FPX Nickel unveils “compelling business case” for standalone nickel sulphate refinery

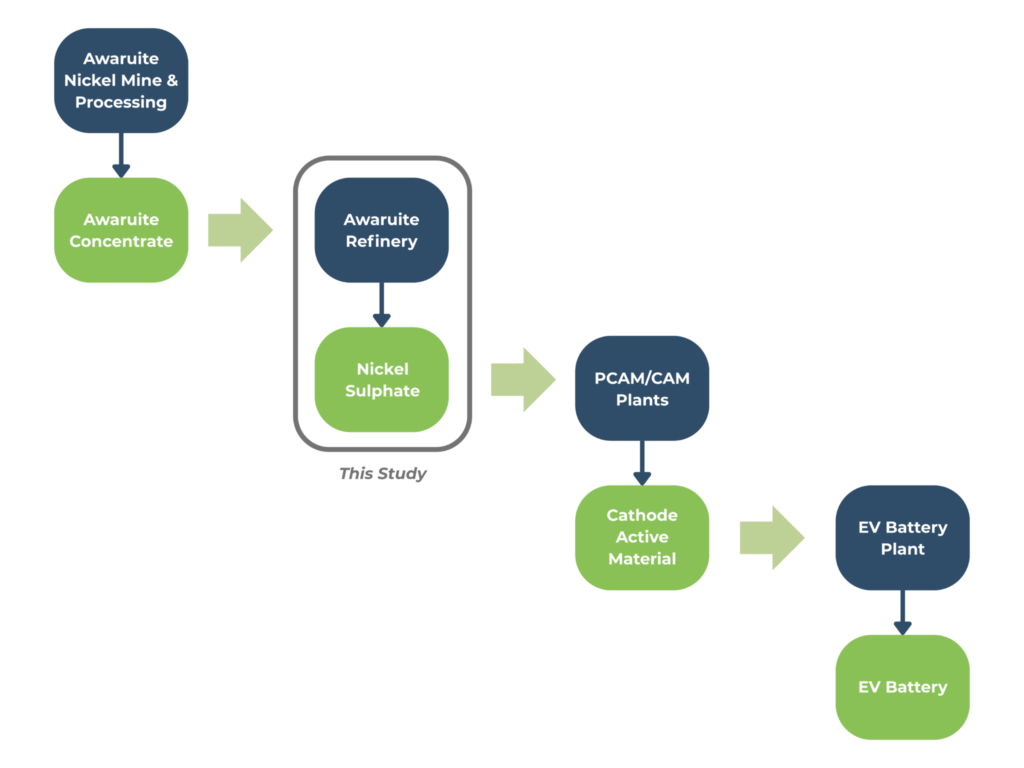

FPX Nickel (TSXV: FPX; OTCQB: FPOCF) announced results from an awaruite refinery scoping study demonstrating a “compelling business case” for the development of a standalone refinery to refine awaruite concentrate into battery-grade nickel sulphate for the electric vehicle industry, along with producing valuable cobalt, copper, and ammonium sulphate by-products.

Wood Canada prepared the scoping study. It relates to a standalone industrial project and involving the production of awaruite ore from projects that are not limited to mineral projects of the company. The study is separate and standalone from the Baptiste nickel project, which demonstrated the technical and commercial advantage of mining and concentrating awaruite ore to a high-grade awaruite concentrate.

The highlights of the study showing robust economics are as follows: Strong economics: After-tax NPV8% of $445 million and IRR of 20% at $8.50 /lb Ni; Large-Scale, Long Life: 40-year operating life producing 32,000 tpa of nickel contained in battery-grade nickel sulphate; Valuable Products: Production of battery-grade nickel sulphate for the EV industry, and by-products including cobalt, copper, and ammonium sulphate, a valuable fertilizer product for the agricultural sector.

Finally, the study showed evidence of Low Cost: Total estimated operating costs of $1,598/t Ni, or $133/t Ni ($0.06 /lb Ni) on a by-product basis for refining awaruite concentrate to battery-grade nickel sulphate, resulting in total all-in production costs of $8,290/t Ni ($3.76/lb Ni) for nickel sulphate generated from awaruite mineralization (inclusive of mining, processing, refining, on a by-product basis), with both figures ranking in the lowest decile of the respective global nickel sulphate cost curves.

Martin Turenne, FPX Nickel's CEO, stated "This study confirms the disruptive potential of awaruite concentrate as an ideal feedstock for the production of battery-grade nickel sulphate for the automotive sector. The study reinforces the opportunity for the development of an integrated, made-in-Canada solution from mine-to-battery, utilizing awaruite concentrate as a lynchpin source of nickel, with conventional refining steps underpinning low-cost, low-carbon nickel production for use in domestic and allied country EV battery supply chains."

FPX commenced development of the study in October 2024 to further demonstrate the economic and strategic opportunity to refine awaruite concentrates to battery-grade nickel sulphate and other valuable by-products. This study incorporates the flowsheet advancements outlined in the FPX Nickel’s previously reported pilot-scale hydrometallurgical test work results.

This study envisioned a mid-stream refinery located in an industrial location in central British Columbia. The company would feed the refinery with awaruite concentrate. The refinery would produce battery-grade nickel sulphate. The study considers a refinery capable of producing 32,000 tonnes per year of contained nickel in battery-grade nickel sulphate. In addition to nickel sulphate, the refinery will produce three by-products, approximately as follows: 570 tons per year of contained cobalt in cobalt carbonate; 240 tons per year of contained copper in copper cement; and 87,400 tons per year of ammonium sulphate, a valuable fertilizer product.

The refinery would process commercially available awaruite concentrate. Published metallurgical test work on awaruite (Ni3Fe) nickel ores has shown that a relatively simple mineral processing flowsheet utilizing magnetic separation followed by conventional froth flotation can produce a highly desirable awaruite concentrate that presents flexibility for downstream consumption. Considering other awaruite nickel projects in development by FPX and others, a refinery operation lifespan of 40 years is considered. For more information, please view the company's website at www.FpxNickel.com.

Comments