[caption id="attachment_1003739712" align="aligncenter" width="550"]

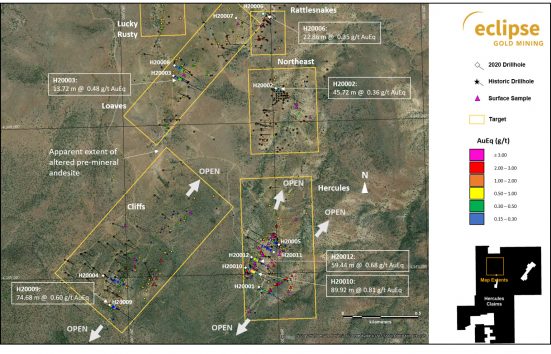

Hercules drill targets Credit: Eclipse

Hercules drill targets Credit: Eclipse[/caption]

TORONTO –

Eclipse Gold Mining has announced an upsized bought deal, raising $10.4 million (from $8 million previously) for working capital and corporate purposes.

The syndicate of underwriters for the offering is co-led by Beacon Securities and Canaccord Genuity, purchasing 13.9 million common shares at $0.75 each for gross proceeds of $10.4 million.

Closing is expected around July 7. The underwriters have the option to purchase up to an additional 15% of the shares offered to cover over-allotments for up to 30 days following closing.

Eclipse is focused on exploring the 85-sq.-km Hercules property in Nevada’s Walker Lane trend. Last week, the

company reported long intervals of shallow gold in oxides from five targets at the site. The company started trading on the Toronto Stock Exchange in February.

The Hercules property has been explored in the past by multiple operators and features a database of over 200 drill holes. Eclipse has a Plan of Operations permit in place, allowing for up to 200 drill sites. Historical metallurgical results suggest that the mineralization may be amenable to heap leaching.

For more information, visit

www.EclipseGoldMining.com.

Hercules drill targets Credit: Eclipse[/caption]

TORONTO – Eclipse Gold Mining has announced an upsized bought deal, raising $10.4 million (from $8 million previously) for working capital and corporate purposes.

The syndicate of underwriters for the offering is co-led by Beacon Securities and Canaccord Genuity, purchasing 13.9 million common shares at $0.75 each for gross proceeds of $10.4 million.

Closing is expected around July 7. The underwriters have the option to purchase up to an additional 15% of the shares offered to cover over-allotments for up to 30 days following closing.

Eclipse is focused on exploring the 85-sq.-km Hercules property in Nevada’s Walker Lane trend. Last week, the

Hercules drill targets Credit: Eclipse[/caption]

TORONTO – Eclipse Gold Mining has announced an upsized bought deal, raising $10.4 million (from $8 million previously) for working capital and corporate purposes.

The syndicate of underwriters for the offering is co-led by Beacon Securities and Canaccord Genuity, purchasing 13.9 million common shares at $0.75 each for gross proceeds of $10.4 million.

Closing is expected around July 7. The underwriters have the option to purchase up to an additional 15% of the shares offered to cover over-allotments for up to 30 days following closing.

Eclipse is focused on exploring the 85-sq.-km Hercules property in Nevada’s Walker Lane trend. Last week, the

Comments