Federal government stiffens guidelines on foreign involvement in Canada’s critical mineral sectors

The federal government immediately plans to significantly tighten the approval process for major transactions by foreign state-owned enterprises (SOEs) in Canada’s critical minerals sectors.

In a joint news release issued Friday, François-Philippe Champagne, Minister of Innovation, Science and Industry, and Natural Resources Minister Jonathan Wilkinson said that under the updated guidelines for how the Investment Canada Act is applied, the transactions "will only be approved as of likely net benefit on an exceptional basis."

"As well, should a foreign state-owned company participate in these types of transactions, it could constitute reasonable grounds to believe that the investment could be injurious to Canada’s national security, regardless of the value of the transaction," the ministers said.

Foreign involvement in Canada's natural resources sector has come under increased scrutiny in recent years, especially as Russia's invasion of Ukraine highlighted the vulnerability of energy supplies controlled by countries regarded as hostile.

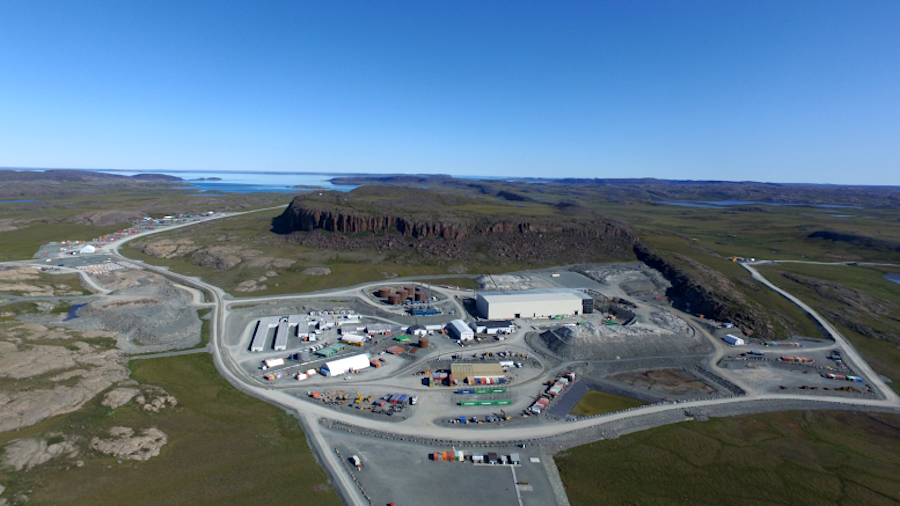

And in late 2020, the Canadian government rejected Chinese state-owned miner Shandong Gold Mining's $150-million bid to acquire TMAC Resources, now owned by Agnico Eagle (TSX: AEM; NYSE: AEM), and its Doris gold mine in Hope Bay, Nunavut, following a national security review.

Comments