[caption id="attachment_1003740914" align="aligncenter" width="600"]

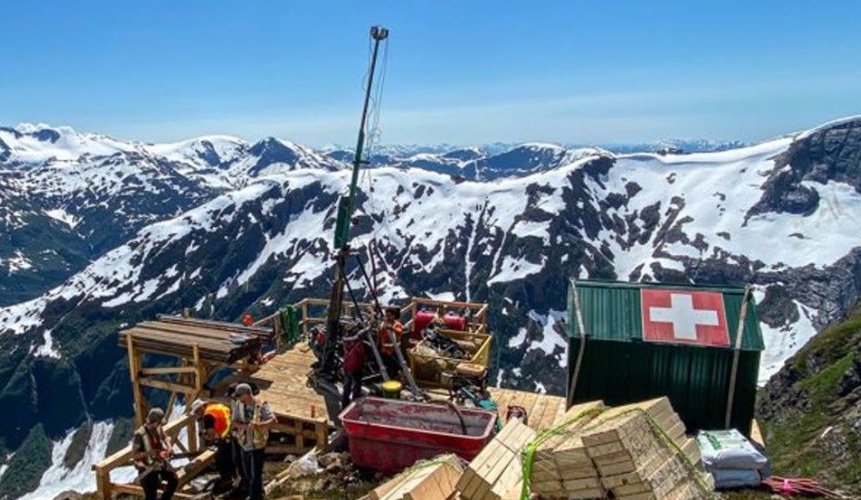

Visible gold at Beta Hunt Credit: Karora

Visible gold at Beta Hunt Credit: Karora[/caption]

TORONTO – In the second quarter of the year, Australia-focused gold producer

Karora Resources generated 24,078 gold oz. at all-in sustaining costs of US$1,065 per oz.

The company’s Beta Hunt underground mine delivered 16,818 oz. in the quarter while the open pit Higginsville gold operations (HGO), 75 km south of Beta Hunt, churned out 7,260 oz.

Karora is maintaining its 2020 production guidance of 90,000 oz. to 95,000 oz. at all-in sustaining costs of US$1,050 to US$1,200 per oz. and is targeting all-in costs of approximately US$1,000 per oz. by year-end. With these latest numbers, the company has produced 48,895 gold oz. in the first half of the year.

With adjusted earnings of $16.6 million, Karora increased its cash position by $11.8 million in the quarter, closing out the reporting period with $50.2 million in cash.

“We have been extremely busy at Karora since the start of the second quarter, with yet another strong operational performance of sustainable gold production and steadily reducing costs, despite the challenges associated with COVID-19,” Paul Huet, the company’s chairman and CEO, said in a release. “Not only did we return a strong financial quarter, but we have also achieved several major corporate objectives, which have transformed the corporation into a top-tier junior producer and have laid the foundation for the next stage of Karora’s growth as a business.”

Earlier this month, Karora also closed its acquisition of the past-producing Spargos high-grade open pit gold project, 65 km from the Higginsville mill, which was

initially announced in May. Huet added that he expects to fast-track this asset into production next year.

At the end of July, the producer also sold its 28% stake in the Dumont nickel project, for net proceeds of up to $47.6 million, as it focuses on its gold assets.

Also in Q2, the company closed out gold hedge agreements – its gold sales are now at market gold prices.

In May, the company eliminated net smelter return (NSR) royalties on its Higginsville operations and, at the end of June, also reduced the royalty on Beta Hunt to 4.75%, down from 7.5% previously.

Karora maintains strict COVID-19 control measures at its operations and has adjusted personnel rotations and chartered flights as necessary to ensure employee safety.

In the second quarter, the central Higginsville mill derived 60% of its feed from Beta Hunt and the remaining 40% from the Higginsville pits. Over the longer term, Karora is aiming for a 50:50 mill feed split, to optimize the HGO plant operations.

With several prospective targets nearby the HGO plant, the company is looking at ways to expedite its exploration work and re-prioritizing the targets. A resource update for the Australian operations is expected in the fourth quarter.

For more information, visit

www.KaroraResources.com.

Visible gold at Beta Hunt Credit: Karora[/caption]

TORONTO – In the second quarter of the year, Australia-focused gold producer Karora Resources generated 24,078 gold oz. at all-in sustaining costs of US$1,065 per oz.

The company’s Beta Hunt underground mine delivered 16,818 oz. in the quarter while the open pit Higginsville gold operations (HGO), 75 km south of Beta Hunt, churned out 7,260 oz.

Karora is maintaining its 2020 production guidance of 90,000 oz. to 95,000 oz. at all-in sustaining costs of US$1,050 to US$1,200 per oz. and is targeting all-in costs of approximately US$1,000 per oz. by year-end. With these latest numbers, the company has produced 48,895 gold oz. in the first half of the year.

With adjusted earnings of $16.6 million, Karora increased its cash position by $11.8 million in the quarter, closing out the reporting period with $50.2 million in cash.

“We have been extremely busy at Karora since the start of the second quarter, with yet another strong operational performance of sustainable gold production and steadily reducing costs, despite the challenges associated with COVID-19,” Paul Huet, the company’s chairman and CEO, said in a release. “Not only did we return a strong financial quarter, but we have also achieved several major corporate objectives, which have transformed the corporation into a top-tier junior producer and have laid the foundation for the next stage of Karora’s growth as a business.”

Earlier this month, Karora also closed its acquisition of the past-producing Spargos high-grade open pit gold project, 65 km from the Higginsville mill, which was

Visible gold at Beta Hunt Credit: Karora[/caption]

TORONTO – In the second quarter of the year, Australia-focused gold producer Karora Resources generated 24,078 gold oz. at all-in sustaining costs of US$1,065 per oz.

The company’s Beta Hunt underground mine delivered 16,818 oz. in the quarter while the open pit Higginsville gold operations (HGO), 75 km south of Beta Hunt, churned out 7,260 oz.

Karora is maintaining its 2020 production guidance of 90,000 oz. to 95,000 oz. at all-in sustaining costs of US$1,050 to US$1,200 per oz. and is targeting all-in costs of approximately US$1,000 per oz. by year-end. With these latest numbers, the company has produced 48,895 gold oz. in the first half of the year.

With adjusted earnings of $16.6 million, Karora increased its cash position by $11.8 million in the quarter, closing out the reporting period with $50.2 million in cash.

“We have been extremely busy at Karora since the start of the second quarter, with yet another strong operational performance of sustainable gold production and steadily reducing costs, despite the challenges associated with COVID-19,” Paul Huet, the company’s chairman and CEO, said in a release. “Not only did we return a strong financial quarter, but we have also achieved several major corporate objectives, which have transformed the corporation into a top-tier junior producer and have laid the foundation for the next stage of Karora’s growth as a business.”

Earlier this month, Karora also closed its acquisition of the past-producing Spargos high-grade open pit gold project, 65 km from the Higginsville mill, which was

Comments