It’s unusual for a privately held company to put a mine into production before it becomes a publicly listed company.

“It’s incredibly rare – by and large it’s virtually impossible unless you find other sources of funding,” says Steve Orr, CEO of Gatos Silver (TSX: GATO; NYSE: GATO).

But that’s exactly what Electrum Group LLC, a private precious metals investment company based in New York chaired by mining entrepreneur Thomas Kaplan, accomplished in Mexico over the last decade, explained Orr, who joined the company in 2011, shortly after it was founded in 2010.

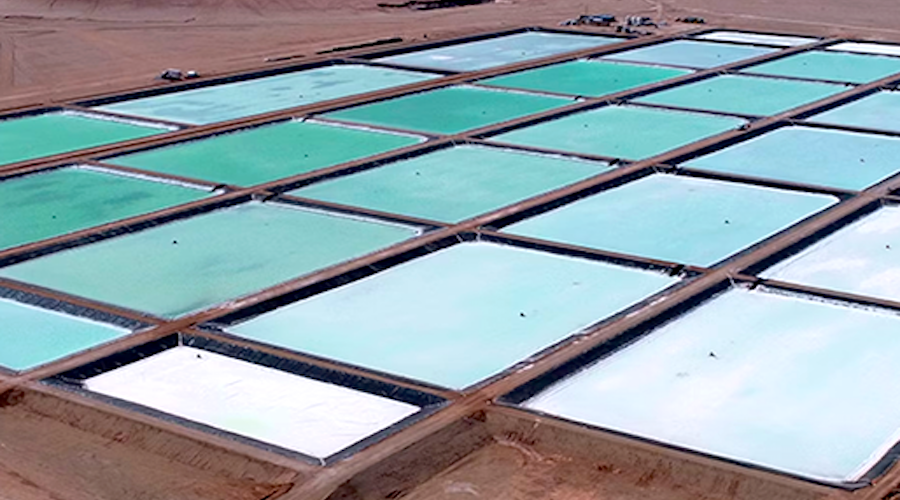

Gatos Silver and later with its joint-venture partner, Japan’s Dowa Metals & Mining (Dowa), put the Cerro Los Gatos underground silver-lead-zinc mine into production in July 2019, and sent the first shipments of concentrate in September of that year. The company then dual-listed its shares on the Toronto and New York stock exchanges on October 27, 2020.

Since the initial public offering on the TSX at $8.50 per share (US$7 per share on the NYSE), the stock has more than doubled, surging to $17.08 per share, up 101%. (On the NYSE it currently trades at US$14 per share.)

Comments