QUEBEC –

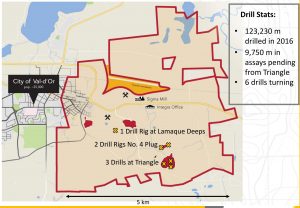

Integra Gold Corp. of Vancouver has updated the preliminary economic assessment for its Lamaque South gold project in Val d’Or. Life-of-mine cash costs are estimated to be $458 (all US dollars) per ounce of gold and the all-in sustaining cost $634 per oz.

The study proposed a pre-production period of 18 months with initial capital expenses of $135.6 million. Anticipated pre-production revenues of $50 million bring the net cost down to $85.4 million. The investment would support development of an underground mine with average annual production of 123,000 oz. and total production of 1.3 million oz., a 156% increase from the PEA prepared in 2015.

The Lamaque South project carries after tax numbers for net present value (5% discount) of $501 million and an internal rate of return of 43%. The payback period would be only 4.2 years as cumulative cash flows of $770 million are expected.

The improved PEA was possible following significant infill drilling and the discovery of the C structures in 2015 at the Triangle deposit. At its peak, the Lamaque project will create up to 425 jobs.

A detailed look at the project is encouraged at

www.IntegraGold.com.

[caption id="attachment_1003717329" align="aligncenter" width="300"]

Drilling at the Lamaque South gold project.

Drilling at the Lamaque South gold project.[/caption]

Drilling at the Lamaque South gold project.[/caption]

Drilling at the Lamaque South gold project.[/caption]

Comments