QUEBEC –

Falco Resources of Montreal has closed a bought deal offering that grossed $28.75 million. The company sold 22.29 million units (including the overallotment) at a price of $1.29 each. Each unit allows the holder to acquire one common share and one-half of a share purchase warrant within a period of 18 months.

[caption id="attachment_1003718670" align="alignright" width="236"]

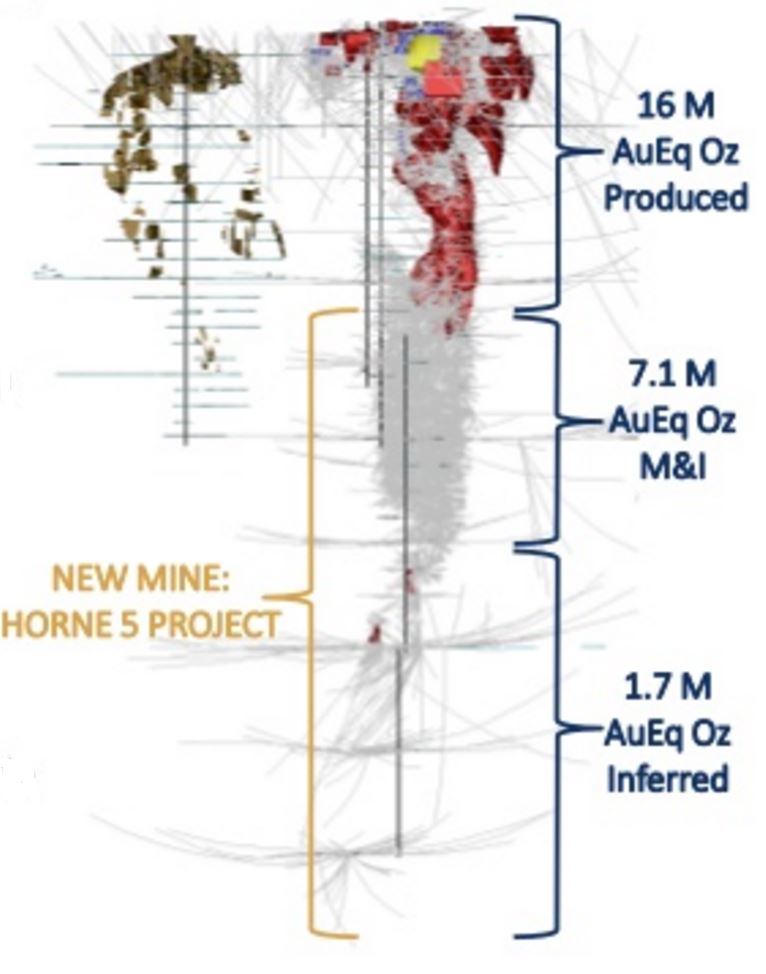

Representation of resources in the old Horne and new Horne 5 mines. Credit: Falco Resources.

Representation of resources in the old Horne and new Horne 5 mines. Credit: Falco Resources.[/caption]

The net proceeds of the offering will be used to advance the Horne 5 deposit in Rouyn-Noranda, including the dewatering program, building acquisitions and relocation, land purchases, purchasing of hoisting system equipment, pre-construction surface installations, and for general corporate purposes.

In October 2016, Falco estimated the measured resource at 736,000 oz. gold equivalent, the indicated resource at 6.34 million oz., and the inferred resource at 1.71 million oz. Expressed otherwise, there are 9.4 million measured tonnes at 1.58 g/t gold, 16.33 g/t silver, 0.18% copper and 0.81% zinc; 81.7 million indicated tonnes at 1.56 g/t gold, 14.19 g/t silver, 0.18% copper and 0.86% zinc; and 22.3 million inferred tonnes grading 1.48 g/t gold, 22.98 g/t silver, 0.2% copper and 0.68% zinc.

In May 2016, the preliminary economic assessment prepared for Falco put all-in sustaining costs at US$427/oz. of gold, net of by-product credits. Annual gold production will be 236,000 oz. for 12 years.

The feasibility study and environmental assessment for the Horne 5 project will be complete shortly. Visit

www.FalcoRes.com to check on the availability.

Representation of resources in the old Horne and new Horne 5 mines. Credit: Falco Resources.[/caption]

The net proceeds of the offering will be used to advance the Horne 5 deposit in Rouyn-Noranda, including the dewatering program, building acquisitions and relocation, land purchases, purchasing of hoisting system equipment, pre-construction surface installations, and for general corporate purposes.

In October 2016, Falco estimated the measured resource at 736,000 oz. gold equivalent, the indicated resource at 6.34 million oz., and the inferred resource at 1.71 million oz. Expressed otherwise, there are 9.4 million measured tonnes at 1.58 g/t gold, 16.33 g/t silver, 0.18% copper and 0.81% zinc; 81.7 million indicated tonnes at 1.56 g/t gold, 14.19 g/t silver, 0.18% copper and 0.86% zinc; and 22.3 million inferred tonnes grading 1.48 g/t gold, 22.98 g/t silver, 0.2% copper and 0.68% zinc.

In May 2016, the preliminary economic assessment prepared for Falco put all-in sustaining costs at US$427/oz. of gold, net of by-product credits. Annual gold production will be 236,000 oz. for 12 years.

The feasibility study and environmental assessment for the Horne 5 project will be complete shortly. Visit

Representation of resources in the old Horne and new Horne 5 mines. Credit: Falco Resources.[/caption]

The net proceeds of the offering will be used to advance the Horne 5 deposit in Rouyn-Noranda, including the dewatering program, building acquisitions and relocation, land purchases, purchasing of hoisting system equipment, pre-construction surface installations, and for general corporate purposes.

In October 2016, Falco estimated the measured resource at 736,000 oz. gold equivalent, the indicated resource at 6.34 million oz., and the inferred resource at 1.71 million oz. Expressed otherwise, there are 9.4 million measured tonnes at 1.58 g/t gold, 16.33 g/t silver, 0.18% copper and 0.81% zinc; 81.7 million indicated tonnes at 1.56 g/t gold, 14.19 g/t silver, 0.18% copper and 0.86% zinc; and 22.3 million inferred tonnes grading 1.48 g/t gold, 22.98 g/t silver, 0.2% copper and 0.68% zinc.

In May 2016, the preliminary economic assessment prepared for Falco put all-in sustaining costs at US$427/oz. of gold, net of by-product credits. Annual gold production will be 236,000 oz. for 12 years.

The feasibility study and environmental assessment for the Horne 5 project will be complete shortly. Visit

Comments