[caption id="attachment_1003739840" align="aligncenter" width="550"]

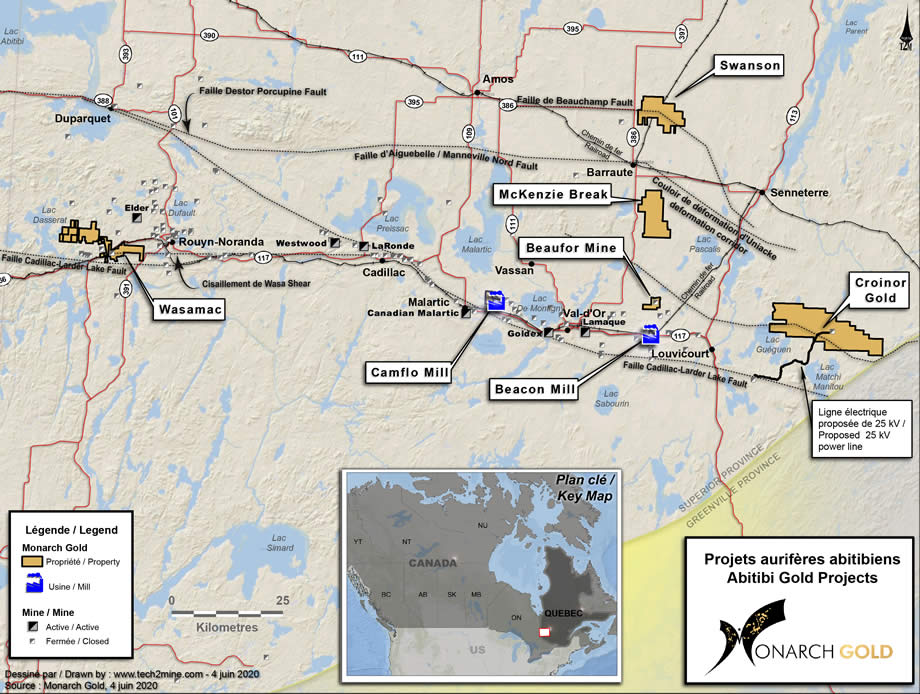

Monarch gold properties Credit: Monarch

Monarch gold properties Credit: Monarch[/caption]

TIMMINS –

Monarch Gold has selected Ausenco Engineering to complete an upgrading study on

Glencore’s Kidd concentrator, which would potentially be used to upgrade ore mined at the company’s Wasamac project in Quebec.

In May, Monarch entered into a memorandum of understanding (MOU) with Glencore, which includes a four-phase work plan for Monarch: the upgrading study, negotiation and signing of a toll milling agreement, Monarch-funded concentrator upgrades and toll milling. Under the terms of the MOU, a toll milling agreement would need to be executed by the end of March 2021, concentrator upgrades completed by July 2023 with the first ore delivery to the concentrator by Dec. 31, 2023.

The upgrading study is expected to be complete by October of this year, and will be done in two phases. The first would look at the costs associated with whole ore leach and flotation leach recovery options while the second will develop the optimal option to the pre-feasibility study level.

The ore from Wasamac would be transported by rail to the 12,500 t/d facility for processing and pouring into doré bars.

In the release, Monarch noted that it retains the right to not disclose the results of the upgrading study.

In addition, earlier this month, Monarch closed a $5.4-million private placement financing with Yamana Gold investing $4.2 million into the company and Alamos Gold purchasing $720,000 worth of its units.

The company’s wholly owned Wasamac deposit features measured and indicated resources of 29.9 million tonnes grading 2.7 g/t gold for a total of 2.6 million oz. Additional inferred resources are at 4.2 million tonnes at 2.2 g/t gold for 293,900 oz. The resources are estimated using a 1 g/t gold cut-off grade.

A 2018 feasibility study for the deposit outlined a 6,000 t/d underground operation producing an average of 142,000 oz. a year at all-in sustaining costs of $826 per oz. with a pre-production capital cost of $464 million. The associated after-tax net present value estimate, at a 5% discount rate, came in at $311 million with an 18.5% internal rate of return.

