[caption id="attachment_1003723904" align="aligncenter" width="510"]

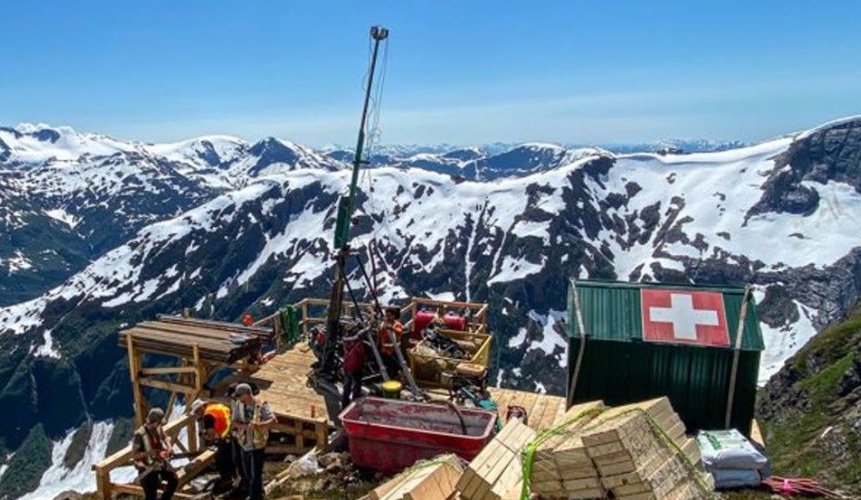

Underground development is in full swing at the Fruta del Norte gold mine. (Image: Lundin Gold)

Underground development is in full swing at the Fruta del Norte gold mine. (Image: Lundin Gold)[/caption]

ECUADOR –

Lundin Gold of Vancouver has closed a $350-million (all amounts are U.S. dollars) senior secured project finance debt facility with a syndicate of seven lenders. The funds will go toward development and construction of the Fruta del Norte gold project. The company also announced an offtake agreement for gold concentrate.

The debt facility has a term of eight years with a maturity date not exceeding June 2026 based on a scheduled amortization starting at the end of 2020. Lundin will draw down $250 million in tranche A and $100 in tranche B. The annual interest will be the three- or six-month LIBOR plus an average margin of about 5.05% for tranche A and 2.50% for tranche B over the term.

The offtake agreement is with

Boliden for about half of the gold-bearing concentrate produced at Fruta over its first eight years of operation.

Fruta del Norte is an underground mine with a life of 15 years. It will operate at a rate of 3,500 t/d to produce 325,000 oz. of gold per year at an all-in sustaining cost of $609 per oz. The probable reserves are 15.5 million tonnes containing 4.8 million oz. of gold and grading 9.67 g/t.

The 2016 43-101 report is available at

www.LundinGold.com.

Underground development is in full swing at the Fruta del Norte gold mine. (Image: Lundin Gold)[/caption]

ECUADOR – Lundin Gold of Vancouver has closed a $350-million (all amounts are U.S. dollars) senior secured project finance debt facility with a syndicate of seven lenders. The funds will go toward development and construction of the Fruta del Norte gold project. The company also announced an offtake agreement for gold concentrate.

The debt facility has a term of eight years with a maturity date not exceeding June 2026 based on a scheduled amortization starting at the end of 2020. Lundin will draw down $250 million in tranche A and $100 in tranche B. The annual interest will be the three- or six-month LIBOR plus an average margin of about 5.05% for tranche A and 2.50% for tranche B over the term.

The offtake agreement is with Boliden for about half of the gold-bearing concentrate produced at Fruta over its first eight years of operation.

Fruta del Norte is an underground mine with a life of 15 years. It will operate at a rate of 3,500 t/d to produce 325,000 oz. of gold per year at an all-in sustaining cost of $609 per oz. The probable reserves are 15.5 million tonnes containing 4.8 million oz. of gold and grading 9.67 g/t.

The 2016 43-101 report is available at

Underground development is in full swing at the Fruta del Norte gold mine. (Image: Lundin Gold)[/caption]

ECUADOR – Lundin Gold of Vancouver has closed a $350-million (all amounts are U.S. dollars) senior secured project finance debt facility with a syndicate of seven lenders. The funds will go toward development and construction of the Fruta del Norte gold project. The company also announced an offtake agreement for gold concentrate.

The debt facility has a term of eight years with a maturity date not exceeding June 2026 based on a scheduled amortization starting at the end of 2020. Lundin will draw down $250 million in tranche A and $100 in tranche B. The annual interest will be the three- or six-month LIBOR plus an average margin of about 5.05% for tranche A and 2.50% for tranche B over the term.

The offtake agreement is with Boliden for about half of the gold-bearing concentrate produced at Fruta over its first eight years of operation.

Fruta del Norte is an underground mine with a life of 15 years. It will operate at a rate of 3,500 t/d to produce 325,000 oz. of gold per year at an all-in sustaining cost of $609 per oz. The probable reserves are 15.5 million tonnes containing 4.8 million oz. of gold and grading 9.67 g/t.

The 2016 43-101 report is available at

Comments