ONTARIO –

New Gold of Toronto has entered into a bought deal financing that will raise at least US$150 million for construction of the Rainy River gold mine 65 km northwest of Fort Frances.

New Gold will issue 53.6 million common shares at a price of US$2.80 each to a syndicate of underwriters led by RBC Capital Markets and Scotiabank. The underwriters have also been given an overallotment option of approximately 8.0 million shares. If the overallotment is exercised in its entirety, the gross proceeds will be US$172.6 million.

[caption id="attachment_1003717309" align="alignleft" width="300"]

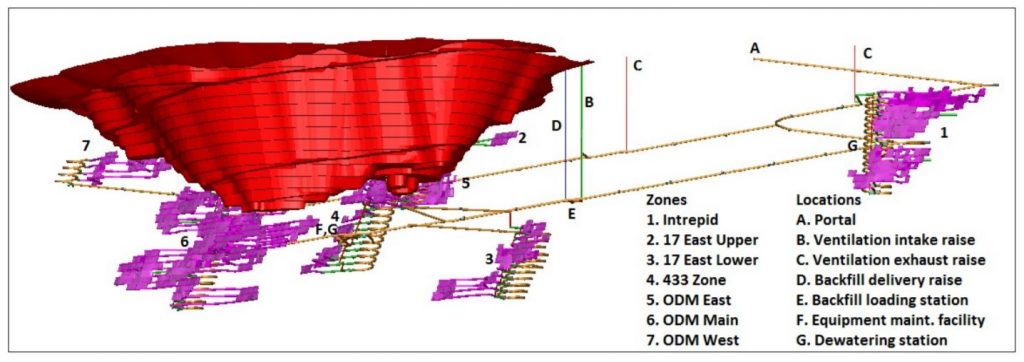

Isometric view of the Rainy River underground mine below the pit.

Isometric view of the Rainy River underground mine below the pit.[/caption]

The Rainy River deposit has total proven and probable reserves of 104.3 million tonnes grading 1.13 g/t gold and 2.8 g/t silver, containing 3.77 million oz. of gold and more than 9.4 million oz. of silver. The measured and indicated resource (exclusive of reserves) is 81.3 million tonnes at 1.11 g/t gold and 3.8 g/t silver, containing almost 2.9 million oz. of gold and 10.0 million oz. of silver. There is also an inferred portion of 18.1 million tonnes grading 1.10 g/t gold and 4.0 g/t silver, containing 637,000 oz. of gold and 2.3 million oz. of silver.

Both open pit and underground mining are planned to feed a 12,000-t/d mill. The pit will be a conventional truck-shovel operation at 19,500 t/d, and the underground mine will supply 1,500 t/d of ore from longitudinal longhole stoping, backfilled with cemented aggregate. Total pre-production capital cost (including contingency) was estimated in 2014 to be C$366.3 million.

The 2014 feasibility study can be read at

www.NewGold.com.

Isometric view of the Rainy River underground mine below the pit.[/caption]

The Rainy River deposit has total proven and probable reserves of 104.3 million tonnes grading 1.13 g/t gold and 2.8 g/t silver, containing 3.77 million oz. of gold and more than 9.4 million oz. of silver. The measured and indicated resource (exclusive of reserves) is 81.3 million tonnes at 1.11 g/t gold and 3.8 g/t silver, containing almost 2.9 million oz. of gold and 10.0 million oz. of silver. There is also an inferred portion of 18.1 million tonnes grading 1.10 g/t gold and 4.0 g/t silver, containing 637,000 oz. of gold and 2.3 million oz. of silver.

Both open pit and underground mining are planned to feed a 12,000-t/d mill. The pit will be a conventional truck-shovel operation at 19,500 t/d, and the underground mine will supply 1,500 t/d of ore from longitudinal longhole stoping, backfilled with cemented aggregate. Total pre-production capital cost (including contingency) was estimated in 2014 to be C$366.3 million.

The 2014 feasibility study can be read at

Isometric view of the Rainy River underground mine below the pit.[/caption]

The Rainy River deposit has total proven and probable reserves of 104.3 million tonnes grading 1.13 g/t gold and 2.8 g/t silver, containing 3.77 million oz. of gold and more than 9.4 million oz. of silver. The measured and indicated resource (exclusive of reserves) is 81.3 million tonnes at 1.11 g/t gold and 3.8 g/t silver, containing almost 2.9 million oz. of gold and 10.0 million oz. of silver. There is also an inferred portion of 18.1 million tonnes grading 1.10 g/t gold and 4.0 g/t silver, containing 637,000 oz. of gold and 2.3 million oz. of silver.

Both open pit and underground mining are planned to feed a 12,000-t/d mill. The pit will be a conventional truck-shovel operation at 19,500 t/d, and the underground mine will supply 1,500 t/d of ore from longitudinal longhole stoping, backfilled with cemented aggregate. Total pre-production capital cost (including contingency) was estimated in 2014 to be C$366.3 million.

The 2014 feasibility study can be read at

Comments