Monarch started the permitting process for Wasamac in November 2019, which is expected to take two years to complete.

For more information, visit

www.MonarquesGold.com.

Monarch gold properties Credit: Monarch[/caption]

TIMMINS – Monarch Gold has selected Ausenco Engineering to complete an upgrading study on Glencore’s Kidd concentrator, which would potentially be used to upgrade ore mined at the company’s Wasamac project in Quebec.

In May, Monarch entered into a memorandum of understanding (MOU) with Glencore, which includes a four-phase work plan for Monarch: the upgrading study, negotiation and signing of a toll milling agreement, Monarch-funded concentrator upgrades and toll milling. Under the terms of the MOU, a toll milling agreement would need to be executed by the end of March 2021, concentrator upgrades completed by July 2023 with the first ore delivery to the concentrator by Dec. 31, 2023.

The upgrading study is expected to be complete by October of this year, and will be done in two phases. The first would look at the costs associated with whole ore leach and flotation leach recovery options while the second will develop the optimal option to the pre-feasibility study level.

The ore from Wasamac would be transported by rail to the 12,500 t/d facility for processing and pouring into doré bars.

In the release, Monarch noted that it retains the right to not disclose the results of the upgrading study.

In addition, earlier this month, Monarch closed a $5.4-million private placement financing with Yamana Gold investing $4.2 million into the company and Alamos Gold purchasing $720,000 worth of its units.

The company’s wholly owned Wasamac deposit features measured and indicated resources of 29.9 million tonnes grading 2.7 g/t gold for a total of 2.6 million oz. Additional inferred resources are at 4.2 million tonnes at 2.2 g/t gold for 293,900 oz. The resources are estimated using a 1 g/t gold cut-off grade.

A 2018 feasibility study for the deposit outlined a 6,000 t/d underground operation producing an average of 142,000 oz. a year at all-in sustaining costs of $826 per oz. with a pre-production capital cost of $464 million. The associated after-tax net present value estimate, at a 5% discount rate, came in at $311 million with an 18.5% internal rate of return.

Monarch started the permitting process for Wasamac in November 2019, which is expected to take two years to complete.

For more information, visit

Monarch gold properties Credit: Monarch[/caption]

TIMMINS – Monarch Gold has selected Ausenco Engineering to complete an upgrading study on Glencore’s Kidd concentrator, which would potentially be used to upgrade ore mined at the company’s Wasamac project in Quebec.

In May, Monarch entered into a memorandum of understanding (MOU) with Glencore, which includes a four-phase work plan for Monarch: the upgrading study, negotiation and signing of a toll milling agreement, Monarch-funded concentrator upgrades and toll milling. Under the terms of the MOU, a toll milling agreement would need to be executed by the end of March 2021, concentrator upgrades completed by July 2023 with the first ore delivery to the concentrator by Dec. 31, 2023.

The upgrading study is expected to be complete by October of this year, and will be done in two phases. The first would look at the costs associated with whole ore leach and flotation leach recovery options while the second will develop the optimal option to the pre-feasibility study level.

The ore from Wasamac would be transported by rail to the 12,500 t/d facility for processing and pouring into doré bars.

In the release, Monarch noted that it retains the right to not disclose the results of the upgrading study.

In addition, earlier this month, Monarch closed a $5.4-million private placement financing with Yamana Gold investing $4.2 million into the company and Alamos Gold purchasing $720,000 worth of its units.

The company’s wholly owned Wasamac deposit features measured and indicated resources of 29.9 million tonnes grading 2.7 g/t gold for a total of 2.6 million oz. Additional inferred resources are at 4.2 million tonnes at 2.2 g/t gold for 293,900 oz. The resources are estimated using a 1 g/t gold cut-off grade.

A 2018 feasibility study for the deposit outlined a 6,000 t/d underground operation producing an average of 142,000 oz. a year at all-in sustaining costs of $826 per oz. with a pre-production capital cost of $464 million. The associated after-tax net present value estimate, at a 5% discount rate, came in at $311 million with an 18.5% internal rate of return.

Monarch started the permitting process for Wasamac in November 2019, which is expected to take two years to complete.

For more information, visit

Comments