[caption id="attachment_1003720135" align="aligncenter" width="477"]

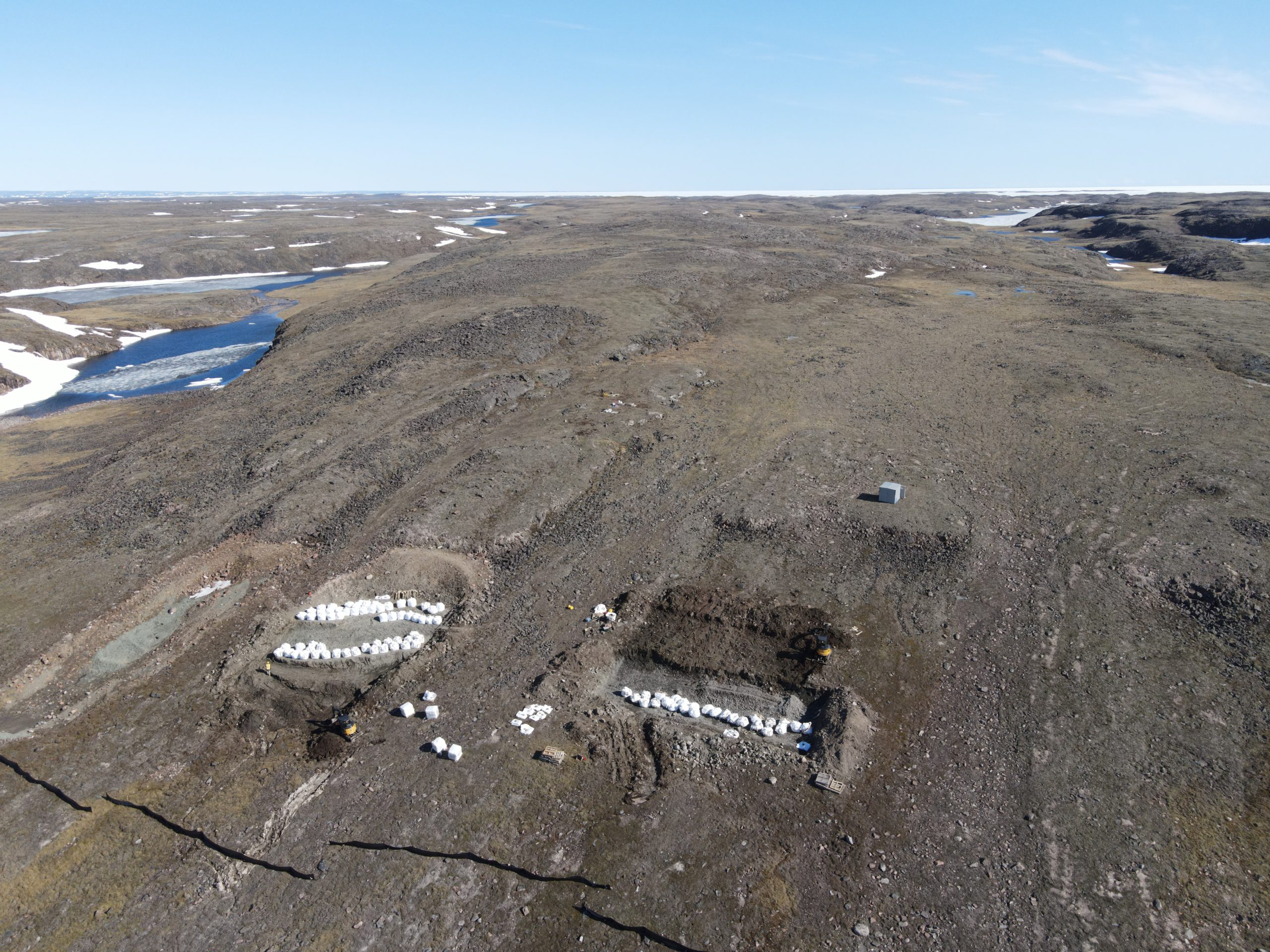

The Young-Davidson headframe near Kirkland Lake, Ont. (Credit: Alamos Gold)

The Young-Davidson headframe near Kirkland Lake, Ont. (Credit: Alamos Gold)[/caption]

TORONTO –

Alamos Gold has increased its existing undrawn revolving credit facility to US$400 million from US$150 million. The company will now pay fees of 0.45% on the undrawn portion and drawn fees of LIBOR plus 2.00%. The facility matures on Sept. 20, 2021.

"The amended facility adds significant liquidity on very attractive terms. Combined with existing cash and expected cash from the recently announced acquisition of Richmont Mines, Alamos will be debt free with more than US$600 million of available liquidity. This greatly improves our financial flexibility as we fund development of our portfolio of growth projects," said John A. McCluskey, president and CEO.

Alamos recently offered US$770 million for Richmont and its assets, particularly the growing Island Gold mine near Wawa, Ont. Alamos also operates the Young-Davidson mine in Ontario and the El Chanate and Mulatos mines in Mexico.

Detailed information about the company’s mines and projects is posted at

www.AlamosGold.com.

The Young-Davidson headframe near Kirkland Lake, Ont. (Credit: Alamos Gold)[/caption]

TORONTO – Alamos Gold has increased its existing undrawn revolving credit facility to US$400 million from US$150 million. The company will now pay fees of 0.45% on the undrawn portion and drawn fees of LIBOR plus 2.00%. The facility matures on Sept. 20, 2021.

"The amended facility adds significant liquidity on very attractive terms. Combined with existing cash and expected cash from the recently announced acquisition of Richmont Mines, Alamos will be debt free with more than US$600 million of available liquidity. This greatly improves our financial flexibility as we fund development of our portfolio of growth projects," said John A. McCluskey, president and CEO.

Alamos recently offered US$770 million for Richmont and its assets, particularly the growing Island Gold mine near Wawa, Ont. Alamos also operates the Young-Davidson mine in Ontario and the El Chanate and Mulatos mines in Mexico.

Detailed information about the company’s mines and projects is posted at

The Young-Davidson headframe near Kirkland Lake, Ont. (Credit: Alamos Gold)[/caption]

TORONTO – Alamos Gold has increased its existing undrawn revolving credit facility to US$400 million from US$150 million. The company will now pay fees of 0.45% on the undrawn portion and drawn fees of LIBOR plus 2.00%. The facility matures on Sept. 20, 2021.

"The amended facility adds significant liquidity on very attractive terms. Combined with existing cash and expected cash from the recently announced acquisition of Richmont Mines, Alamos will be debt free with more than US$600 million of available liquidity. This greatly improves our financial flexibility as we fund development of our portfolio of growth projects," said John A. McCluskey, president and CEO.

Alamos recently offered US$770 million for Richmont and its assets, particularly the growing Island Gold mine near Wawa, Ont. Alamos also operates the Young-Davidson mine in Ontario and the El Chanate and Mulatos mines in Mexico.

Detailed information about the company’s mines and projects is posted at

Comments