First Phosphate PEA for Begin-Lamarche sees 900,000 concentrate annually

First Phosphate (CSE: PHOS; OTCQB: FRSPF) has positive results form the preliminary economic assessment on its Bégin-Lamarche project 75 km northwest of Saguenay, Que. The project would have a 23-year mine life.

The property could support an open pit mine and an 18,000 t/d processing plant with a capacity of 900,000 tonnes of 40% phosphorus pentoxide (P2O5) concentrate annually. An additional 380,000 tonnes of 92% magnetite (Fe2O3) would also be produced.

The Bégin-Lamarche project will generate a pre-tax internal rate of return (IRR) of 37.1% and a pre-tax net present value with an 8% discount (NPV8) $2.1 billion. After taxes, the project will have a 33% IRR and $1.59 billion NPV8. The project would generate an after-tax cash flow of $700 million in years one to three, resulting in a 2.6-year payback period. The PEA puts the pre-production capital requirement at $675 million followed by sustaining costs of $317 million.

Parameters for the PEA included 40% P2O5 concentrate would sell for US$350/tonne, 92% Fe2O3 concentrated at US$168/tonne, and an exchange rate of C$1.37:US$0.73.

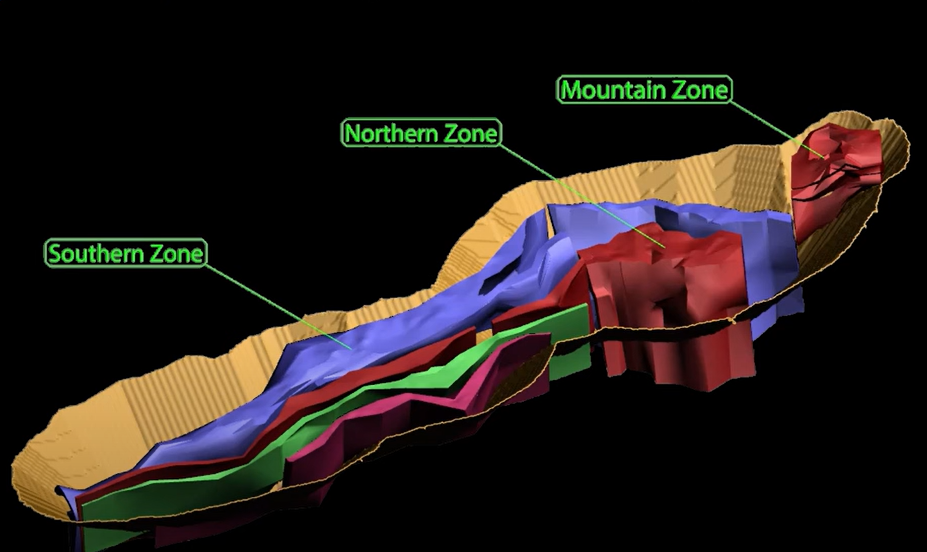

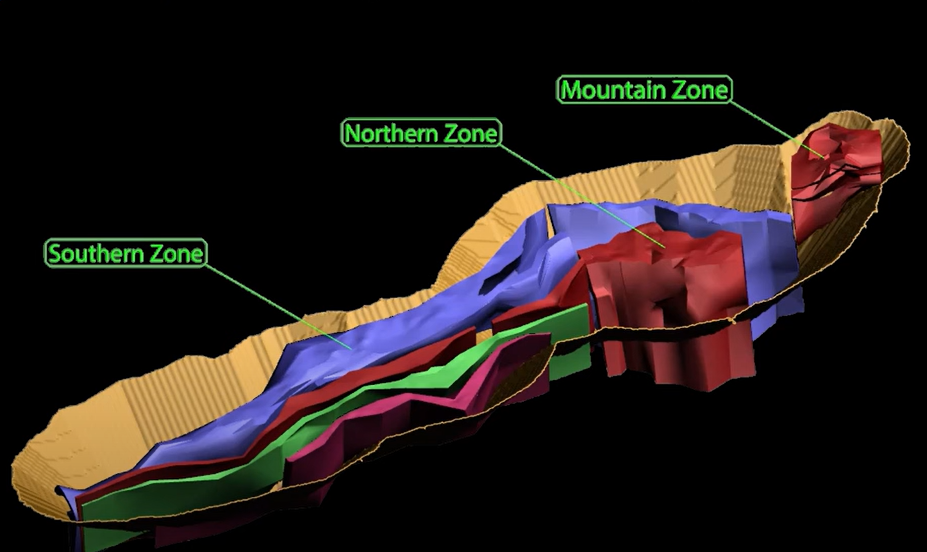

Pit-constrained resources are 41.5 million indicated tonnes grading 6.49% P2O5, 10.69% Fe2O3, and 3.31% titanium oxide (TiO2). The inferred portion is 214 million tonnes grading 6.01% P2O5, 10.85% Fe2O3, and 3.63% TiO2.

Visit www.FirstPhosphate.com for additional information.

Comments