[caption id="attachment_1003721711" align="aligncenter" width="474"]

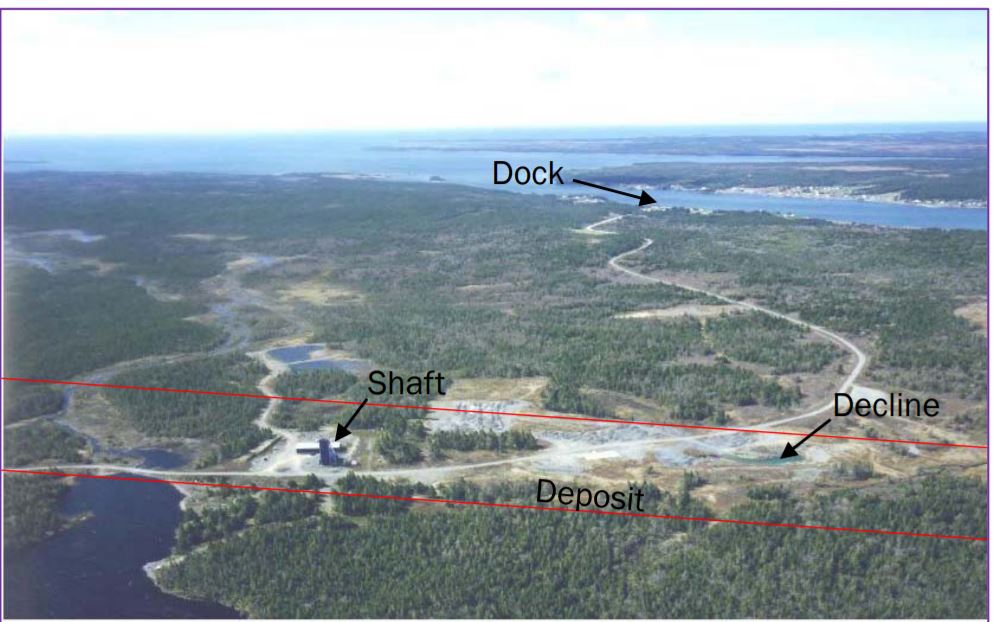

The Goldboro property has an existing shaft and decline as well as a tidewater port for shipping ore. (Image: Anaconda Mining)

The Goldboro property has an existing shaft and decline as well as a tidewater port for shipping ore. (Image: Anaconda Mining)[/caption]

NOVA SCOTIA –

Anaconda Mining of Toronto has released a positive preliminary economic assessment of its 100% owned Goldboro project in Guysborough County. Both open pit and underground development are planned.

Anaconda is looking at a mine life of 8.8 years from pit ore grading 2.99 g/t gold during the first three years and underground ore grading 6.83 g/t thereafter. The mining rate will be 600 t/d of ore plus 200 t/d of stockpiled low grade open pit ore. The ore will be processed at Anaconda’s Pine Cove mill. Gold production will total 375,900 oz.

The after tax net present value (7% discount) is $61 million, and the internal rate of return is 26%, for a 2.9-year payback period. Total capex will be $89 million including pre-production expenditures of $47 million. The Goldboro project is expected to have an undiscounted cash flow of $106 million after taxes. Life of mine all-in sustaining costs are expected to about US$640 per oz. of gold produced.

The open pit (0.50 g/t cut-off) has measured and indicated resources of 1.1 million tonnes averaging 3.01 g/t gold and inferred resources of 45,000 tonnes at 2.54 g/t. The underground (2.0 g/t cut-off) has measured and indicated resources of 3.6 million tonnes averaging 4.48 g/t gold and inferred resources of 2.5 million tonnes at 4.25 g/t.

Details of the PEA are available at

www.AnacondaMining.com.

The Goldboro property has an existing shaft and decline as well as a tidewater port for shipping ore. (Image: Anaconda Mining)[/caption]

NOVA SCOTIA – Anaconda Mining of Toronto has released a positive preliminary economic assessment of its 100% owned Goldboro project in Guysborough County. Both open pit and underground development are planned.

Anaconda is looking at a mine life of 8.8 years from pit ore grading 2.99 g/t gold during the first three years and underground ore grading 6.83 g/t thereafter. The mining rate will be 600 t/d of ore plus 200 t/d of stockpiled low grade open pit ore. The ore will be processed at Anaconda’s Pine Cove mill. Gold production will total 375,900 oz.

The after tax net present value (7% discount) is $61 million, and the internal rate of return is 26%, for a 2.9-year payback period. Total capex will be $89 million including pre-production expenditures of $47 million. The Goldboro project is expected to have an undiscounted cash flow of $106 million after taxes. Life of mine all-in sustaining costs are expected to about US$640 per oz. of gold produced.

The open pit (0.50 g/t cut-off) has measured and indicated resources of 1.1 million tonnes averaging 3.01 g/t gold and inferred resources of 45,000 tonnes at 2.54 g/t. The underground (2.0 g/t cut-off) has measured and indicated resources of 3.6 million tonnes averaging 4.48 g/t gold and inferred resources of 2.5 million tonnes at 4.25 g/t.

Details of the PEA are available at

The Goldboro property has an existing shaft and decline as well as a tidewater port for shipping ore. (Image: Anaconda Mining)[/caption]

NOVA SCOTIA – Anaconda Mining of Toronto has released a positive preliminary economic assessment of its 100% owned Goldboro project in Guysborough County. Both open pit and underground development are planned.

Anaconda is looking at a mine life of 8.8 years from pit ore grading 2.99 g/t gold during the first three years and underground ore grading 6.83 g/t thereafter. The mining rate will be 600 t/d of ore plus 200 t/d of stockpiled low grade open pit ore. The ore will be processed at Anaconda’s Pine Cove mill. Gold production will total 375,900 oz.

The after tax net present value (7% discount) is $61 million, and the internal rate of return is 26%, for a 2.9-year payback period. Total capex will be $89 million including pre-production expenditures of $47 million. The Goldboro project is expected to have an undiscounted cash flow of $106 million after taxes. Life of mine all-in sustaining costs are expected to about US$640 per oz. of gold produced.

The open pit (0.50 g/t cut-off) has measured and indicated resources of 1.1 million tonnes averaging 3.01 g/t gold and inferred resources of 45,000 tonnes at 2.54 g/t. The underground (2.0 g/t cut-off) has measured and indicated resources of 3.6 million tonnes averaging 4.48 g/t gold and inferred resources of 2.5 million tonnes at 4.25 g/t.

Details of the PEA are available at

Comments