tests, enhance the current pit slope designs, conduct gap analyses and environmental baseline studies needed for permitting, and continue to optimize water management strategies.

Additional details from the PEA are available at

Comments