[caption id="attachment_1003739221" align="aligncenter" width="550"]

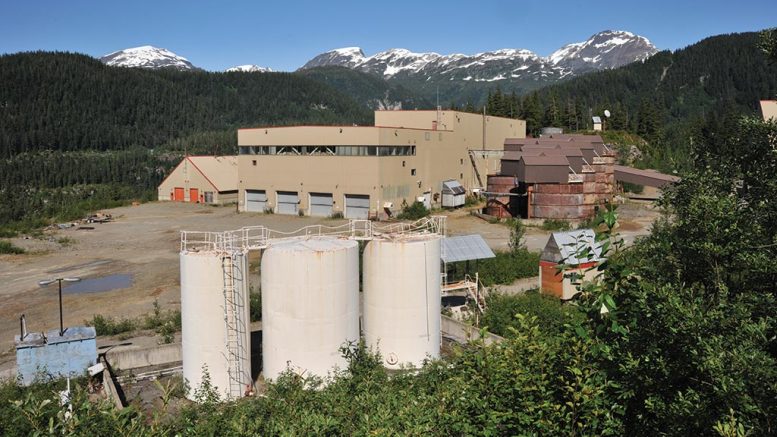

The historic mill at Ascot Resources’ Premier gold project Credit: Ascot

The historic mill at Ascot Resources’ Premier gold project Credit: Ascot[/caption]

BRITISH COLUMBIA –

Ascot Resources has announced a $25 million bought deal, led by Desjardins Capital Markets and Stifel GMP.

The underwriters have agreed to purchase 29.4 million shares of the company at $0.85 per share for gross proceeds of $25 million. They have an over-allotment option, exercisable within 30 days of closing, to purchase an additional 15% of the shares offered.

Ascot will pay the underwriters a cash commission of 5% of the gross proceeds, with a 1% commission payable on sales to certain buyers of the stock – this portion is capped at $1 million.

Net proceeds are intended for development of the Premier gold project, including the purchase of long-lead time items and general working capital with closing expected around Jun. 17.

Ascot is working to re-start the past producing Premier gold mine within its Premier gold project in B.C.’s Golden Triangle. In April, the company announced the results of a feasibility study on the project, which outlined an underground operation, extracting material from four deposits, and producing an average of 132,375 oz. of gold and 370,500 oz. of silver annually over an 8-year life at all-in sustaining costs of US$769 per oz. The associated capital cost estimate came in at $146.6 million, with a net present value estimate, at a 5% discount rate, of $341 million and a 51% internal rate of return.

For more information, visit

www.AscotGold.com.

The historic mill at Ascot Resources’ Premier gold project Credit: Ascot[/caption]

BRITISH COLUMBIA – Ascot Resources has announced a $25 million bought deal, led by Desjardins Capital Markets and Stifel GMP.

The underwriters have agreed to purchase 29.4 million shares of the company at $0.85 per share for gross proceeds of $25 million. They have an over-allotment option, exercisable within 30 days of closing, to purchase an additional 15% of the shares offered.

Ascot will pay the underwriters a cash commission of 5% of the gross proceeds, with a 1% commission payable on sales to certain buyers of the stock – this portion is capped at $1 million.

Net proceeds are intended for development of the Premier gold project, including the purchase of long-lead time items and general working capital with closing expected around Jun. 17.

Ascot is working to re-start the past producing Premier gold mine within its Premier gold project in B.C.’s Golden Triangle. In April, the company announced the results of a feasibility study on the project, which outlined an underground operation, extracting material from four deposits, and producing an average of 132,375 oz. of gold and 370,500 oz. of silver annually over an 8-year life at all-in sustaining costs of US$769 per oz. The associated capital cost estimate came in at $146.6 million, with a net present value estimate, at a 5% discount rate, of $341 million and a 51% internal rate of return.

For more information, visit

The historic mill at Ascot Resources’ Premier gold project Credit: Ascot[/caption]

BRITISH COLUMBIA – Ascot Resources has announced a $25 million bought deal, led by Desjardins Capital Markets and Stifel GMP.

The underwriters have agreed to purchase 29.4 million shares of the company at $0.85 per share for gross proceeds of $25 million. They have an over-allotment option, exercisable within 30 days of closing, to purchase an additional 15% of the shares offered.

Ascot will pay the underwriters a cash commission of 5% of the gross proceeds, with a 1% commission payable on sales to certain buyers of the stock – this portion is capped at $1 million.

Net proceeds are intended for development of the Premier gold project, including the purchase of long-lead time items and general working capital with closing expected around Jun. 17.

Ascot is working to re-start the past producing Premier gold mine within its Premier gold project in B.C.’s Golden Triangle. In April, the company announced the results of a feasibility study on the project, which outlined an underground operation, extracting material from four deposits, and producing an average of 132,375 oz. of gold and 370,500 oz. of silver annually over an 8-year life at all-in sustaining costs of US$769 per oz. The associated capital cost estimate came in at $146.6 million, with a net present value estimate, at a 5% discount rate, of $341 million and a 51% internal rate of return.

For more information, visit

Comments