Glencore licenses Horne 5 operations to Falco Resources

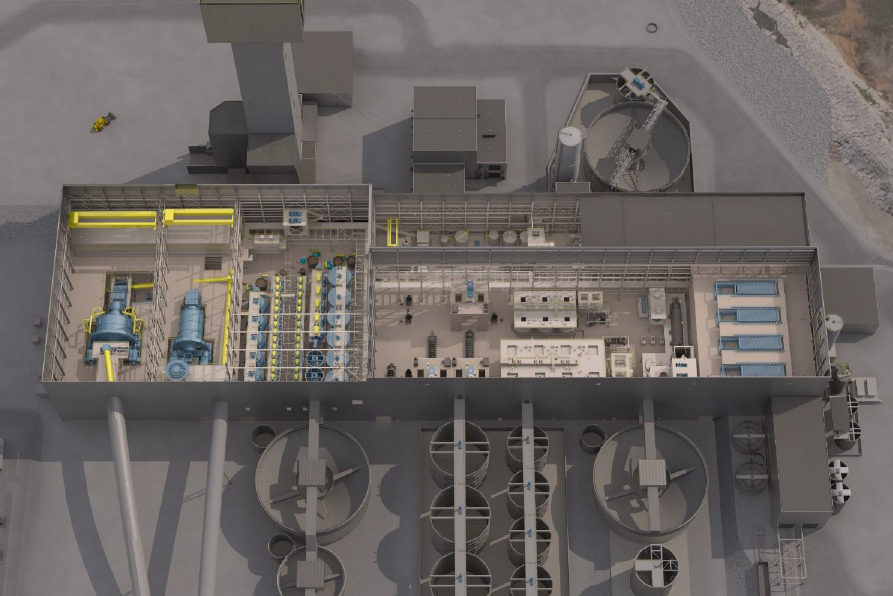

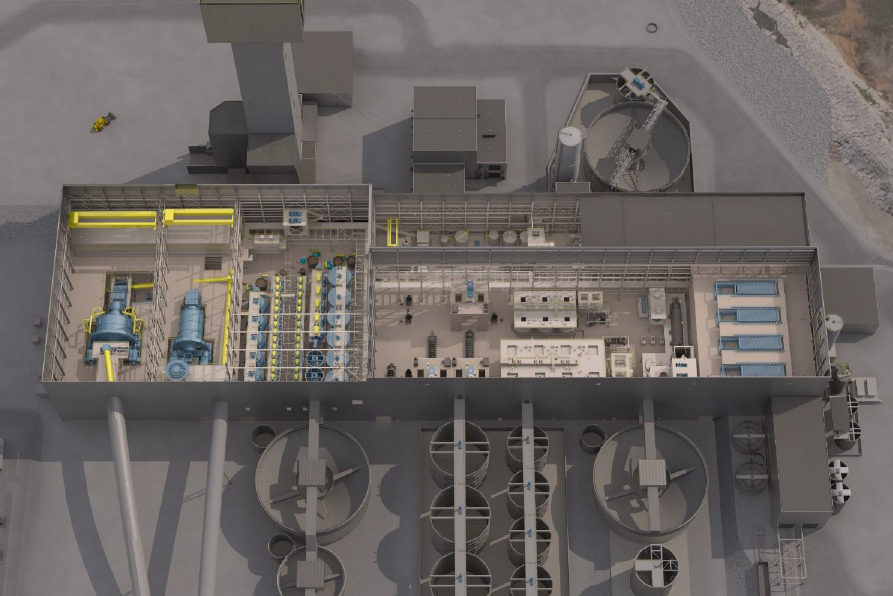

Falco Resources (TSXV: FPC) has entered into an operating license and indemnity agreement (OLIA) with Glencore Canada allowing Falco to use part of Glencore’s lands. Falco intends to develop and operate its wholly owned Horne 5 copper-zinc mine at Rouyn-Noranda, Que.

The agreement includes the creation of a technical committee consisting of two nominees from Glencore and two from Falco to ensure that operations of Glencore’s Horne copper smelter are not adversely affected. A similar strategic committee will also be created. Glencore will appoint one nominee to Falco’s board of directors. Glencore will retain priority over the operations of the Horne 5 project. Falco must make financial assurances, guarantees, and indemnification to Glencore to cover risks and losses to the smelter. Glencore retains the right to require remediation, suspension, or other risk mitigation to protect the Horne smelter.

The successful completion of the OLIA combined with life-of-mine copper-zinc concentrate offtake agreements with Glencore allows Falco to advance its Horne 5 project, said Falco president and CEO Luc Lessard. The company is moving forward with permitting and financing for the project.

The Horne 5 mine is to be developed below the historic Horne mine, which was operational from 1927 to 1976 and produced 11.6 million oz. of gold and 2.5 billion lb. of copper. The environmental impact assessment is currently under review.

As per the 2021 feasibility study, the Horne 5 project has proven and probable reserves of 80.9 million tonnes grading 0.17% copper, 0.77% zinc, 1.44 g/t gold, and 14.14 g/t silver. The measured and indicated resource is 105.6 million tonnes of almost identical grades and containing 389.8 million lb. of copper and 1.85 billion lb. of zinc. There is also an inferred resource of 24.3 million tonnes grading 0.19% copper, 0.67% zinc, 1.35 g/t gold, and 21.40 g/t silver.

After taxes, the project has a net present value with a 5% discount of US$1.25 billion and an internal rate of return of 27.3%. Payback should occur in 3.5 years.

Read the corporate presentation at www.FalcoRes.com.

2 Comments

Georges Jr Bernier

Do you have an estimation date for the start of the project?

Marilyn Scales

No. But Falco still need to finance the project, so it could be months or maybe a few years away.