MEXICO – Thanks to a bought deal,

Alio Gold (formerly Timmins Gold) of Vancouver has raised approximately C$50.4 million for its Ana Paula gold project in Guerrero. The financing was underwritten by a syndicate led by Cormark Securities and Clarus Securities.

[caption id="attachment_1003719297" align="alignleft" width="411"]

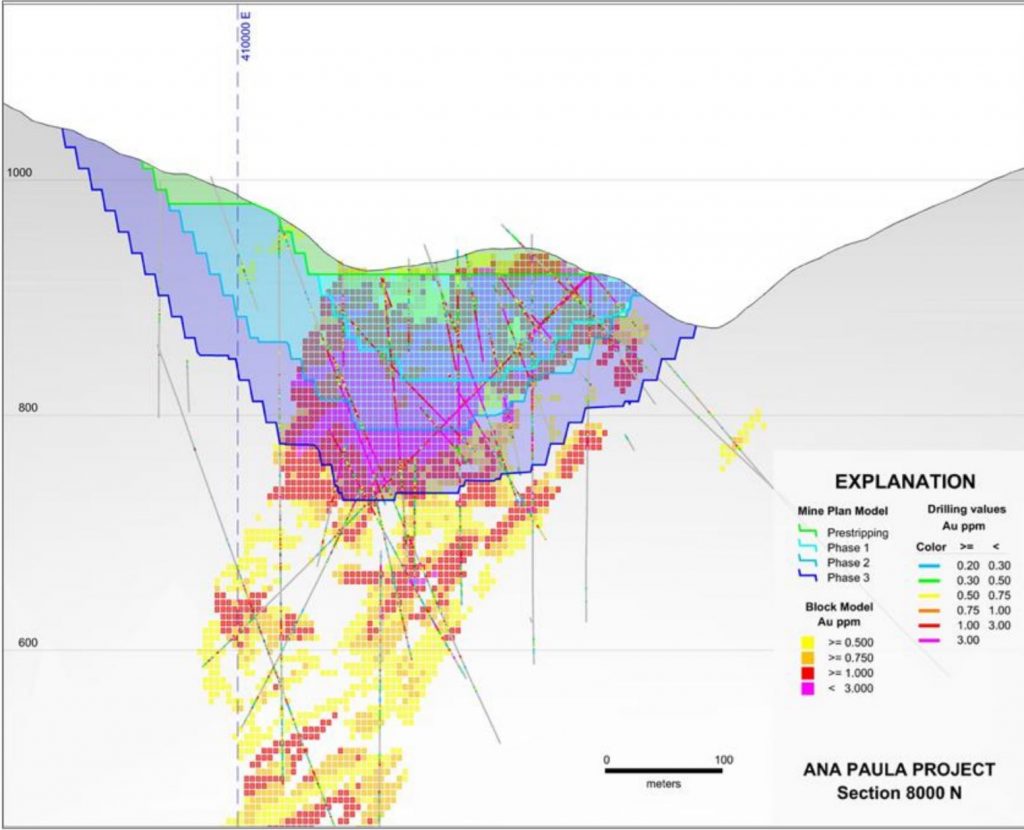

Cross-section of the Ana Paula deposit. Note the potential for underground development as well as open pit. (Credit: Alio Gold)

Cross-section of the Ana Paula deposit. Note the potential for underground development as well as open pit. (Credit: Alio Gold)[/caption]

Alio issued 8.0 million units at a price of $6.25 per unit for C$50 million. Each unit consists of one common share and one-half of a share purchase warrant. Each whole warrant will allow the bearer to purchase one common share at a price of $8.00 before July 20, 2018. The underwriters exercised their over-allotment option for additional gross proceeds of C$387,500.

Alio is working on a feasibility study to be completed in Q1 2018. An open pit and conventional gravity-CIL mill is planned. Proven and probable reserves stand at 13.4 million tonnes grading 2.36 g/t gold containing 1.0 million oz. Gold production will average 116,000 oz. annually. The capital cost of development is estimated to be US$150.6 million.

Read about the history of the historic Ana Paula mine at

www.AlioGold.com.

Cross-section of the Ana Paula deposit. Note the potential for underground development as well as open pit. (Credit: Alio Gold)[/caption]

Alio issued 8.0 million units at a price of $6.25 per unit for C$50 million. Each unit consists of one common share and one-half of a share purchase warrant. Each whole warrant will allow the bearer to purchase one common share at a price of $8.00 before July 20, 2018. The underwriters exercised their over-allotment option for additional gross proceeds of C$387,500.

Alio is working on a feasibility study to be completed in Q1 2018. An open pit and conventional gravity-CIL mill is planned. Proven and probable reserves stand at 13.4 million tonnes grading 2.36 g/t gold containing 1.0 million oz. Gold production will average 116,000 oz. annually. The capital cost of development is estimated to be US$150.6 million.

Read about the history of the historic Ana Paula mine at

Cross-section of the Ana Paula deposit. Note the potential for underground development as well as open pit. (Credit: Alio Gold)[/caption]

Alio issued 8.0 million units at a price of $6.25 per unit for C$50 million. Each unit consists of one common share and one-half of a share purchase warrant. Each whole warrant will allow the bearer to purchase one common share at a price of $8.00 before July 20, 2018. The underwriters exercised their over-allotment option for additional gross proceeds of C$387,500.

Alio is working on a feasibility study to be completed in Q1 2018. An open pit and conventional gravity-CIL mill is planned. Proven and probable reserves stand at 13.4 million tonnes grading 2.36 g/t gold containing 1.0 million oz. Gold production will average 116,000 oz. annually. The capital cost of development is estimated to be US$150.6 million.

Read about the history of the historic Ana Paula mine at

Comments