QUEBEC – Montreal’s

Falco Resources has closed a $10.8-million private placement with which to dewatering old workings to advance development at the Horne 5 gold mine in the Rouyn-Noranda camp. The company issued 10.1 million units at a price of $1.07 each.

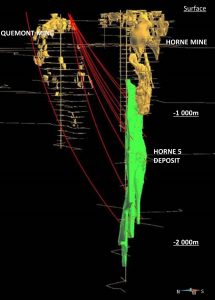

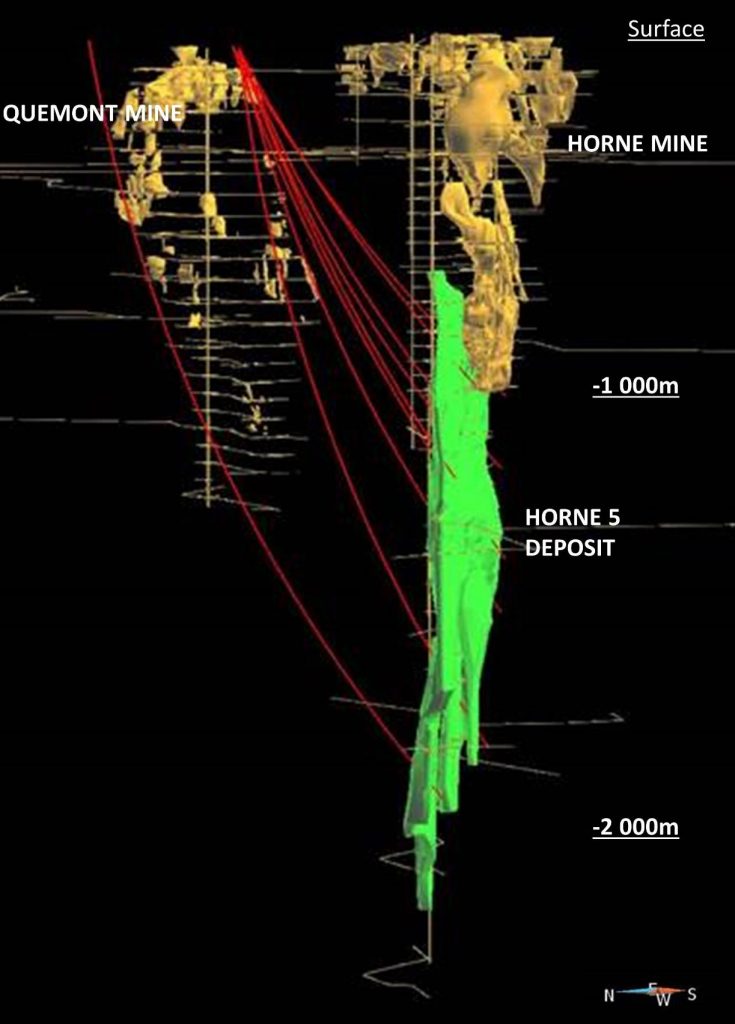

[caption id="attachment_1003716919" align="alignleft" width="215"]

Confirmation and metallurgical drilling at Horne 5. (Image: Falco Resources)

Confirmation and metallurgical drilling at Horne 5. (Image: Falco Resources)[/caption]

Each unit consists of one Falco common share and one-half of a share purchase warrant. Each warrant is exercisable to acquire one additional common share for a period of 18 months from the closing date of the offering at an exercise price of $1.45 each.

Falco’s Horne project includes the former Horne and Quemont gold mines as well as the Horne 5 deposit. The original Horne mine, discovered by Ed Horne in 1920, was operated by Noranda from 1926 to 1976. The Horne 5 deposit has a measured resource of 736,000 oz AuEq in 9.4 million tonnes grading 1.48 g/t Au, 16.33 g/t Ag, 0.18% Cu, and 0.81% Zn. The indicated resource contains more than 6.33 million oz AuEq in 81.7 million tonnes averaging 1.56 g/t Au, 14.19 g/t Ag, 0.18% Cu, and 0.86% Zn. There is also an inferred resource containing over 1.7 million oz AuEq in 22.3 million tonnes averaging 1.47 g/t Au, 22.98 g/t Ag, 0.20% Cu and 0.68% Zn.

Additional information about the Horne project is available at

www.FalcoRes.com.

Confirmation and metallurgical drilling at Horne 5. (Image: Falco Resources)[/caption]

Each unit consists of one Falco common share and one-half of a share purchase warrant. Each warrant is exercisable to acquire one additional common share for a period of 18 months from the closing date of the offering at an exercise price of $1.45 each.

Falco’s Horne project includes the former Horne and Quemont gold mines as well as the Horne 5 deposit. The original Horne mine, discovered by Ed Horne in 1920, was operated by Noranda from 1926 to 1976. The Horne 5 deposit has a measured resource of 736,000 oz AuEq in 9.4 million tonnes grading 1.48 g/t Au, 16.33 g/t Ag, 0.18% Cu, and 0.81% Zn. The indicated resource contains more than 6.33 million oz AuEq in 81.7 million tonnes averaging 1.56 g/t Au, 14.19 g/t Ag, 0.18% Cu, and 0.86% Zn. There is also an inferred resource containing over 1.7 million oz AuEq in 22.3 million tonnes averaging 1.47 g/t Au, 22.98 g/t Ag, 0.20% Cu and 0.68% Zn.

Additional information about the Horne project is available at

Confirmation and metallurgical drilling at Horne 5. (Image: Falco Resources)[/caption]

Each unit consists of one Falco common share and one-half of a share purchase warrant. Each warrant is exercisable to acquire one additional common share for a period of 18 months from the closing date of the offering at an exercise price of $1.45 each.

Falco’s Horne project includes the former Horne and Quemont gold mines as well as the Horne 5 deposit. The original Horne mine, discovered by Ed Horne in 1920, was operated by Noranda from 1926 to 1976. The Horne 5 deposit has a measured resource of 736,000 oz AuEq in 9.4 million tonnes grading 1.48 g/t Au, 16.33 g/t Ag, 0.18% Cu, and 0.81% Zn. The indicated resource contains more than 6.33 million oz AuEq in 81.7 million tonnes averaging 1.56 g/t Au, 14.19 g/t Ag, 0.18% Cu, and 0.86% Zn. There is also an inferred resource containing over 1.7 million oz AuEq in 22.3 million tonnes averaging 1.47 g/t Au, 22.98 g/t Ag, 0.20% Cu and 0.68% Zn.

Additional information about the Horne project is available at

Comments