GOLD: ATAC files PEA for Tiger deposit at Rackla

YUKON – ATAC Resources of Vancouver has filed the preliminary economic assessment for the Tiger deposit at its Rackla gold project 55 […]

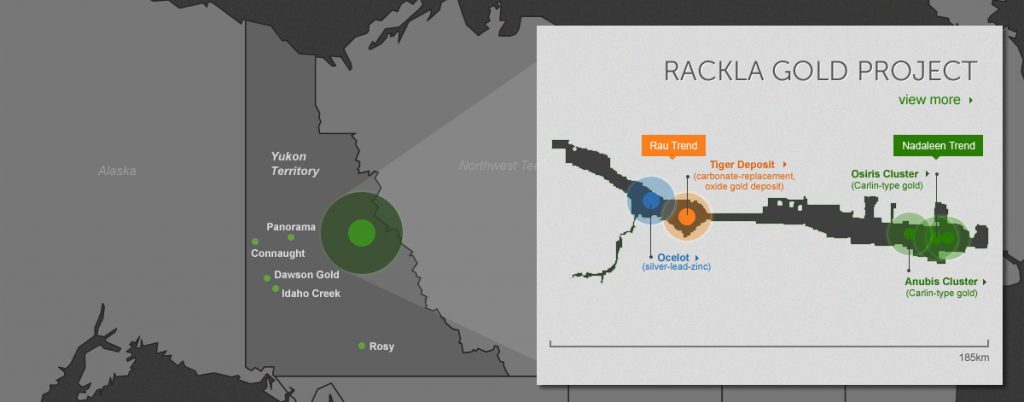

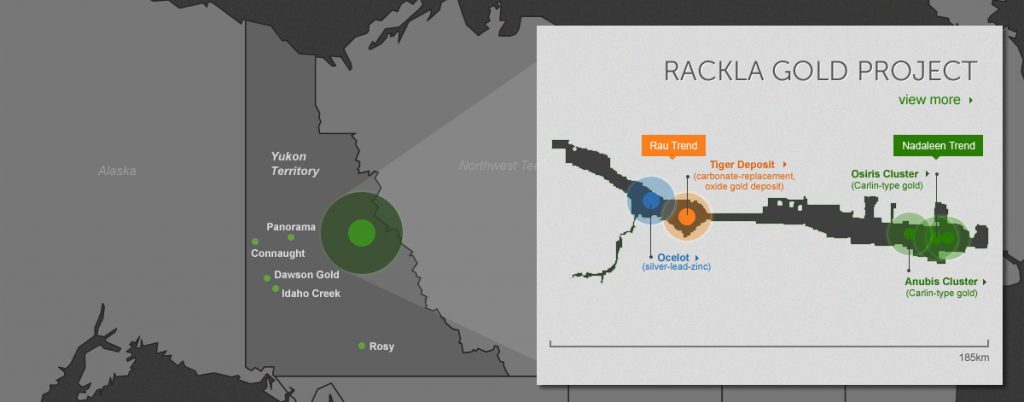

ATAC’s Rackla gold project.

ATAC’s Rackla gold project.[/caption]

The base case PEA assumed a gold price of US$1,260/oz and an exchange rate of C$1.00 equal to US$0.78. With those parameters, the deposit has a net present value (5% discount) of C$106.6 million and an internal rate of return of 34.8% before taxes. After taxes the NPV (5%) will be C$75.7 million and the IRR 28.2% with an all-in sustaining cost of US$864/oz of gold produced.

Pre-production capital requirements are C$109.4 million plus life of mine sustaining costs totaling C$8.3 million. Construction will take one year, followed by six years of open pit mining and two years of reclamation. The mill will have a throughput of 1,500 t/d. Life of mine annual gold production will average 50,000 oz.

The full PEA can be read at www.ATACResources.com. Enjoy the photo gallery, too.

ATAC’s Rackla gold project.[/caption]

The base case PEA assumed a gold price of US$1,260/oz and an exchange rate of C$1.00 equal to US$0.78. With those parameters, the deposit has a net present value (5% discount) of C$106.6 million and an internal rate of return of 34.8% before taxes. After taxes the NPV (5%) will be C$75.7 million and the IRR 28.2% with an all-in sustaining cost of US$864/oz of gold produced.

Pre-production capital requirements are C$109.4 million plus life of mine sustaining costs totaling C$8.3 million. Construction will take one year, followed by six years of open pit mining and two years of reclamation. The mill will have a throughput of 1,500 t/d. Life of mine annual gold production will average 50,000 oz.

The full PEA can be read at www.ATACResources.com. Enjoy the photo gallery, too.

Comments