MONTREAL – Only five minutes after

Osisko Mining announced a $30 million unit offering this morning, the company said that it was also making a $30 million flow-through share offering. Then before lunch, Osisko said due to high demand, the unit offering was being increased to $52 million. That’s a total of $82 million.

[caption id="attachment_1003717067" align="alignright" width="300"]

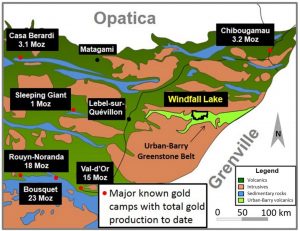

Geology map of the Abitibi Greenstone Belt with location of the Windfall property in the Urban-Barry belt.

Geology map of the Abitibi Greenstone Belt with location of the Windfall property in the Urban-Barry belt.[/caption]

First, the flow-through deal: Osisko is selling on a bought deal basis 5.45 million flow-through common shares at a price of $5.52 per share. The price represents a 55% premium to the closing price of the company’s common shares on the TSX on Feb. 3. The gross proceeds will be approximately $30 million.

Second, the unit offering: The original $30 million bought deal financing was to sell approximately 8.8 million units at a price of $3.40 each. Each unit would allow the holder to purchase one whole common share at a price of $5.00 each for a period of 18 months after closing. Only hours later, Osisko said that demand was so great that it was expanding the private placement to 15.3 million units.

