[caption id="attachment_1003723348" align="aligncenter" width="631"]

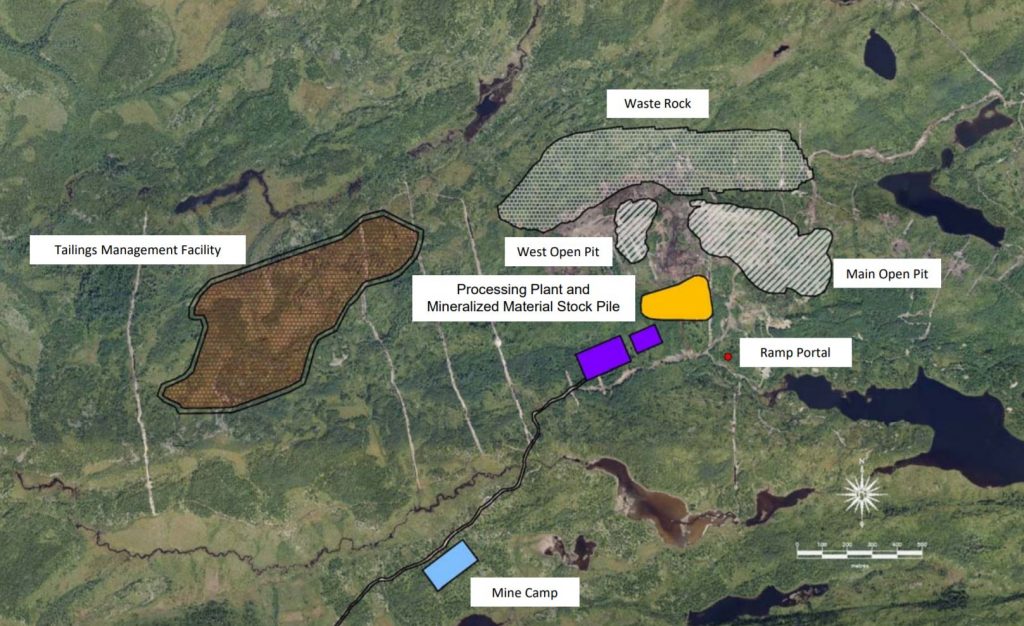

Proposed site layout for the Eau Claire gold project. (Image: Eastmain Resources)

Proposed site layout for the Eau Claire gold project. (Image: Eastmain Resources)[/caption]

QUEBEC – Toronto-based

Eastmain Resources says the preliminary economic assessment for its Eau Claire gold project in the James Bay region points to a pre-production capex of $175 million. That would see the development of both an open pit and an underground mine.

The PEA has an after tax net present value at a 5% discount rate of $260 million and an after tax internal rate of return of 27%. The project would pay for itself in the first 3.1 years of its 12-year mine life. Average all-in sustaining costs are estimated to be $746/oz. (US$574/oz.)

At an average mining and processing rate of 1,500 t/d and gold recoveries of 95%, the project would have average annual production of 79,200 oz. of gold or 951,000 oz. over the life of the mine.

Eastmain says the property has several upside opportunities to further improve the project economics. President and CEO Claude Lemasson said, “We intend to move Eau Claire along a development track and to aggressively pursue nearby exploration targets with potential to provide additional process plant feed and further improve project economics.”

Thus far, the property has total measured and indicated resources of 4.3 million tonnes grading 6.18 g/t gold for 853,000 contained oz. The inferred portion is 2.4 million tonnes averaging 6.53 g/t for 500,000 contained oz. About 1.6 million tonnes at 3.78 g/t gold are recoverable with open pit methods and about 4.8 million tonnes at 5.24 g/t are recoverable from underground.

Details of the Eau Claire (Clearwater) project are available at

www.Eastmain.com.

Proposed site layout for the Eau Claire gold project. (Image: Eastmain Resources)[/caption]

QUEBEC – Toronto-based Eastmain Resources says the preliminary economic assessment for its Eau Claire gold project in the James Bay region points to a pre-production capex of $175 million. That would see the development of both an open pit and an underground mine.

The PEA has an after tax net present value at a 5% discount rate of $260 million and an after tax internal rate of return of 27%. The project would pay for itself in the first 3.1 years of its 12-year mine life. Average all-in sustaining costs are estimated to be $746/oz. (US$574/oz.)

At an average mining and processing rate of 1,500 t/d and gold recoveries of 95%, the project would have average annual production of 79,200 oz. of gold or 951,000 oz. over the life of the mine.

Eastmain says the property has several upside opportunities to further improve the project economics. President and CEO Claude Lemasson said, “We intend to move Eau Claire along a development track and to aggressively pursue nearby exploration targets with potential to provide additional process plant feed and further improve project economics.”

Thus far, the property has total measured and indicated resources of 4.3 million tonnes grading 6.18 g/t gold for 853,000 contained oz. The inferred portion is 2.4 million tonnes averaging 6.53 g/t for 500,000 contained oz. About 1.6 million tonnes at 3.78 g/t gold are recoverable with open pit methods and about 4.8 million tonnes at 5.24 g/t are recoverable from underground.

Details of the Eau Claire (Clearwater) project are available at

Proposed site layout for the Eau Claire gold project. (Image: Eastmain Resources)[/caption]

QUEBEC – Toronto-based Eastmain Resources says the preliminary economic assessment for its Eau Claire gold project in the James Bay region points to a pre-production capex of $175 million. That would see the development of both an open pit and an underground mine.

The PEA has an after tax net present value at a 5% discount rate of $260 million and an after tax internal rate of return of 27%. The project would pay for itself in the first 3.1 years of its 12-year mine life. Average all-in sustaining costs are estimated to be $746/oz. (US$574/oz.)

At an average mining and processing rate of 1,500 t/d and gold recoveries of 95%, the project would have average annual production of 79,200 oz. of gold or 951,000 oz. over the life of the mine.

Eastmain says the property has several upside opportunities to further improve the project economics. President and CEO Claude Lemasson said, “We intend to move Eau Claire along a development track and to aggressively pursue nearby exploration targets with potential to provide additional process plant feed and further improve project economics.”

Thus far, the property has total measured and indicated resources of 4.3 million tonnes grading 6.18 g/t gold for 853,000 contained oz. The inferred portion is 2.4 million tonnes averaging 6.53 g/t for 500,000 contained oz. About 1.6 million tonnes at 3.78 g/t gold are recoverable with open pit methods and about 4.8 million tonnes at 5.24 g/t are recoverable from underground.

Details of the Eau Claire (Clearwater) project are available at

Comments