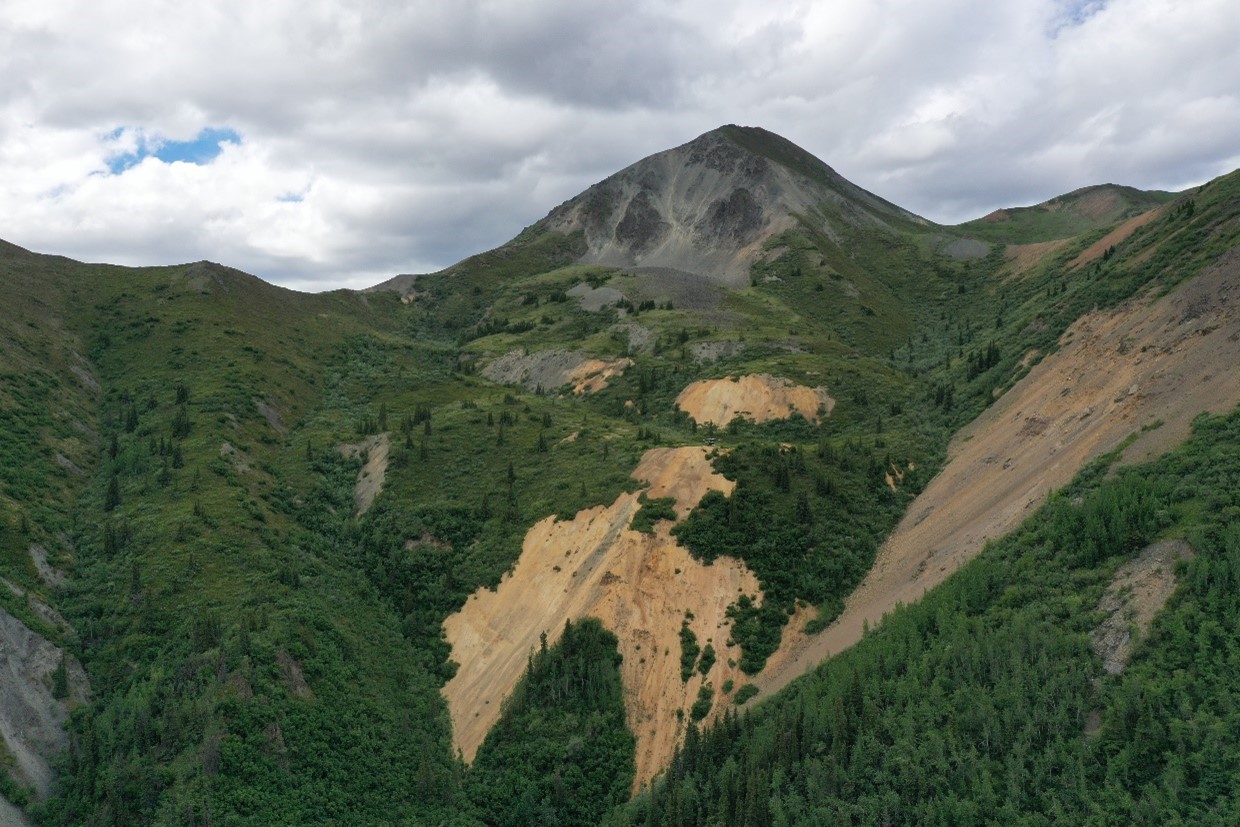

Osisko plans to use the net proceeds of both offerings for exploration and development of its Windfall Lake project 115 km east of Lebel-sur-Quevillon, QC. In 2014 the resource was estimated to contain at least 1.5 million oz of gold. The company says the bulk of the mineralization averages roughly 10 g/t Au over 5 metres with the highest grade pockets returning up to 248 g/t over 12.4 metres.

The preliminary economic assessment outlined annual production of 106,000 oz of payable gold. With a mining rate of 1,200 t/d, the mine life would be only 7.8 years. The preproduction capital requirement is $240.6 million, and the sustaining capital $53.5 million. With gold at US$1,200/oz and an exchange rate of US$1:C$0.86, the project has a post-tax internal rate of return of 17.2% and a 3.9-year payback period.

Complete details of the PEA are posted at

www.OsiskoMining.com.

Geology map of the Abitibi Greenstone Belt with location of the Windfall property in the Urban-Barry belt.[/caption]

First, the flow-through deal: Osisko is selling on a bought deal basis 5.45 million flow-through common shares at a price of $5.52 per share. The price represents a 55% premium to the closing price of the company’s common shares on the TSX on Feb. 3. The gross proceeds will be approximately $30 million.

Second, the unit offering: The original $30 million bought deal financing was to sell approximately 8.8 million units at a price of $3.40 each. Each unit would allow the holder to purchase one whole common share at a price of $5.00 each for a period of 18 months after closing. Only hours later, Osisko said that demand was so great that it was expanding the private placement to 15.3 million units.

Osisko plans to use the net proceeds of both offerings for exploration and development of its Windfall Lake project 115 km east of Lebel-sur-Quevillon, QC. In 2014 the resource was estimated to contain at least 1.5 million oz of gold. The company says the bulk of the mineralization averages roughly 10 g/t Au over 5 metres with the highest grade pockets returning up to 248 g/t over 12.4 metres.

The preliminary economic assessment outlined annual production of 106,000 oz of payable gold. With a mining rate of 1,200 t/d, the mine life would be only 7.8 years. The preproduction capital requirement is $240.6 million, and the sustaining capital $53.5 million. With gold at US$1,200/oz and an exchange rate of US$1:C$0.86, the project has a post-tax internal rate of return of 17.2% and a 3.9-year payback period.

Complete details of the PEA are posted at

Geology map of the Abitibi Greenstone Belt with location of the Windfall property in the Urban-Barry belt.[/caption]

First, the flow-through deal: Osisko is selling on a bought deal basis 5.45 million flow-through common shares at a price of $5.52 per share. The price represents a 55% premium to the closing price of the company’s common shares on the TSX on Feb. 3. The gross proceeds will be approximately $30 million.

Second, the unit offering: The original $30 million bought deal financing was to sell approximately 8.8 million units at a price of $3.40 each. Each unit would allow the holder to purchase one whole common share at a price of $5.00 each for a period of 18 months after closing. Only hours later, Osisko said that demand was so great that it was expanding the private placement to 15.3 million units.

Osisko plans to use the net proceeds of both offerings for exploration and development of its Windfall Lake project 115 km east of Lebel-sur-Quevillon, QC. In 2014 the resource was estimated to contain at least 1.5 million oz of gold. The company says the bulk of the mineralization averages roughly 10 g/t Au over 5 metres with the highest grade pockets returning up to 248 g/t over 12.4 metres.

The preliminary economic assessment outlined annual production of 106,000 oz of payable gold. With a mining rate of 1,200 t/d, the mine life would be only 7.8 years. The preproduction capital requirement is $240.6 million, and the sustaining capital $53.5 million. With gold at US$1,200/oz and an exchange rate of US$1:C$0.86, the project has a post-tax internal rate of return of 17.2% and a 3.9-year payback period.

Complete details of the PEA are posted at

Comments